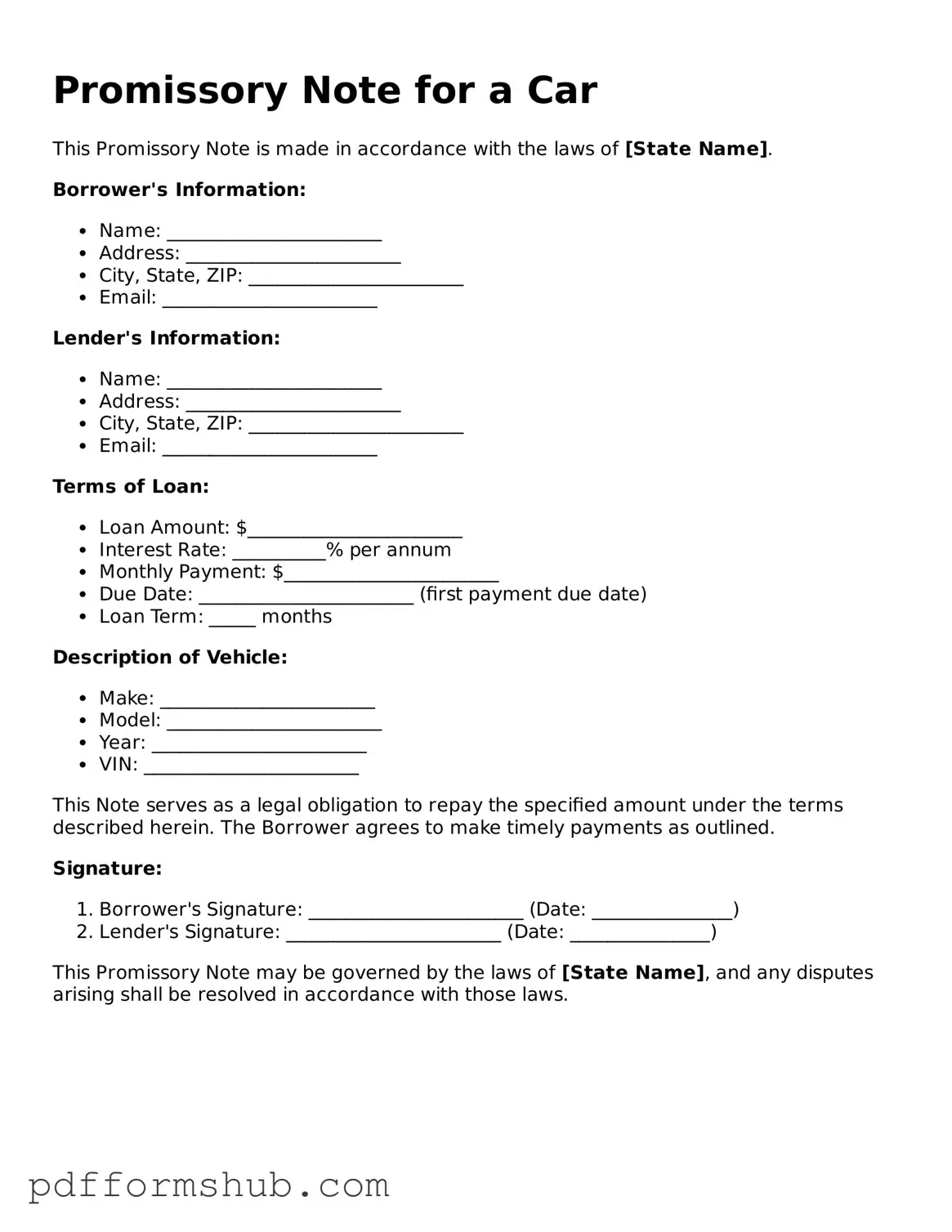

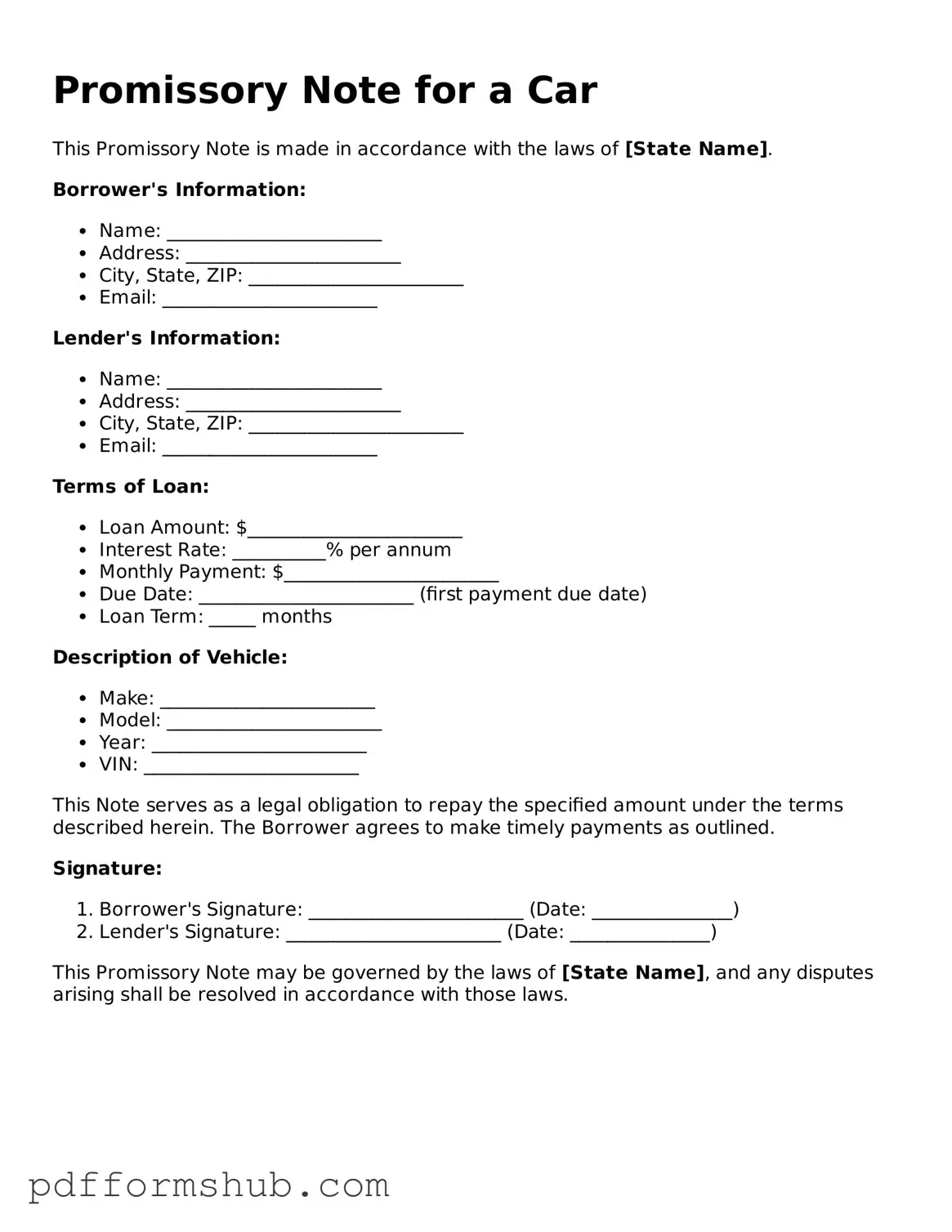

Valid Promissory Note for a Car Form

A Promissory Note for a Car is a legal document that outlines the borrower's promise to repay a loan used to purchase a vehicle. This form serves as a written record of the loan agreement, detailing the amount borrowed, repayment terms, and interest rates. For those looking to formalize their car financing, filling out this form is a crucial step; click the button below to get started.

Customize Form

Valid Promissory Note for a Car Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Promissory Note for a Car online without printing hassles.