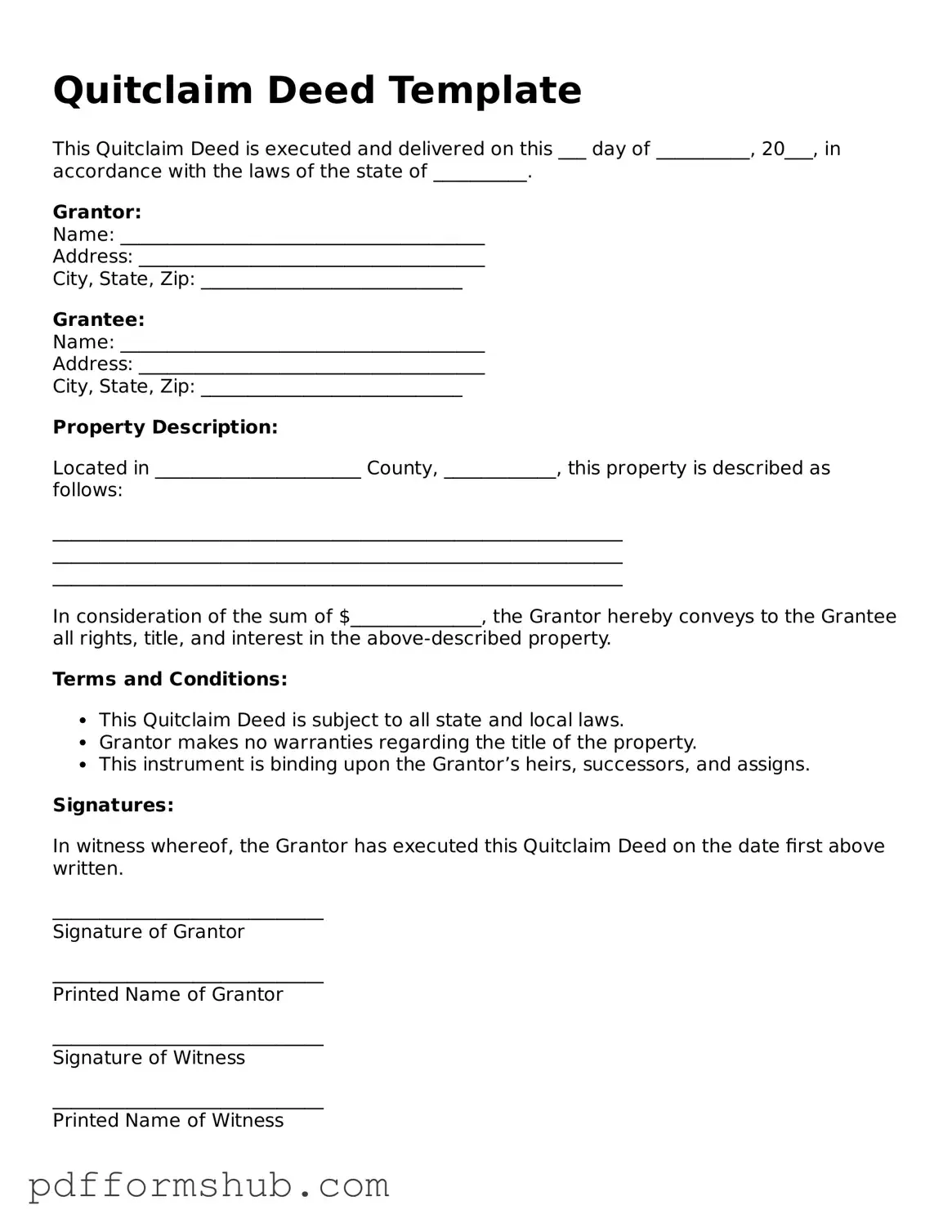

Valid Quitclaim Deed Form

A Quitclaim Deed is a legal document that allows one person to transfer their interest in a property to another person without making any guarantees about the title. This type of deed is often used in situations such as transferring property between family members or resolving disputes. If you're ready to fill out the Quitclaim Deed form, click the button below.

Customize Form

Valid Quitclaim Deed Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Quitclaim Deed online without printing hassles.