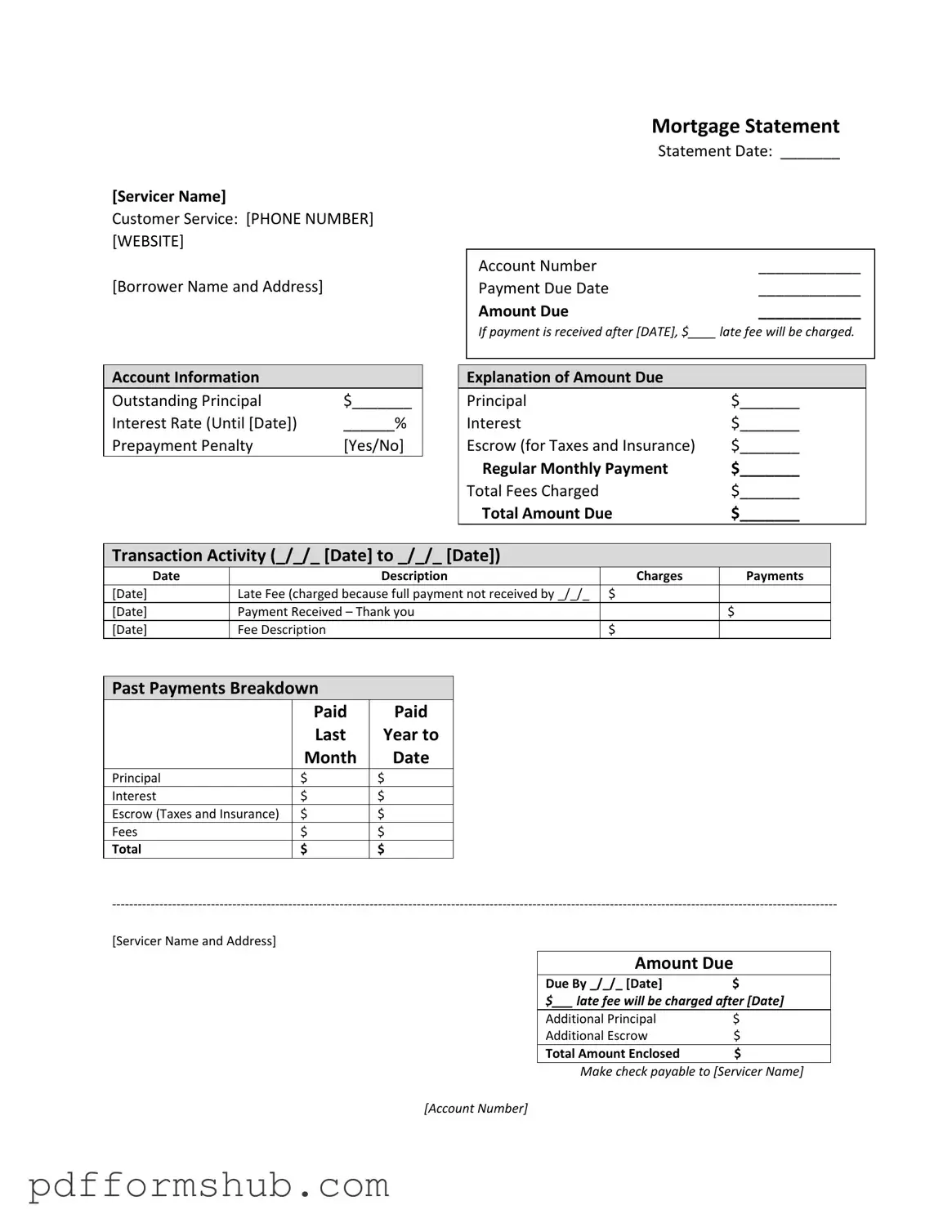

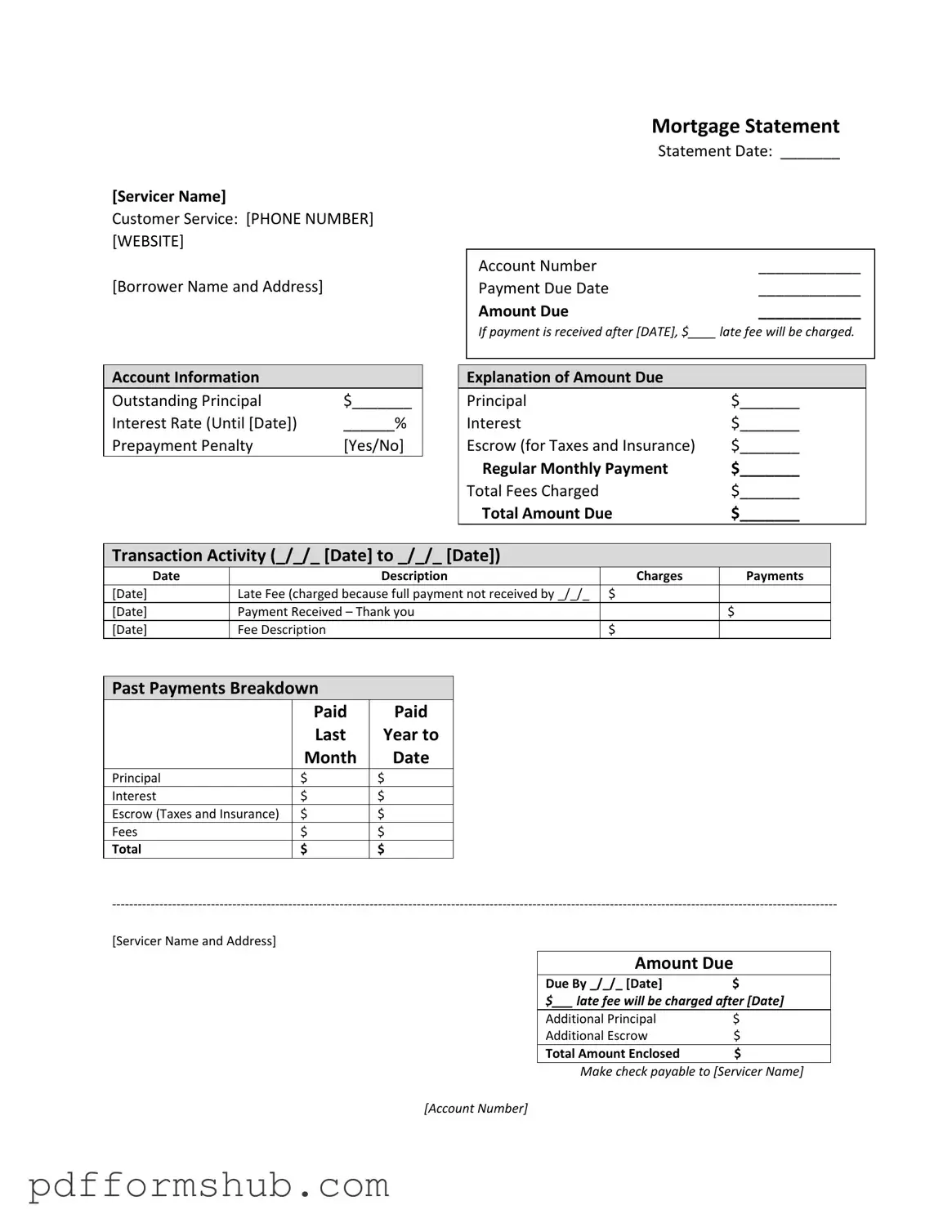

Fill in Your Mortgage Statement Form

The Mortgage Statement form is a crucial document that outlines the details of your mortgage account, including payment amounts, due dates, and any outstanding balances. It serves as a comprehensive summary of your mortgage status, helping you stay informed about your financial obligations. To ensure you meet your payment deadlines and avoid late fees, please fill out the form by clicking the button below.

Customize Form

Fill in Your Mortgage Statement Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Mortgage Statement online without printing hassles.