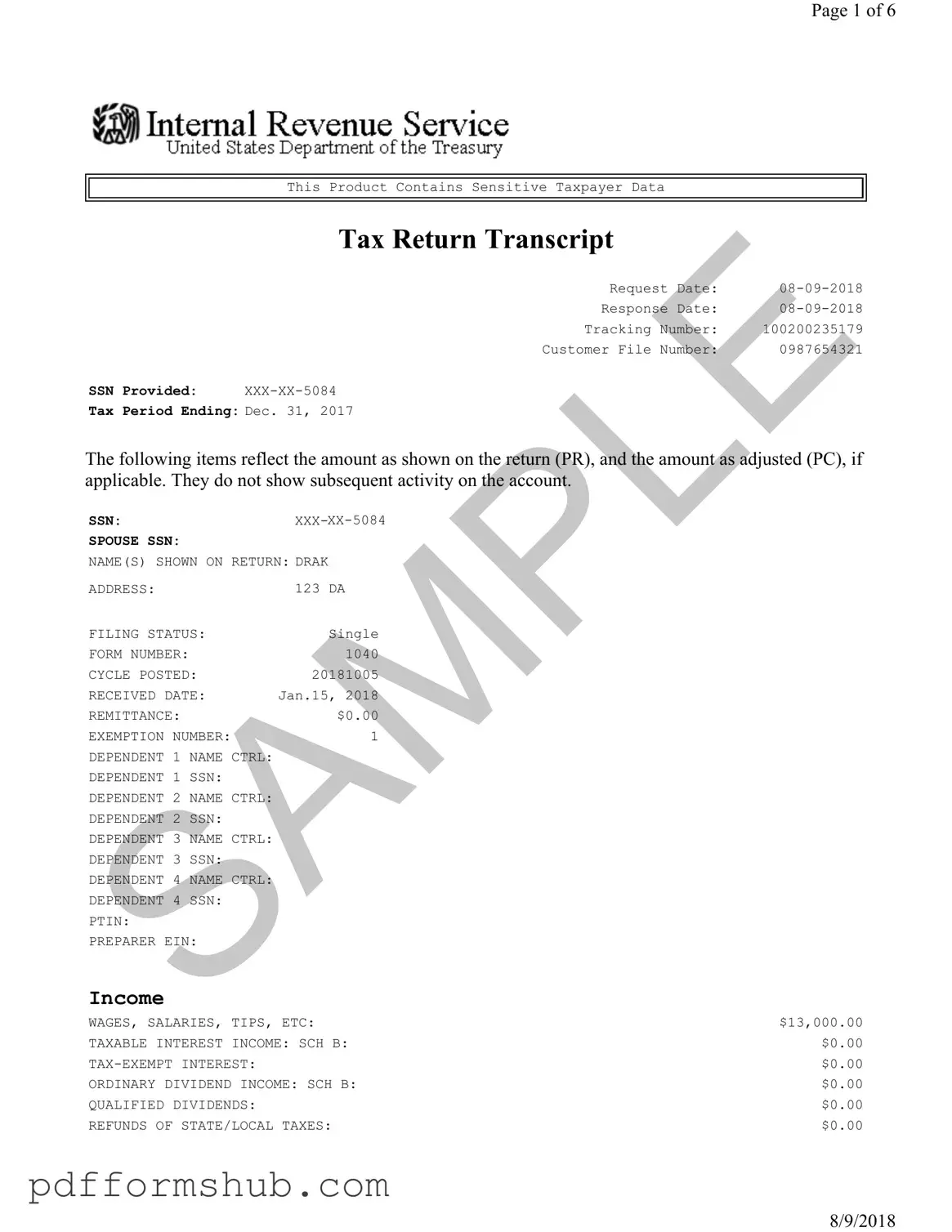

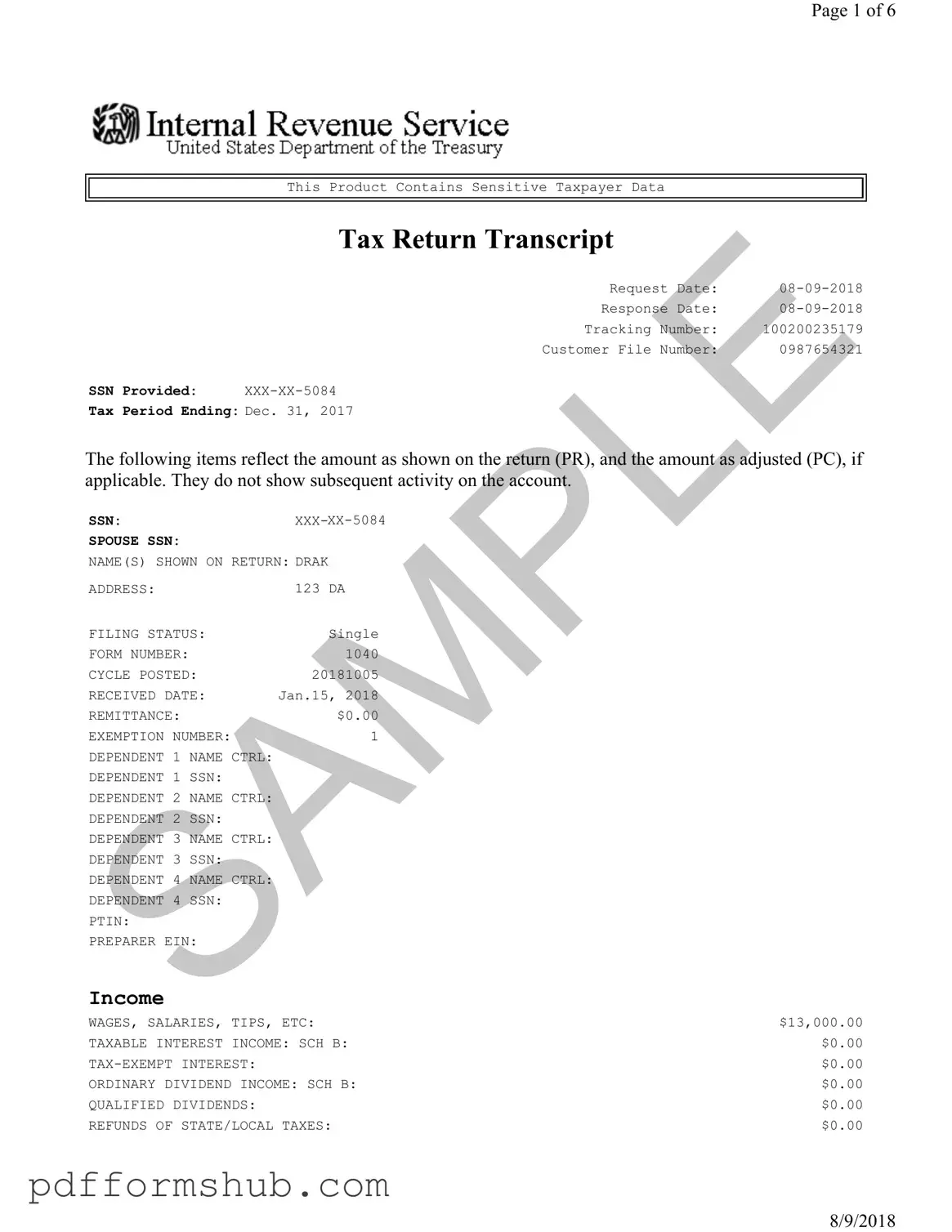

Fill in Your Sample Tax Return Transcript Form

A Sample Tax Return Transcript is a document that provides a summary of your tax return information as it was originally filed. It includes details like your income, deductions, and tax credits for a specific tax year. If you need to fill out this form, click the button below to get started.

Customize Form

Fill in Your Sample Tax Return Transcript Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Sample Tax Return Transcript online without printing hassles.