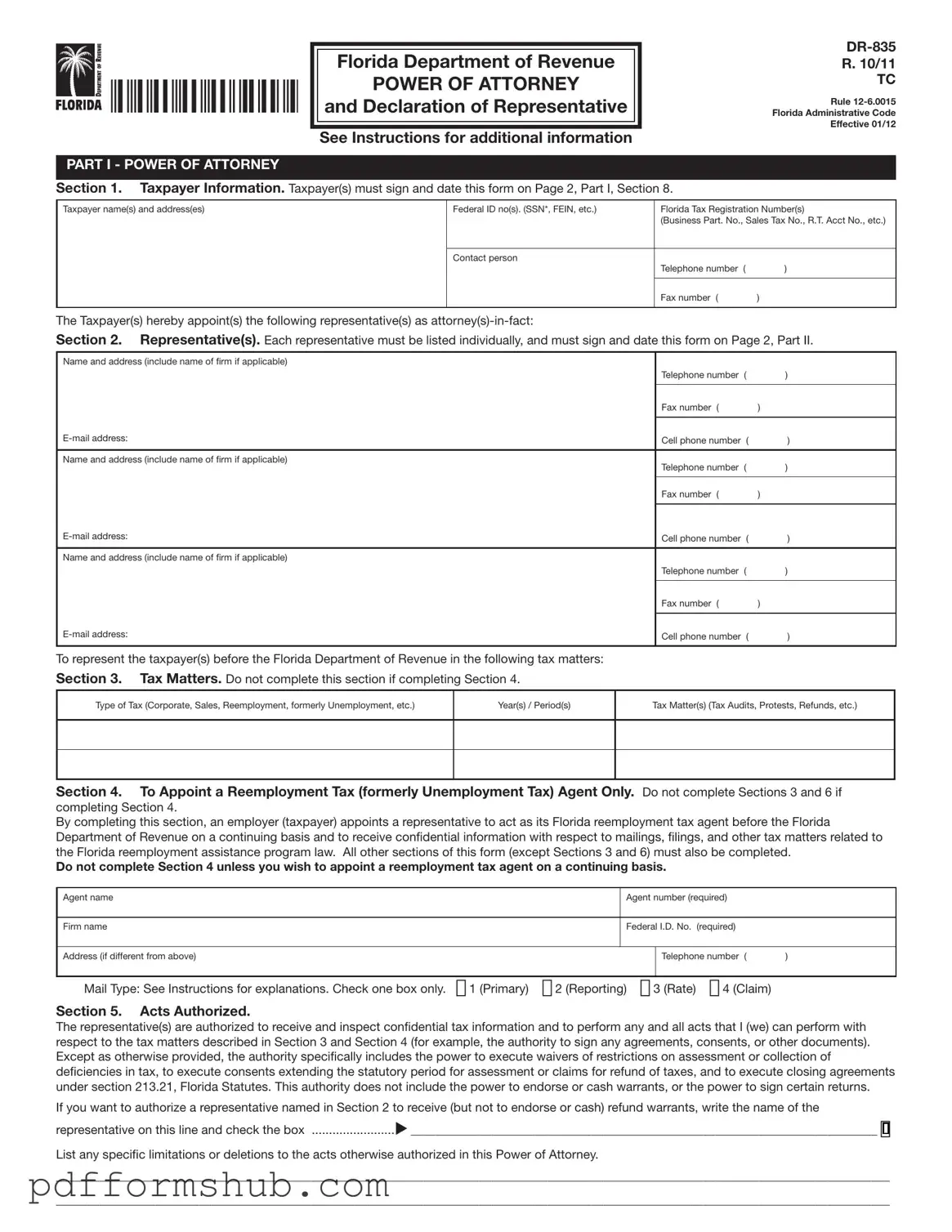

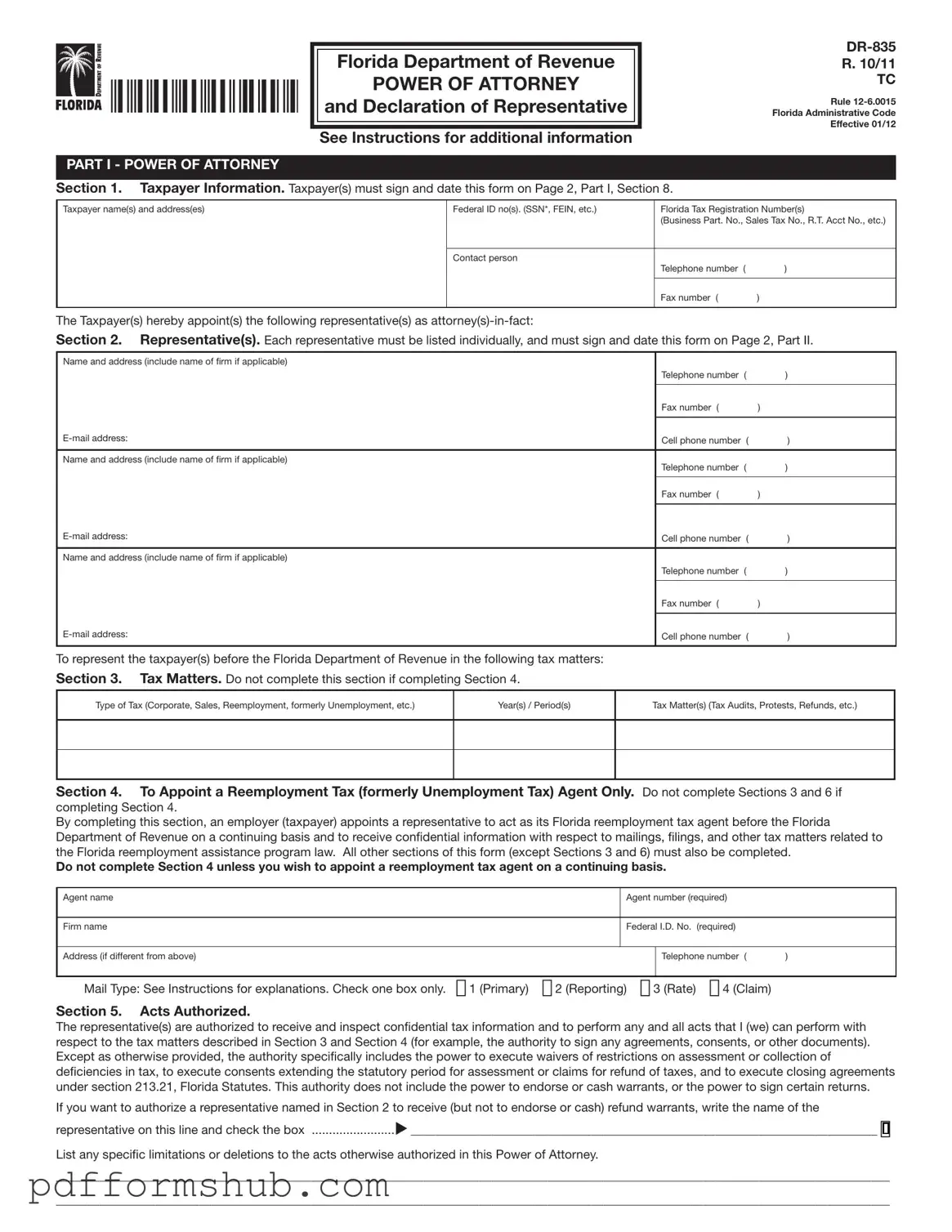

Fill in Your Tax POA dr 835 Form

The Tax POA DR 835 form is a document that allows taxpayers to authorize someone else to act on their behalf regarding tax matters. This form is essential for ensuring that your representative can communicate with tax authorities and handle your tax-related issues effectively. If you need to grant someone this authority, it’s crucial to fill out the form accurately—click the button below to get started.

Customize Form

Fill in Your Tax POA dr 835 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Tax POA dr 835 online without printing hassles.