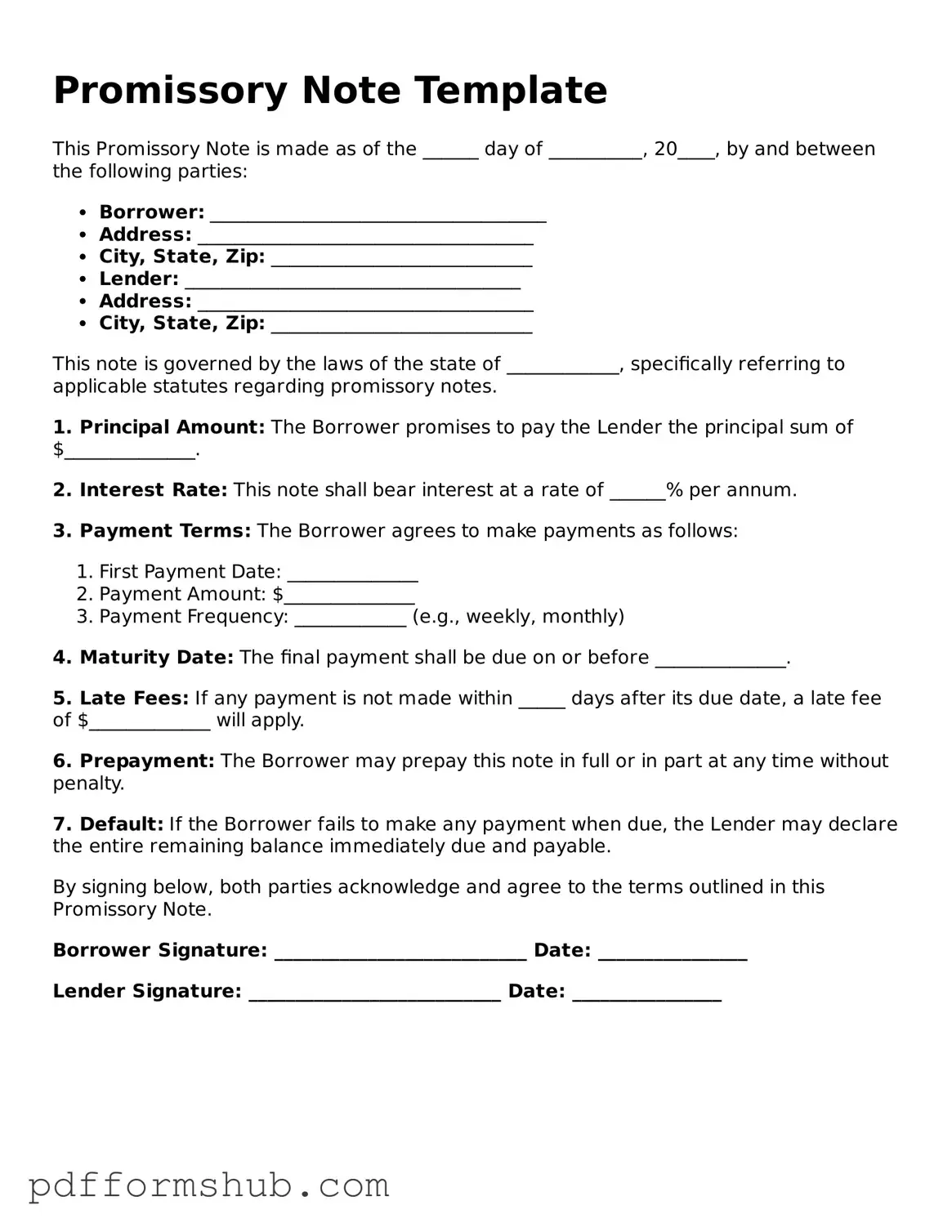

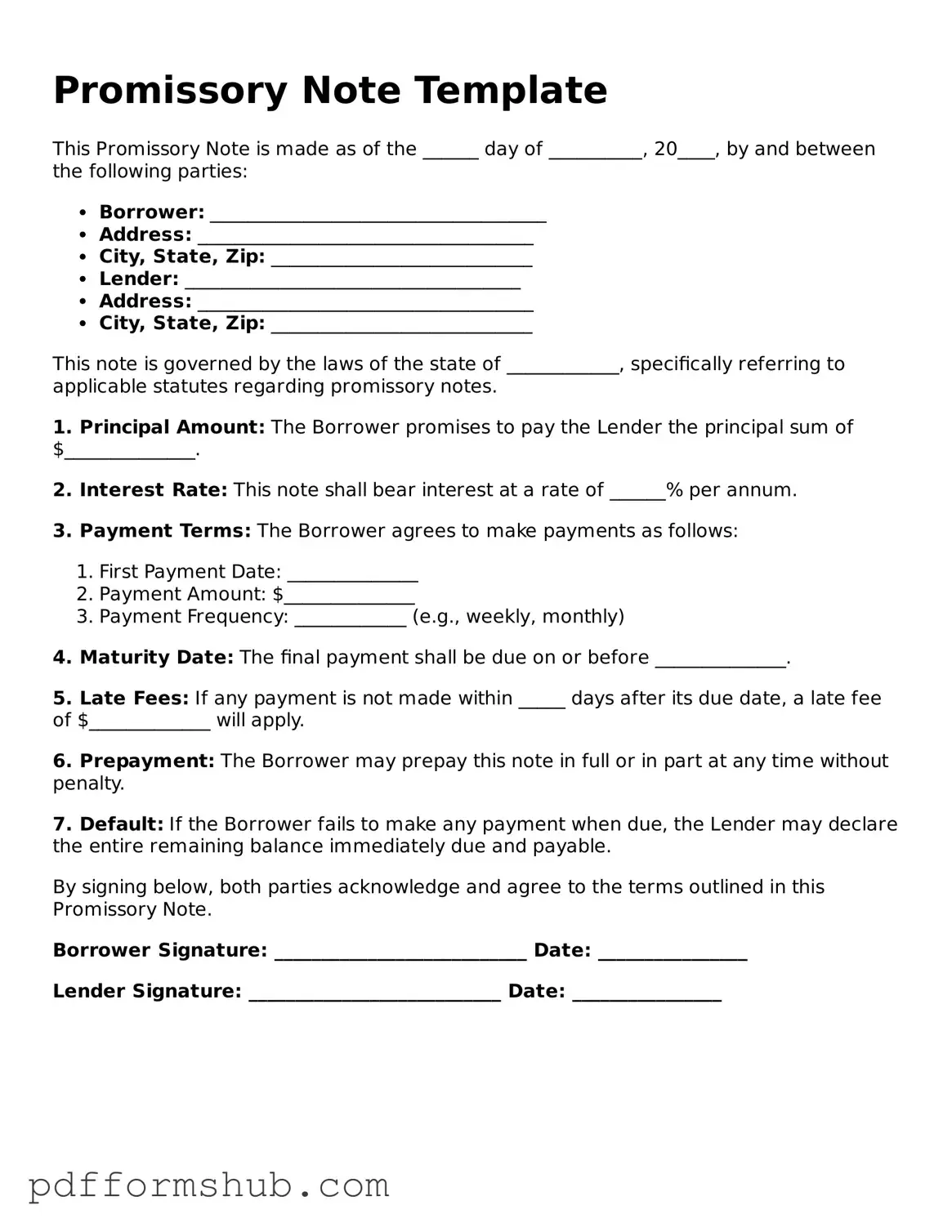

Valid Promissory Note Form

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a predetermined time or on demand. This important financial document outlines the terms of the loan, including interest rates and repayment schedules. Understanding how to properly fill out a Promissory Note can safeguard both lenders and borrowers, ensuring clear communication and legal protection.

Ready to create your own Promissory Note? Click the button below to get started!

Customize Form

Valid Promissory Note Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Promissory Note online without printing hassles.