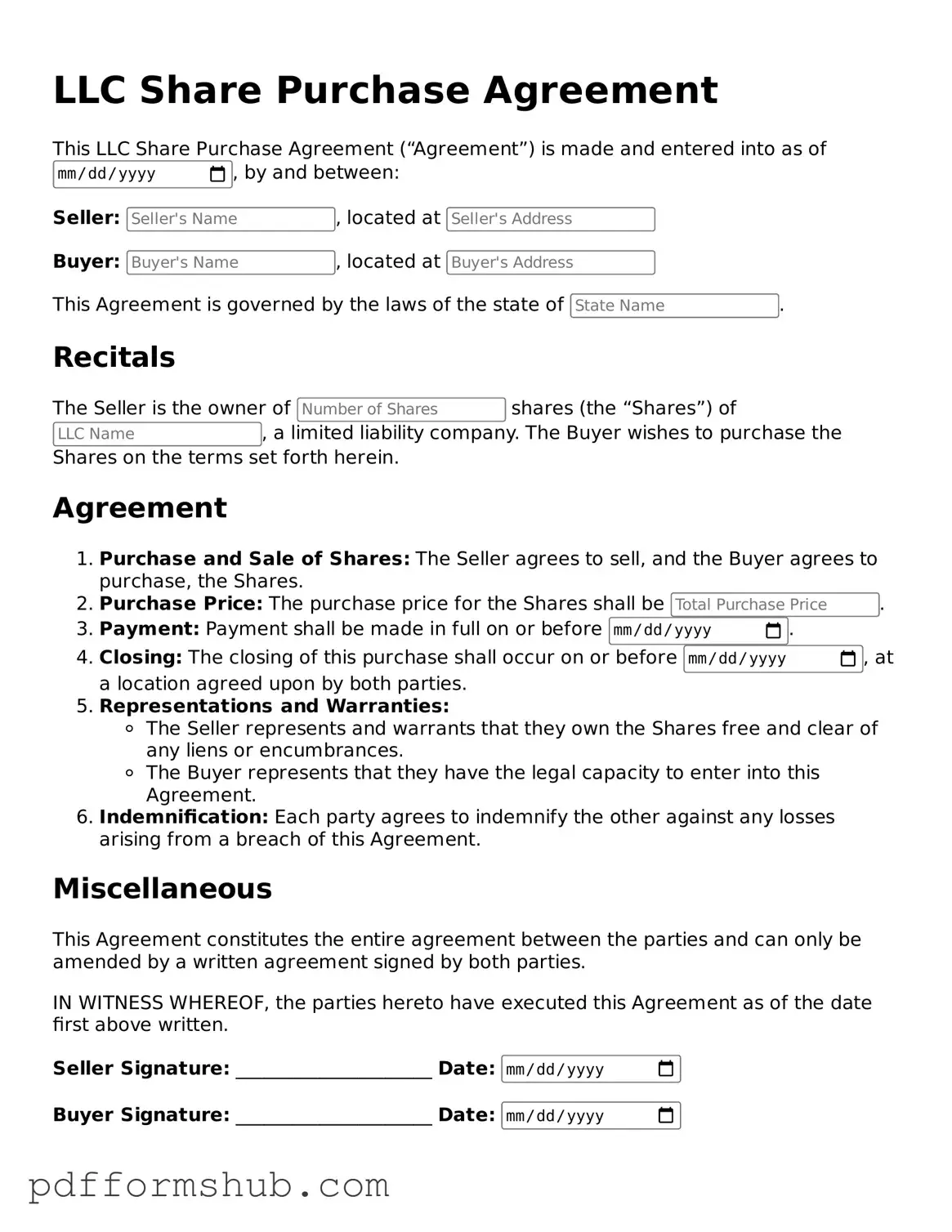

Valid LLC Share Purchase Agreement Form

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase shares in a limited liability company. This agreement serves to protect both the buyer and the seller by clearly defining the rights and obligations of each party involved in the transaction. To ensure a smooth process, it’s important to fill out the form accurately and completely; click the button below to get started.

Customize Form

Valid LLC Share Purchase Agreement Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete LLC Share Purchase Agreement online without printing hassles.