Fill in Your Netspend Dispute Form

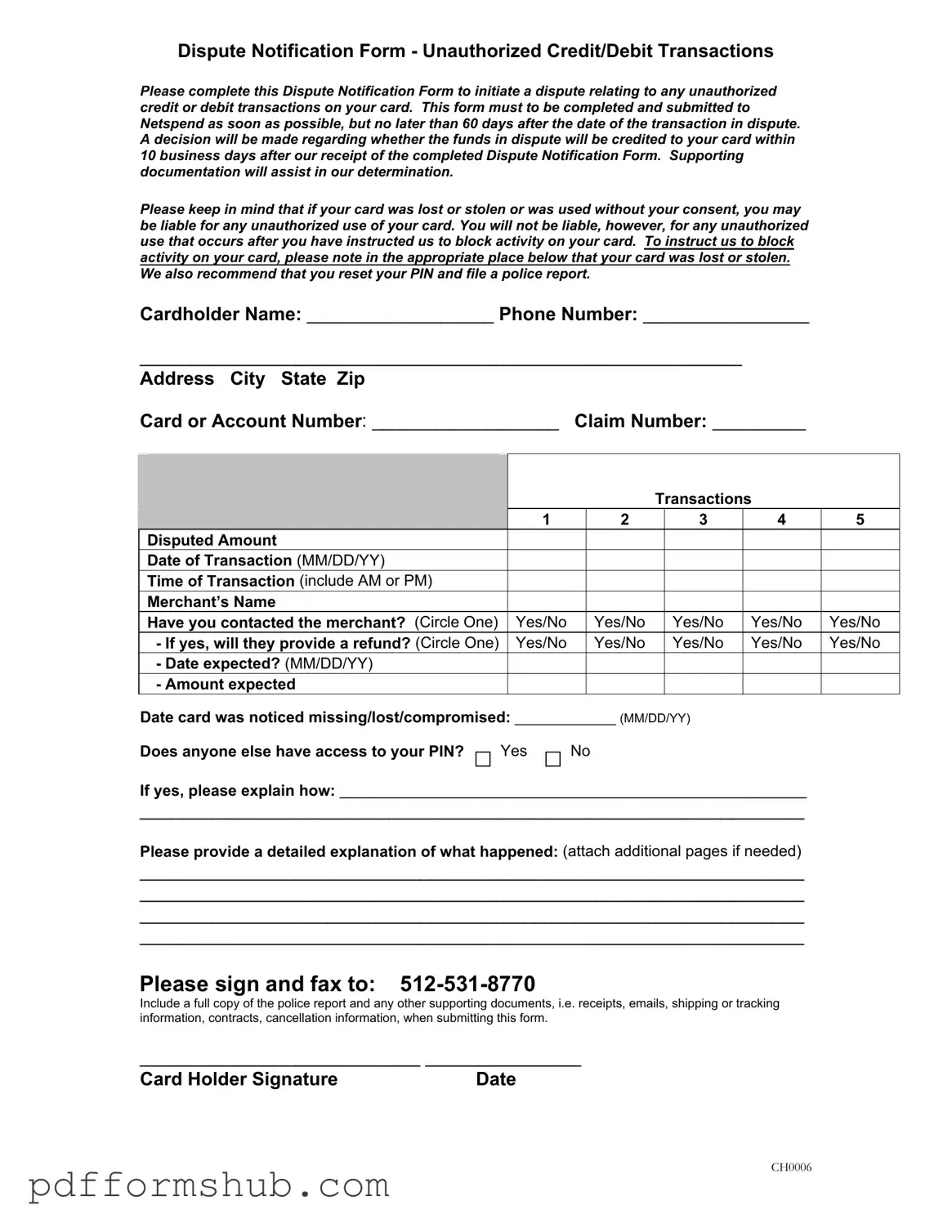

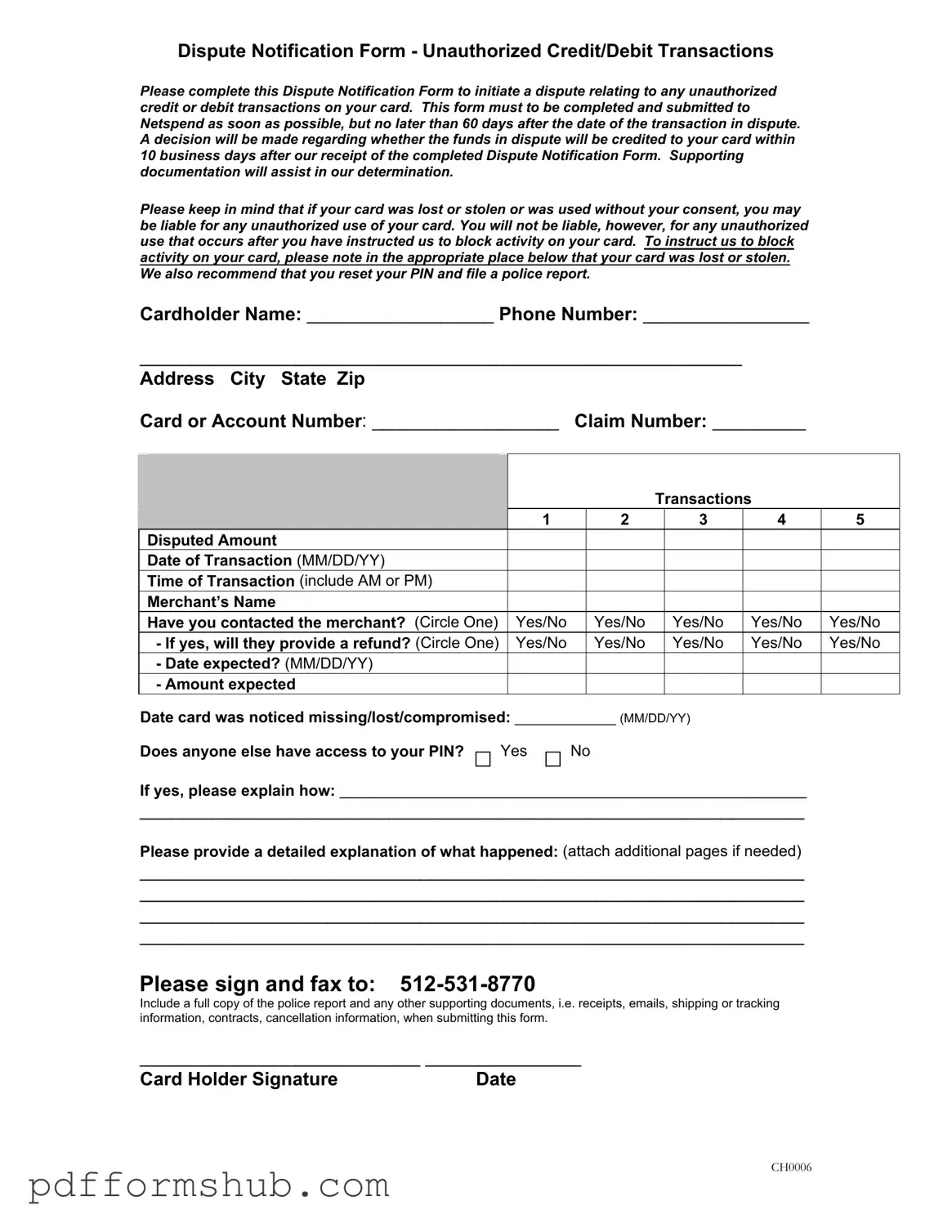

The Netspend Dispute Notification Form is a crucial tool for cardholders seeking to address unauthorized credit or debit transactions. By completing this form, individuals can initiate a dispute process that must be submitted within 60 days of the transaction date. Timely submission and accurate information will help ensure a prompt resolution, as decisions regarding fund credits are typically made within 10 business days after receipt of the form.

If you believe you have a valid dispute, please fill out the form by clicking the button below.

Customize Form

Fill in Your Netspend Dispute Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Netspend Dispute online without printing hassles.