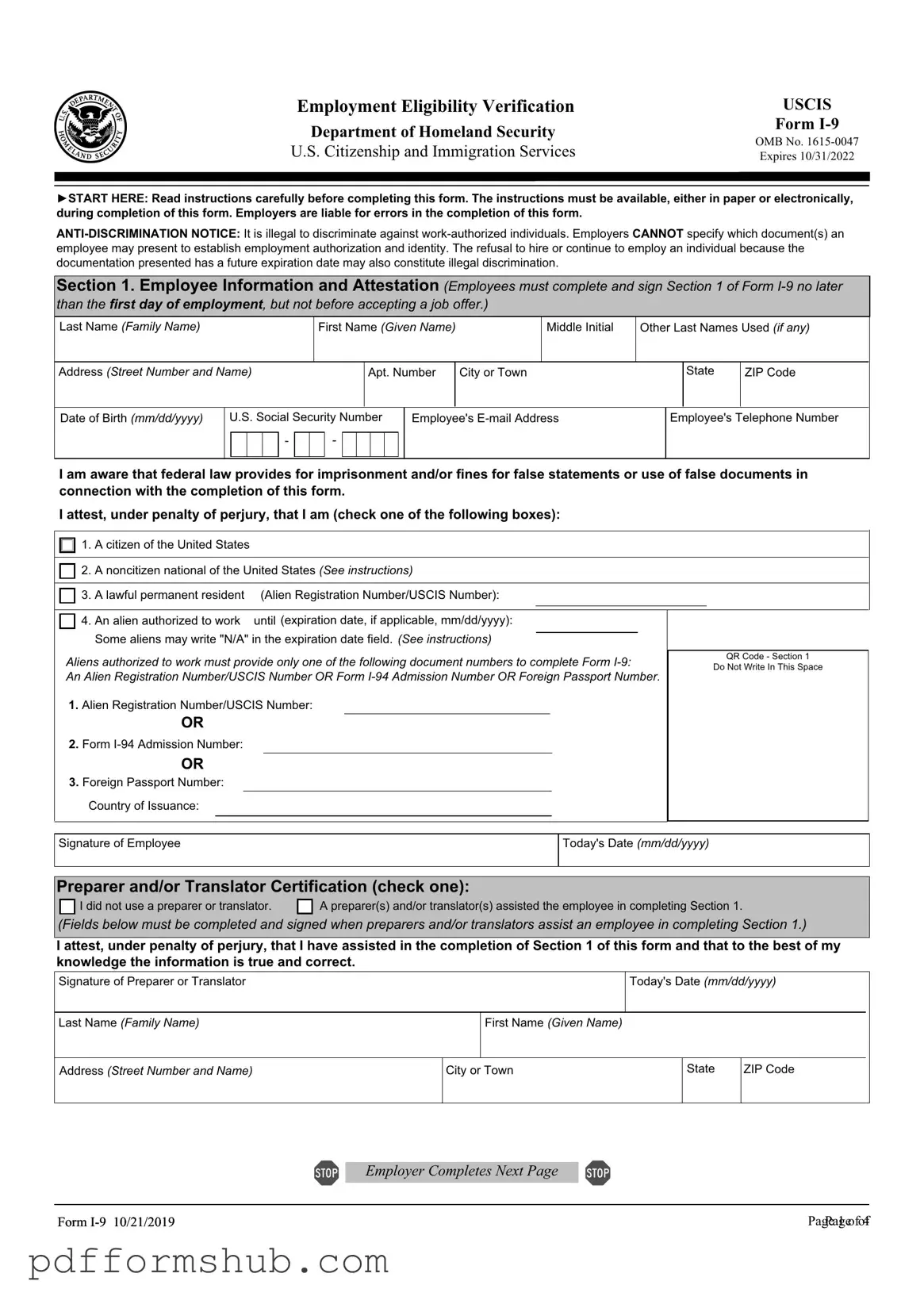

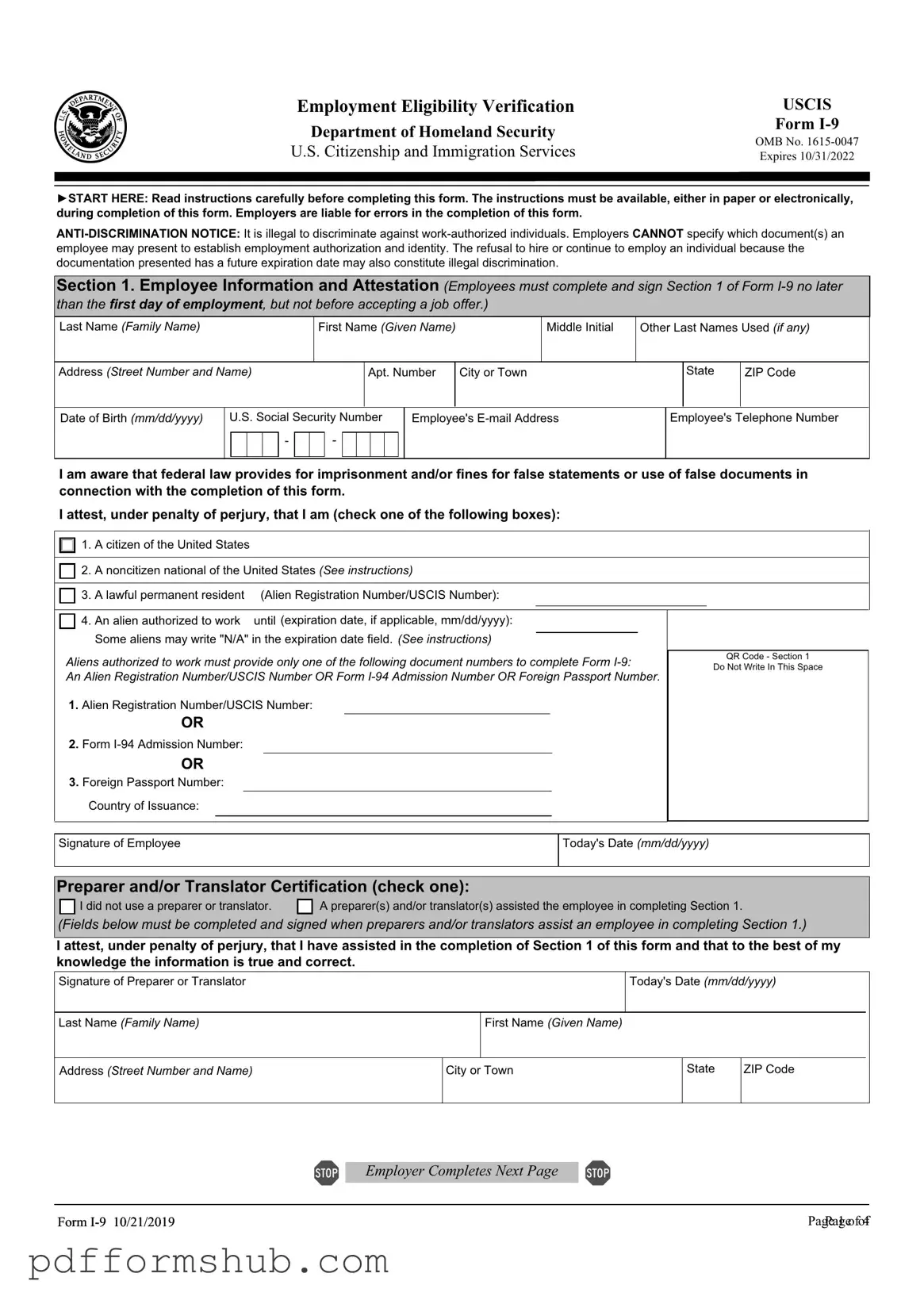

Fill in Your USCIS I-9 Form

The USCIS I-9 form is a document used by employers in the United States to verify the identity and employment authorization of individuals hired for work. This form plays a crucial role in ensuring compliance with immigration laws. To learn more about filling out the I-9 form, click the button below.

Customize Form

Fill in Your USCIS I-9 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete USCIS I-9 online without printing hassles.