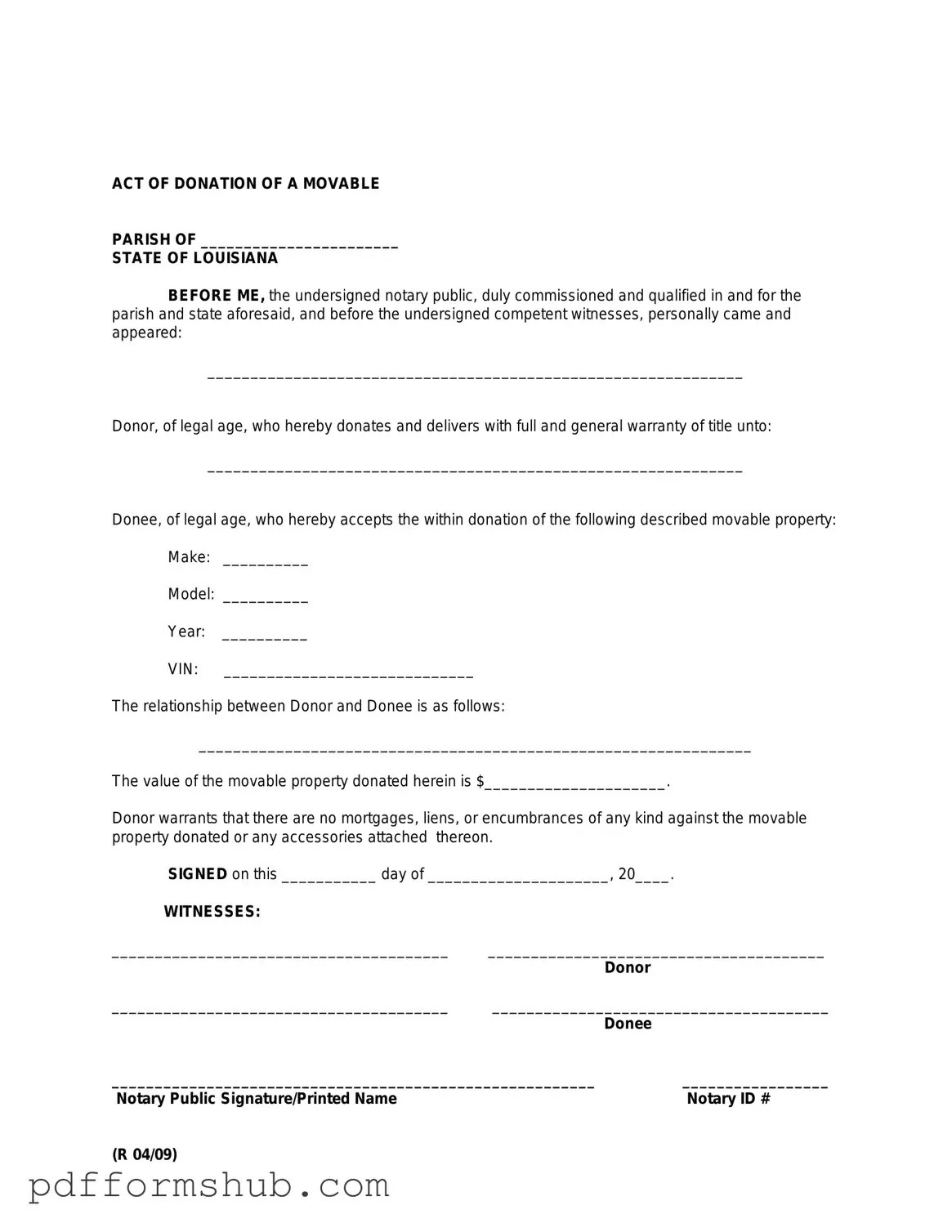

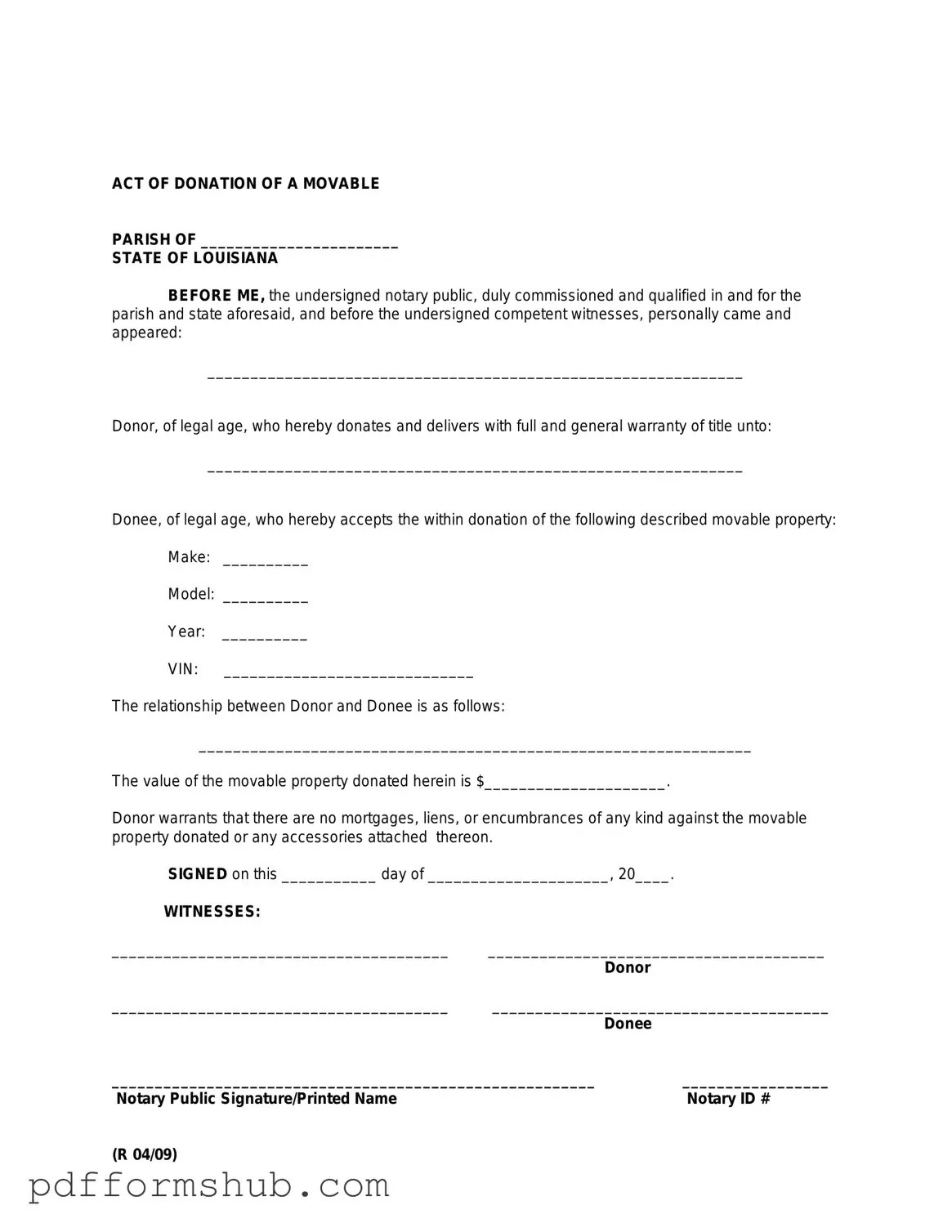

Fill in Your Louisiana act of donation Form

The Louisiana Act of Donation Form is a legal document that allows an individual to gift property or assets to another person without any exchange of payment. This form serves to formalize the donation process and ensures that both parties understand the terms of the gift. For those considering making a donation, filling out this form is a crucial step; click the button below to get started.

Customize Form

Fill in Your Louisiana act of donation Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Louisiana act of donation online without printing hassles.