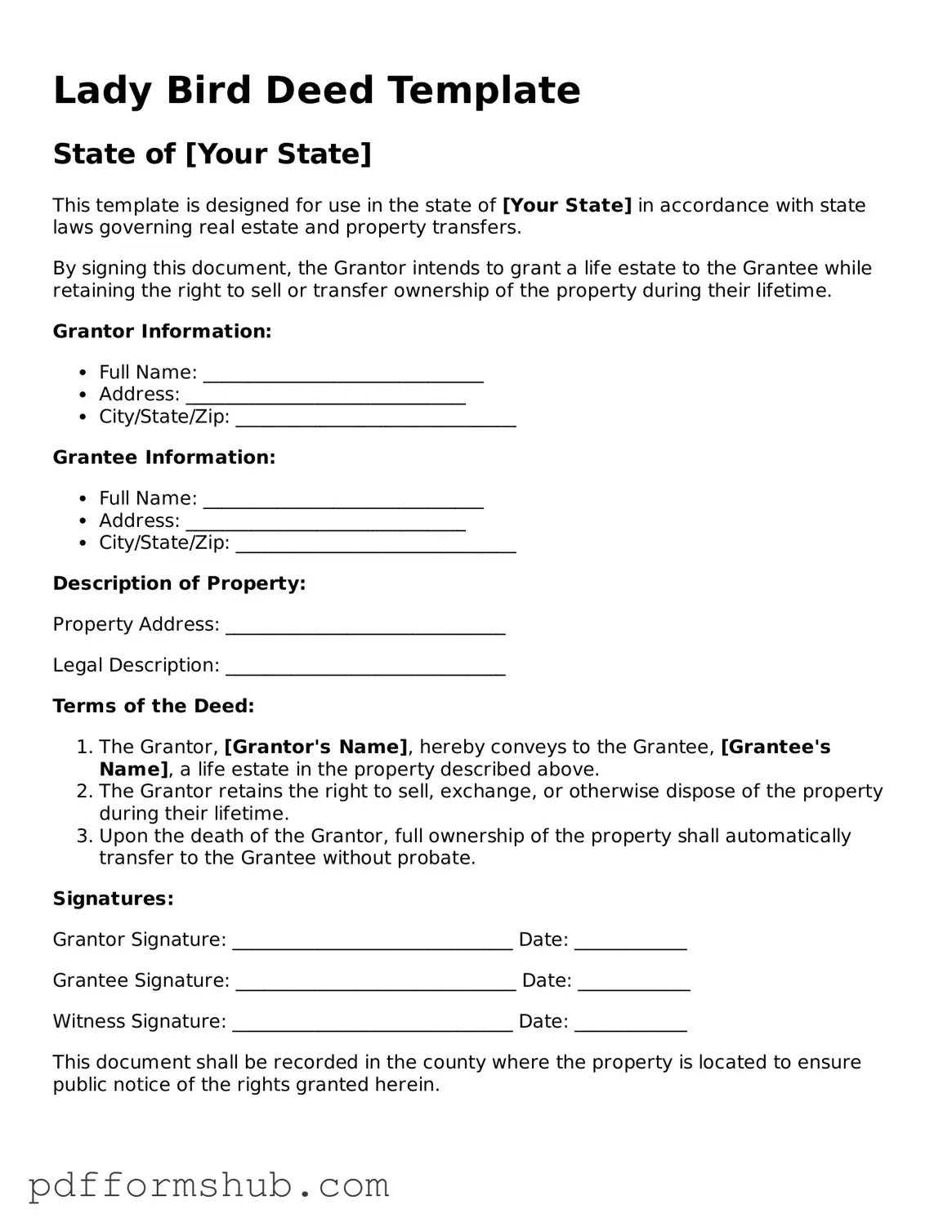

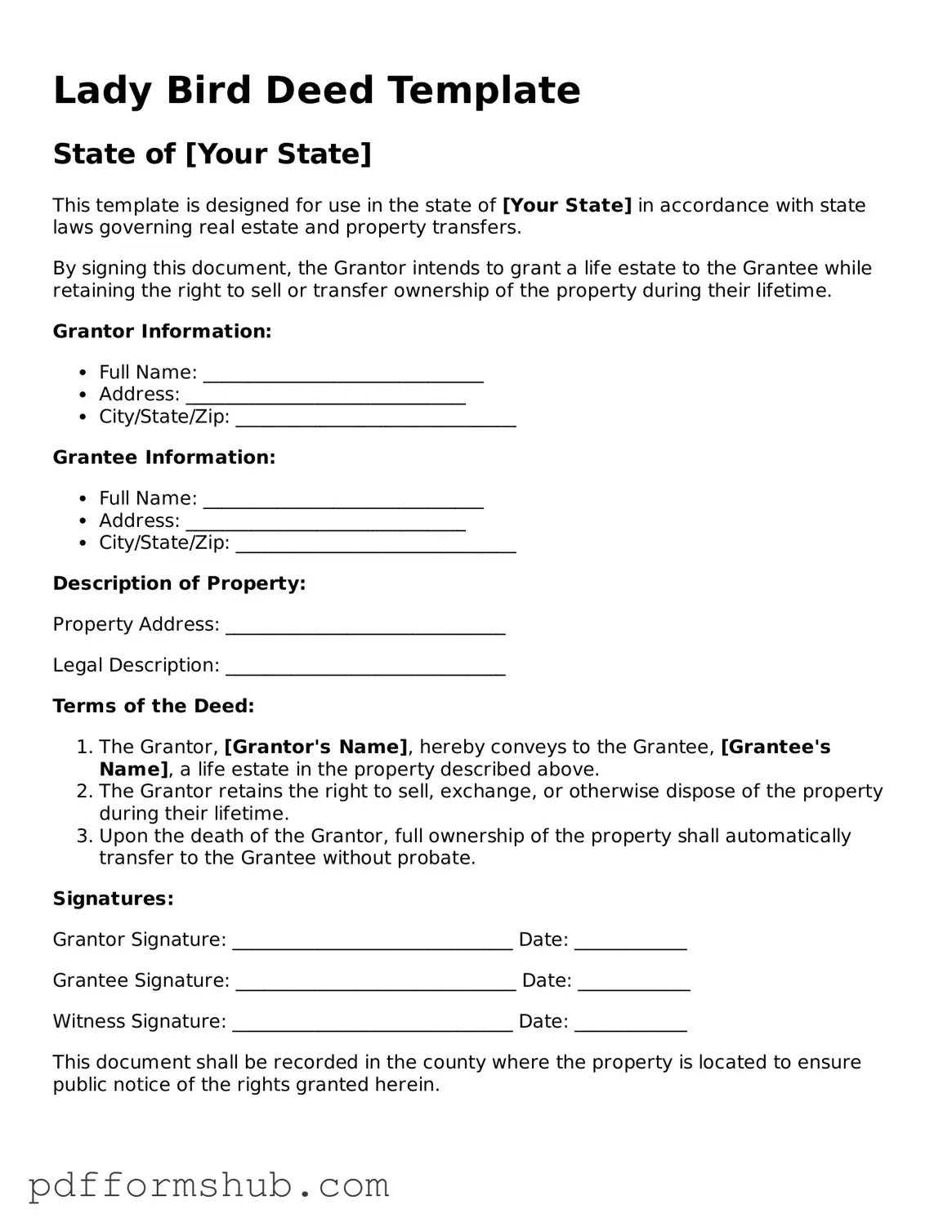

Valid Lady Bird Deed Form

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. This type of deed provides flexibility and can help avoid probate, making it an attractive option for many individuals. To learn more about how to fill out the Lady Bird Deed form, click the button below.

Customize Form

Valid Lady Bird Deed Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Lady Bird Deed online without printing hassles.