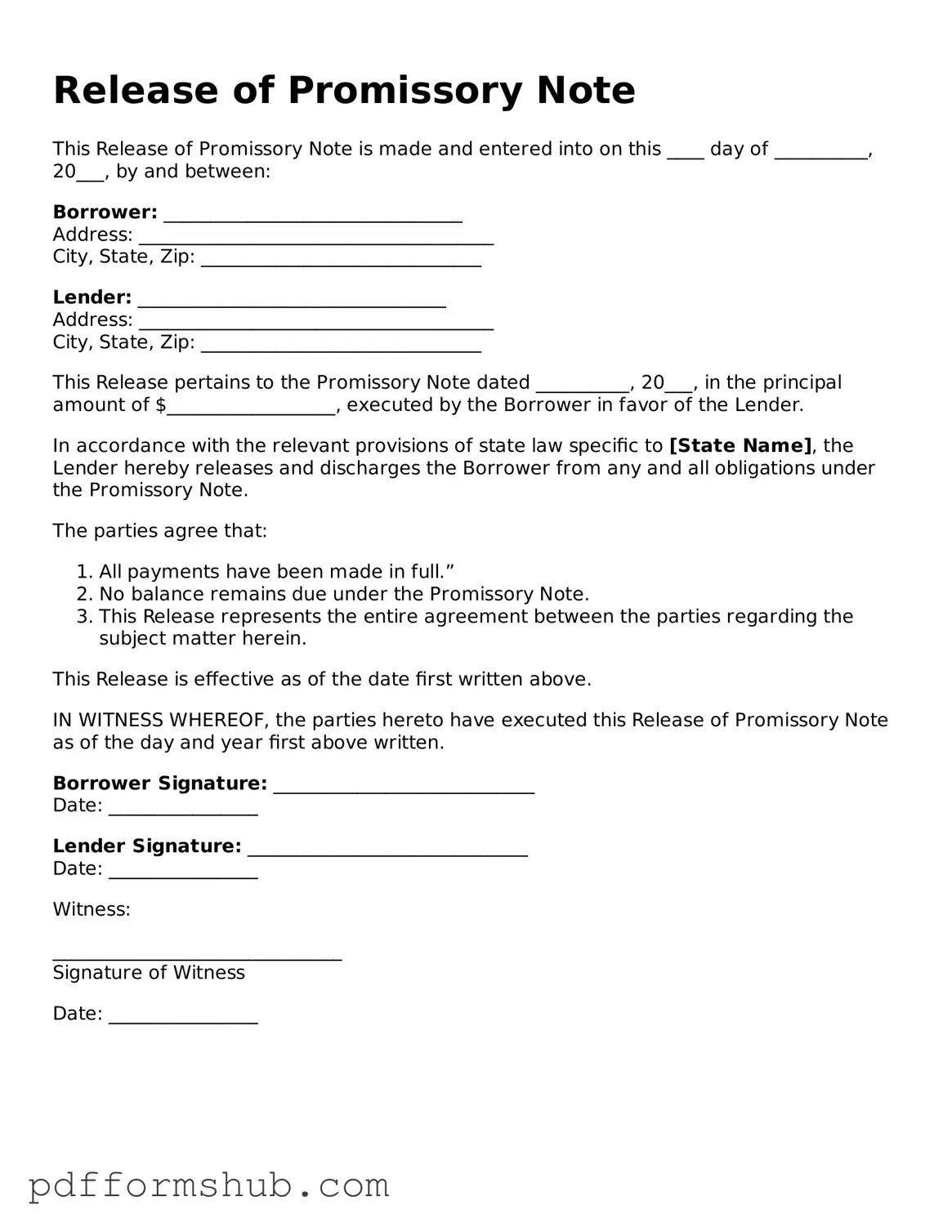

Valid Release of Promissory Note Form

A Release of Promissory Note form is a legal document used to formally acknowledge the repayment of a promissory note, thereby releasing the borrower from any further obligations. This form serves as proof that the debt has been satisfied and protects both parties involved. For those needing to finalize their financial agreements, filling out the form is essential; click the button below to get started.

Customize Form

Valid Release of Promissory Note Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Release of Promissory Note online without printing hassles.