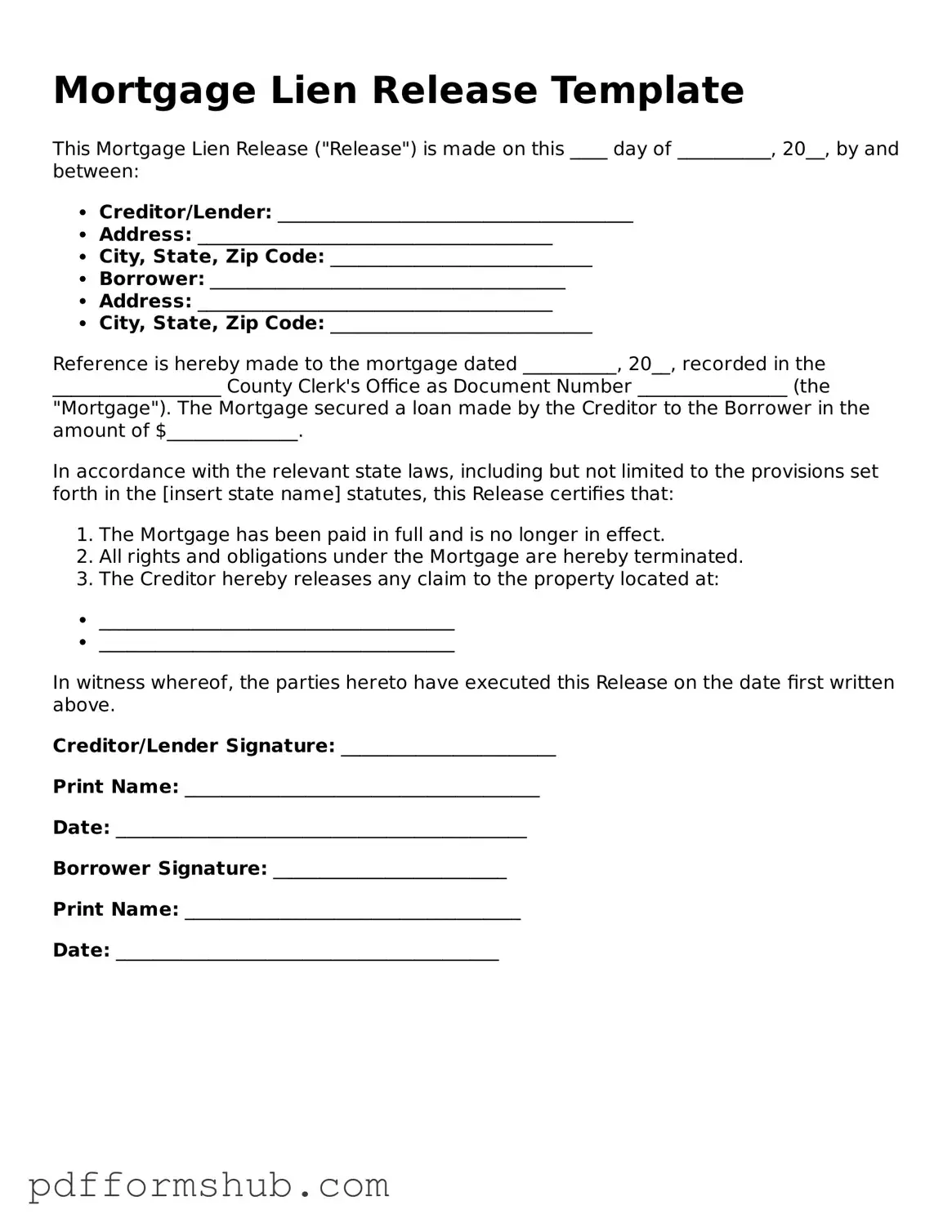

Valid Mortgage Lien Release Form

The Mortgage Lien Release form is a crucial document that formally removes a mortgage lien from a property once the associated debt has been paid in full. This release signifies that the borrower has fulfilled their financial obligations, allowing for a clear title to the property. Understanding this process is essential for homeowners looking to navigate their financial landscape effectively.

Ready to take the next step? Fill out the form by clicking the button below.

Customize Form

Valid Mortgage Lien Release Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Mortgage Lien Release online without printing hassles.