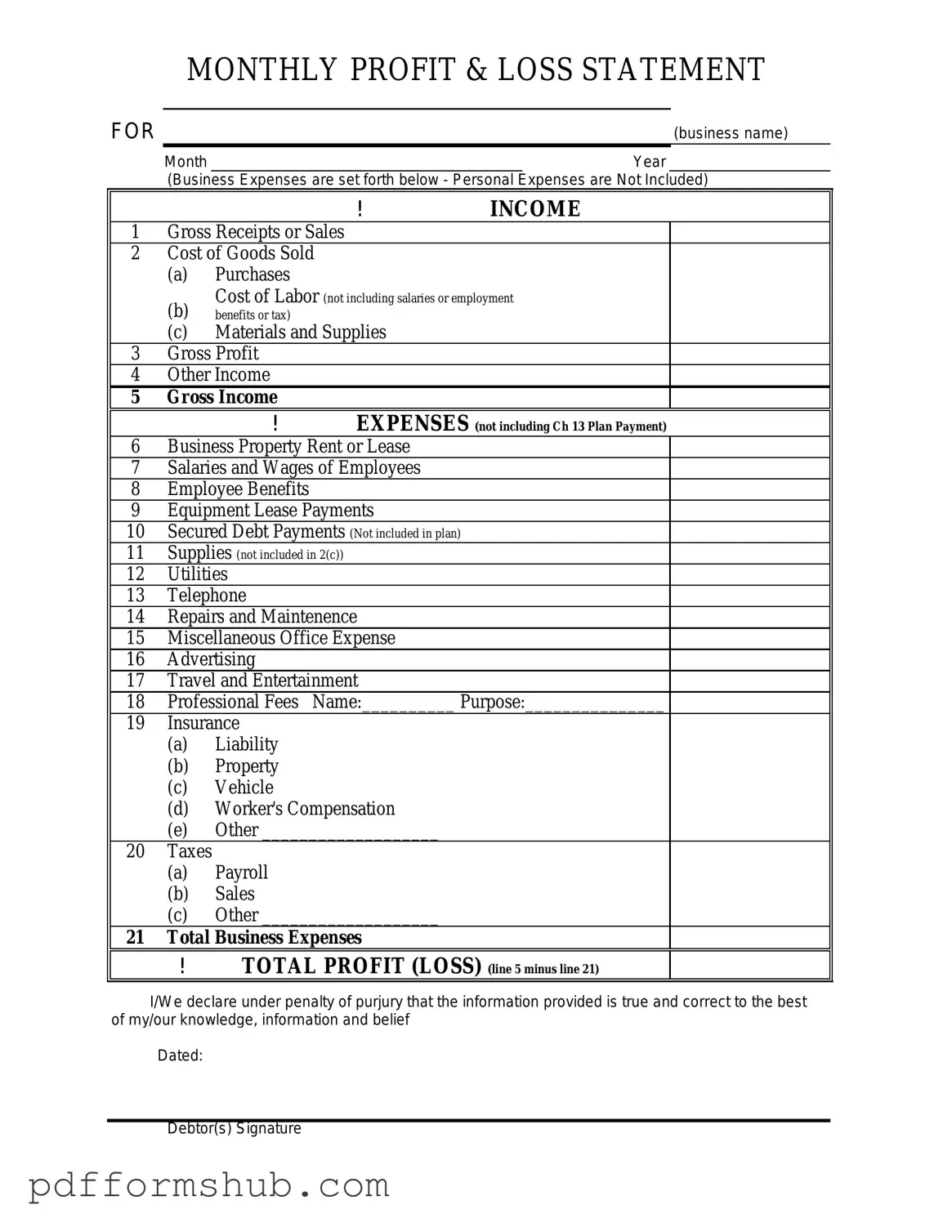

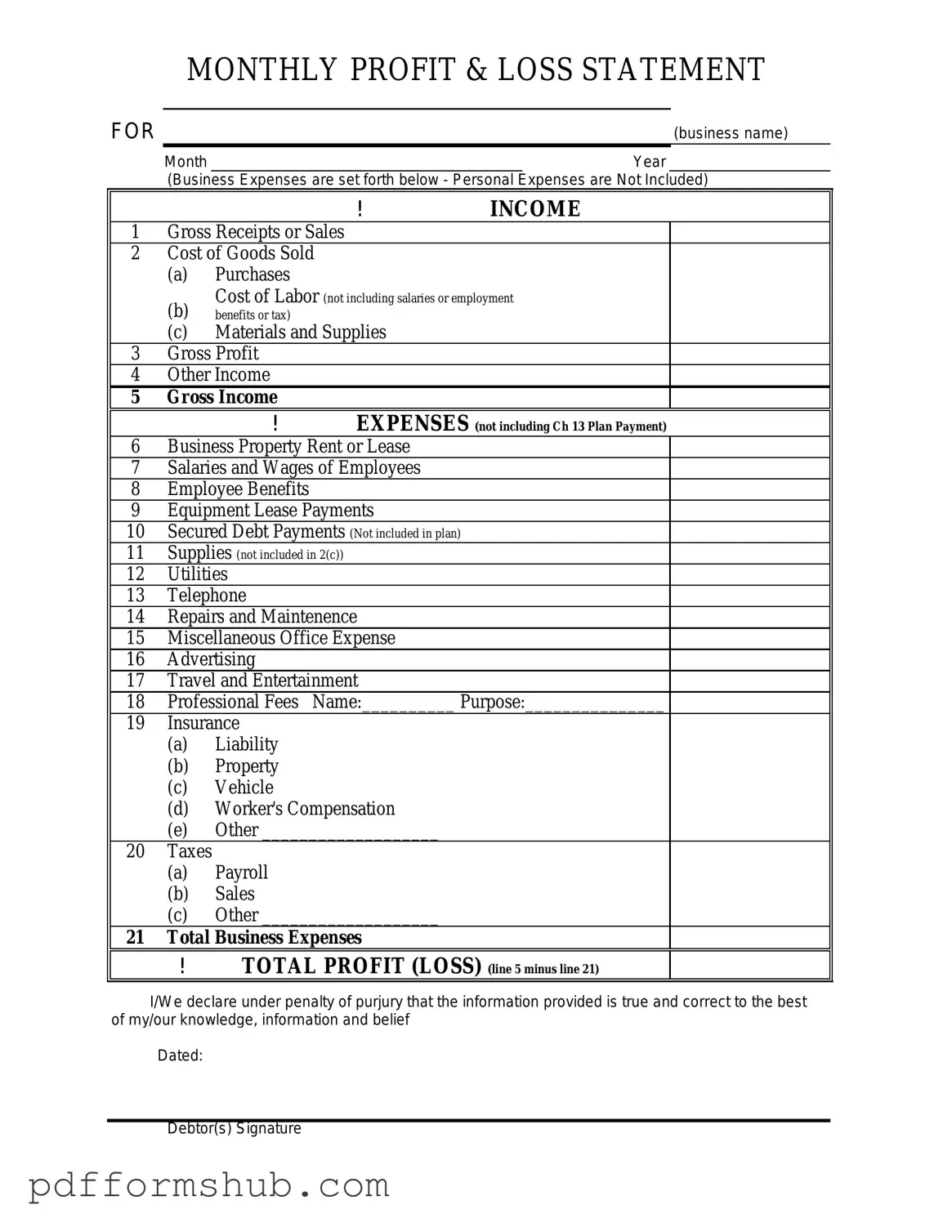

Fill in Your Profit And Loss Form

The Profit and Loss form, also known as an income statement, provides a clear overview of a business's revenues and expenses over a specific period. This essential financial document helps business owners assess their profitability and make informed decisions for future growth. To gain insights into your financial performance, consider filling out the form by clicking the button below.

Customize Form

Fill in Your Profit And Loss Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Profit And Loss online without printing hassles.