Fill in Your P 45 It Form

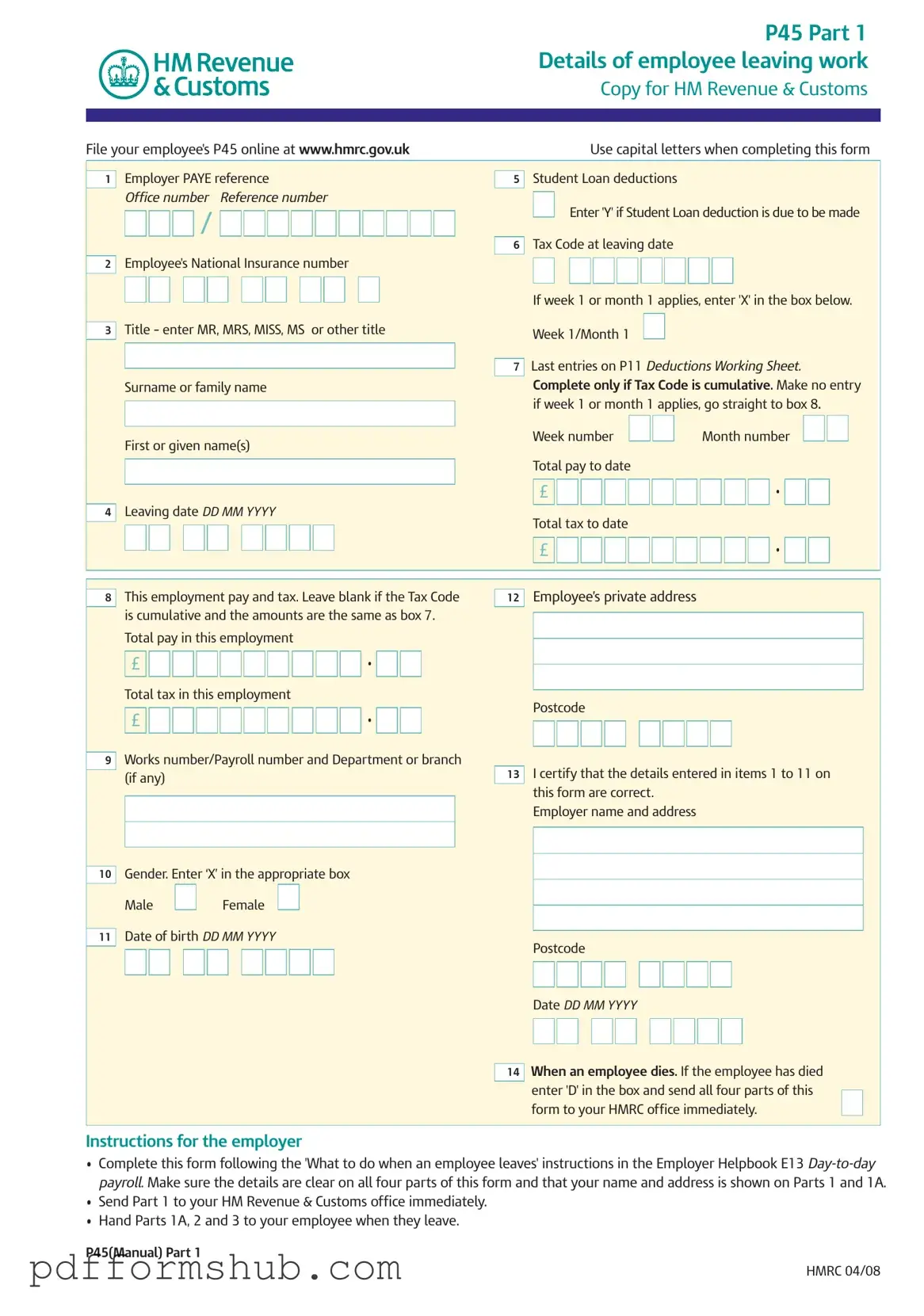

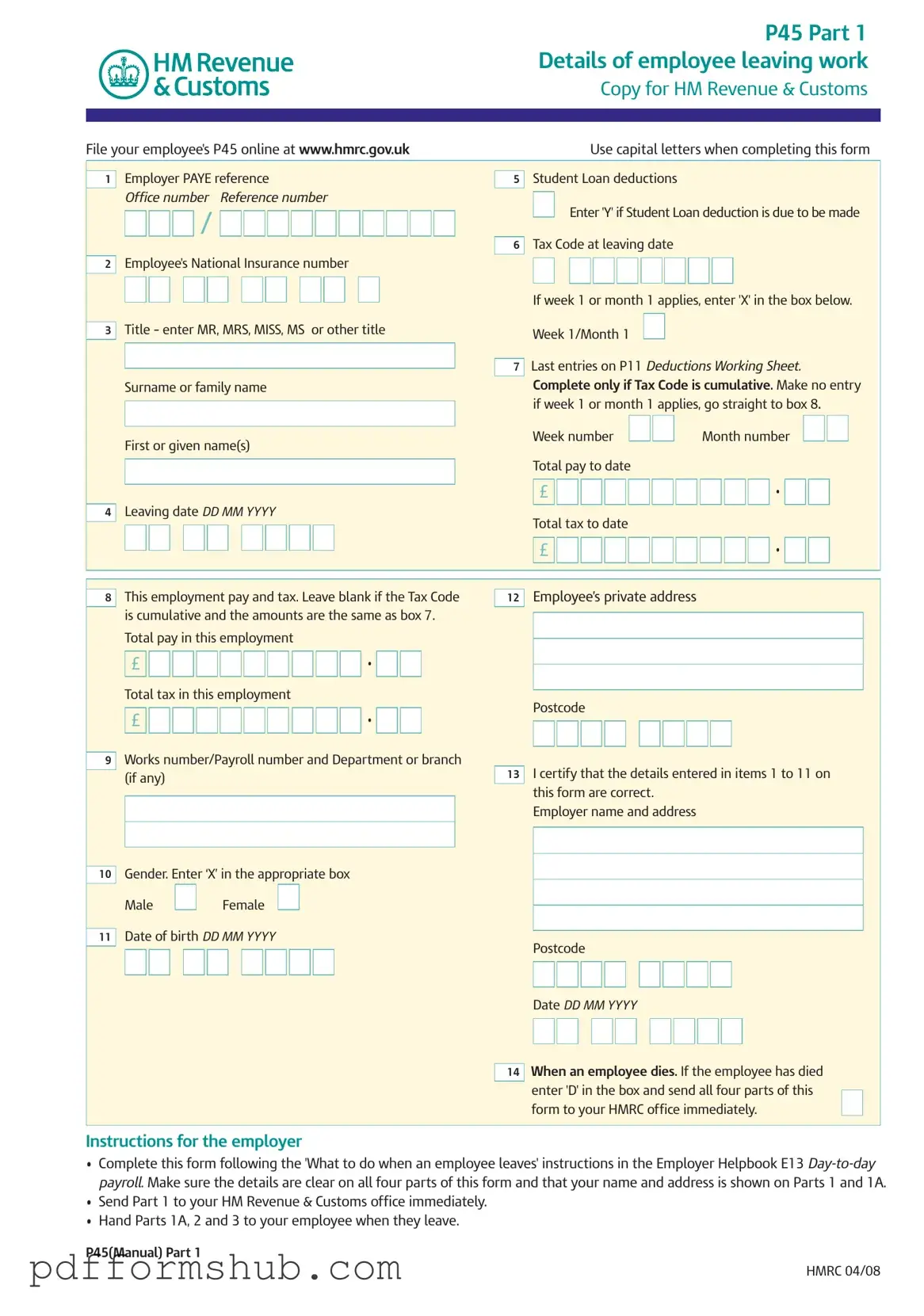

The P45 It form is a document used in the UK that provides details about an employee who is leaving their job. This form is essential for tax purposes, as it outlines the employee's earnings and tax deductions during their employment. Proper completion of the P45 ensures a smooth transition for both the employee and the new employer.

To fill out the form, please click the button below.

Customize Form

Fill in Your P 45 It Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete P 45 It online without printing hassles.