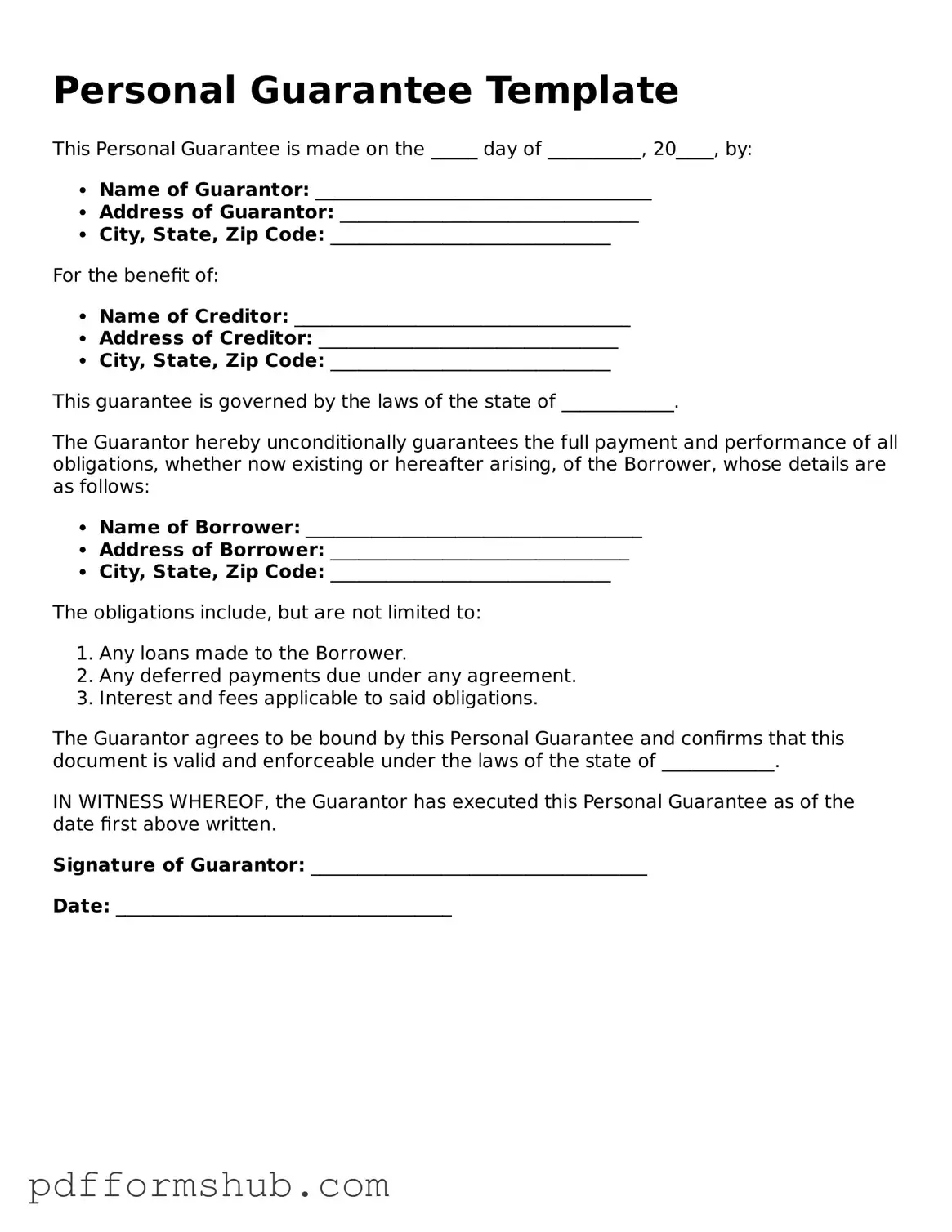

Valid Personal Guarantee Form

A Personal Guarantee form is a legal document in which an individual agrees to be responsible for another person's debt or obligation. This form is commonly used in business transactions to provide additional security for lenders or creditors. Understanding the implications of signing this form is crucial, so be sure to fill it out by clicking the button below.

Customize Form

Valid Personal Guarantee Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Personal Guarantee online without printing hassles.