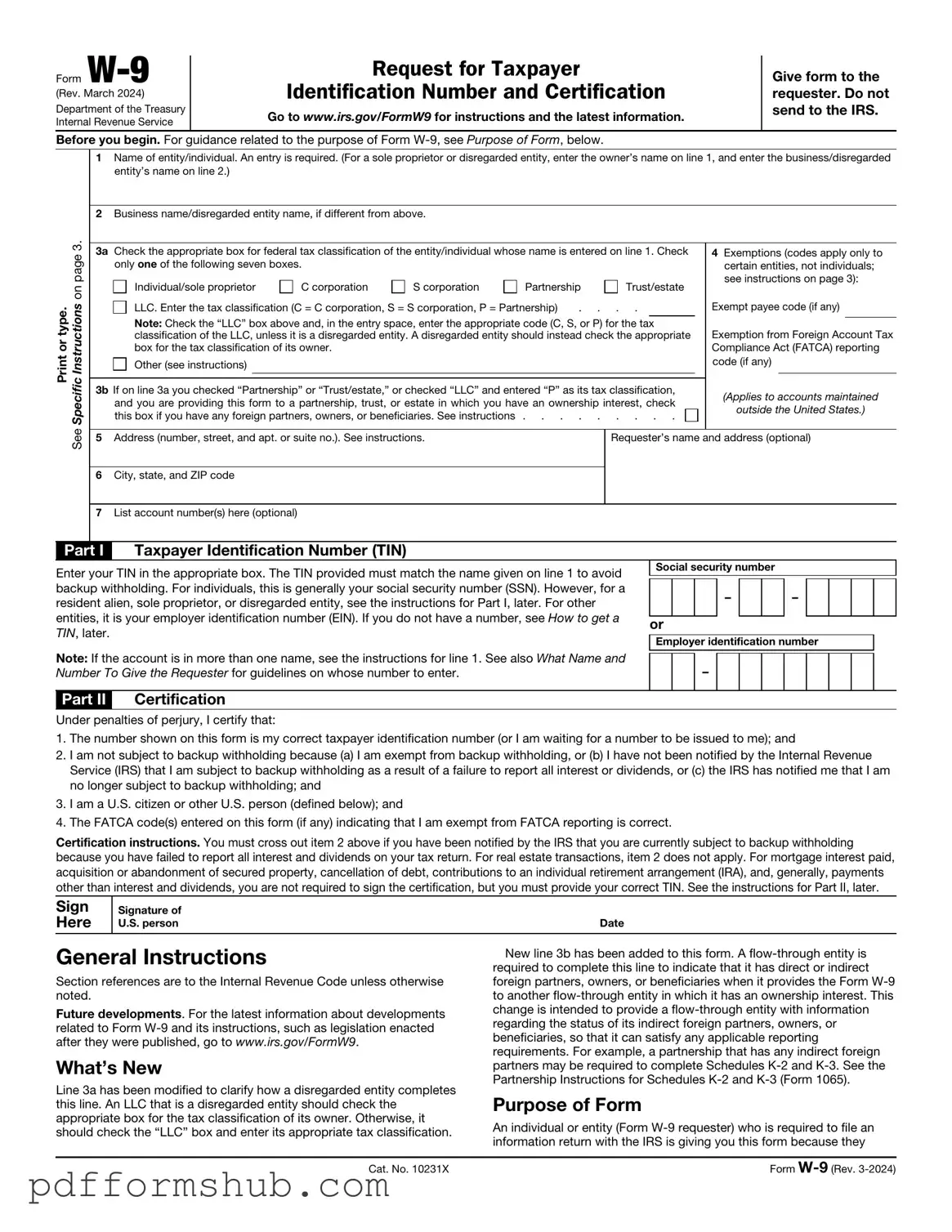

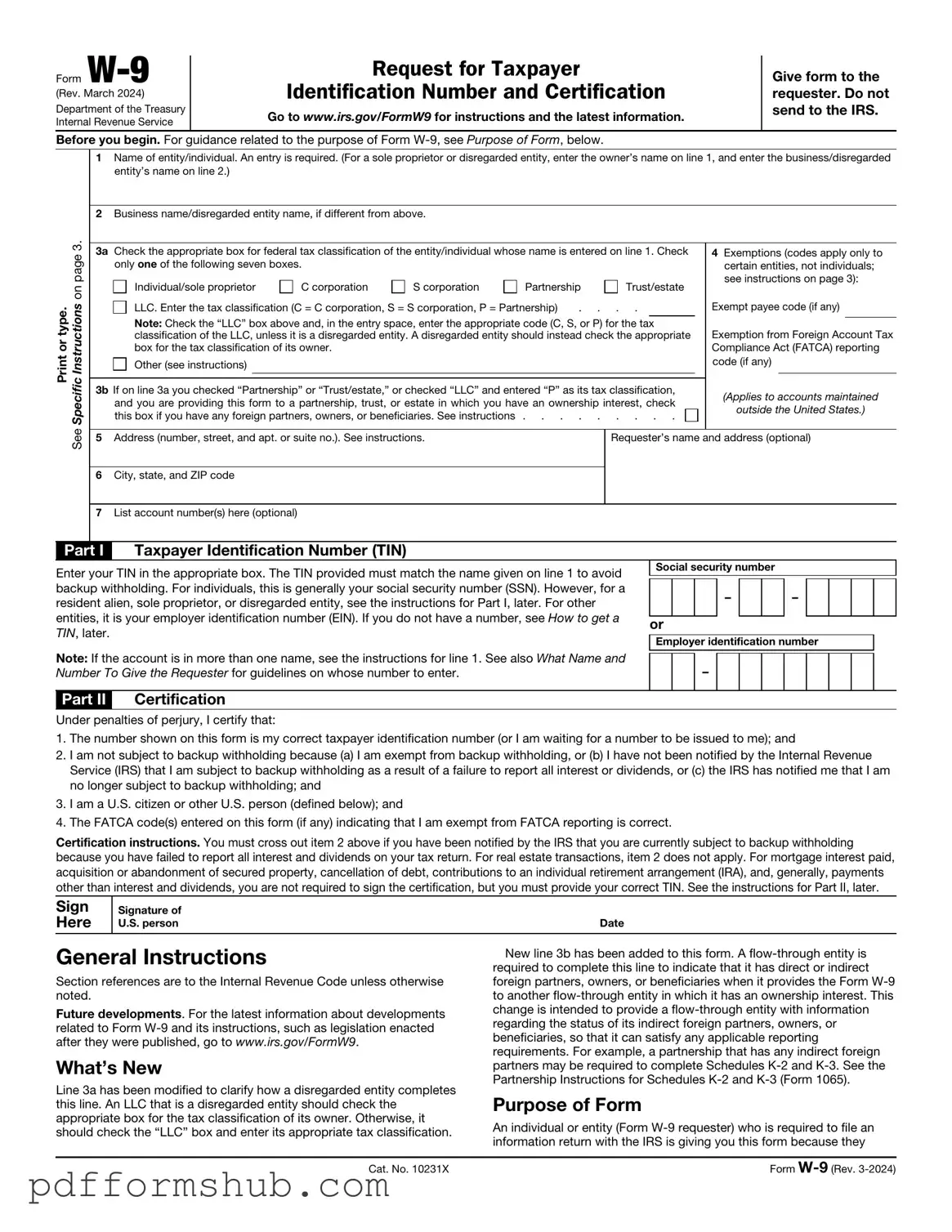

Fill in Your IRS W-9 Form

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. It is essential for freelancers, contractors, and vendors who receive payments, ensuring that the correct tax information is reported to the IRS. Understanding how to fill out this form accurately can save you from potential tax issues down the line.

Ready to get started? Fill out the form by clicking the button below.

Customize Form

Fill in Your IRS W-9 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS W-9 online without printing hassles.