Fill in Your SSA SSA-44 Form

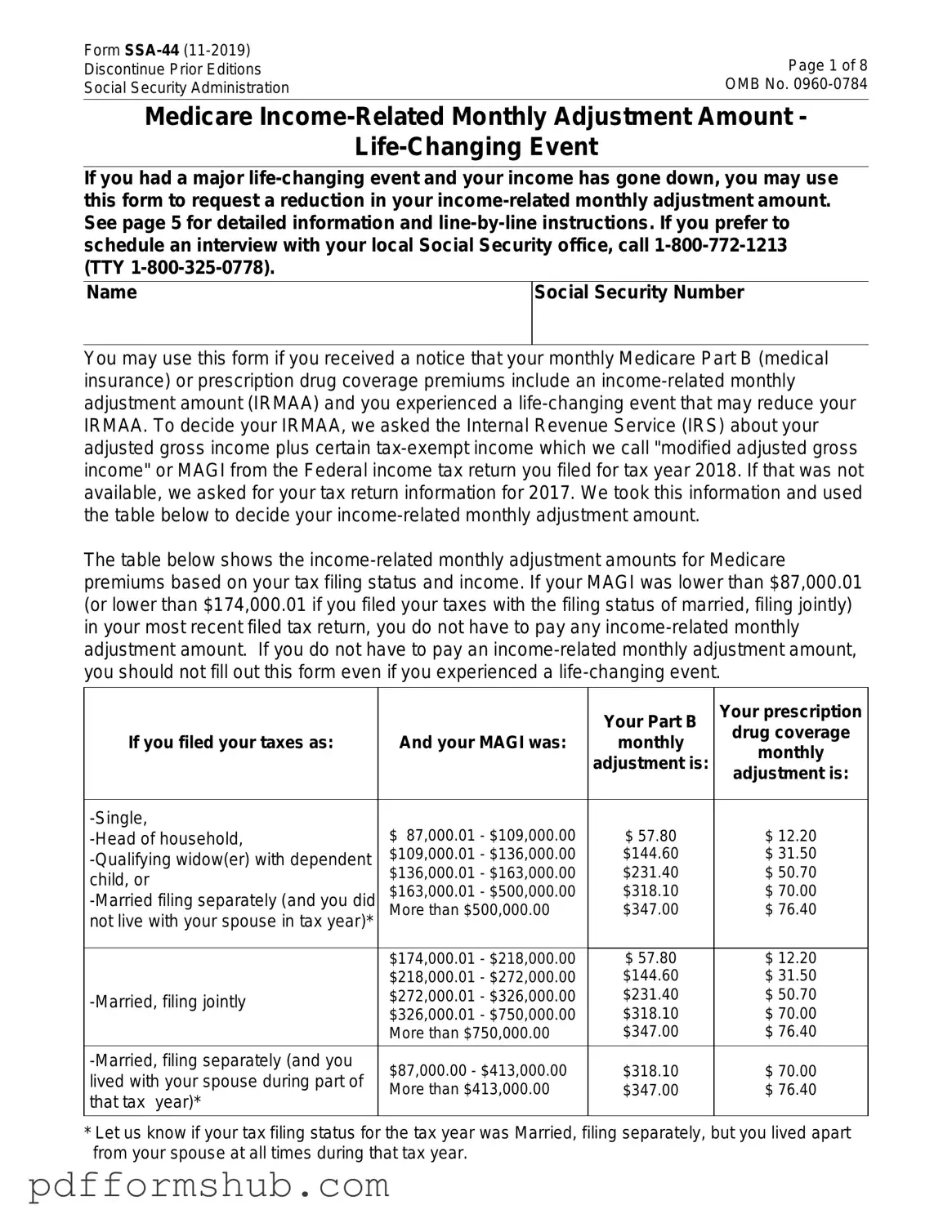

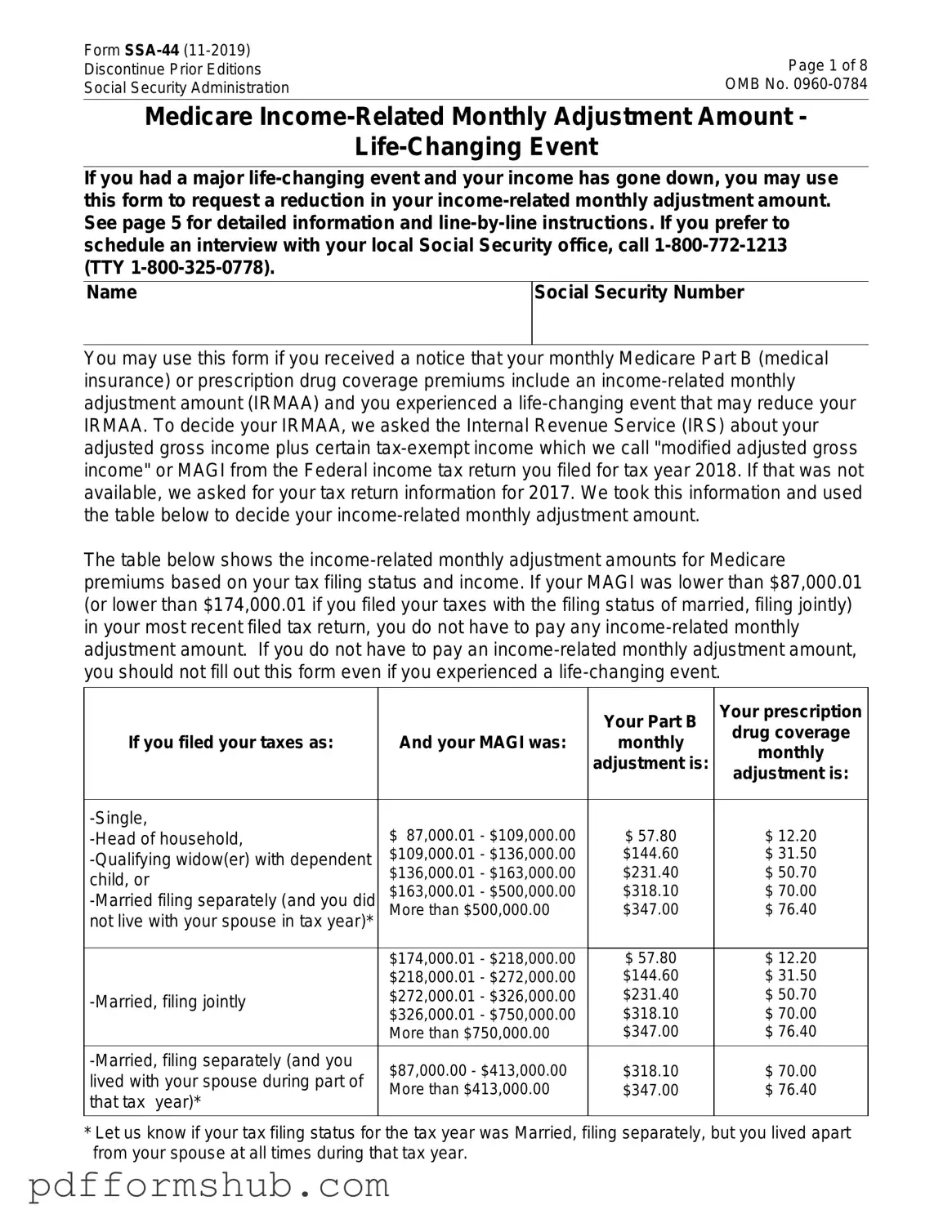

The SSA SSA-44 form is a request for the Social Security Administration to reconsider the amount of your monthly benefits due to a change in your income or living situation. This form is essential for individuals who may qualify for a higher benefit amount or need to report changes that affect their eligibility. To learn more about how to fill out this form, click the button below.

Customize Form

Fill in Your SSA SSA-44 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete SSA SSA-44 online without printing hassles.