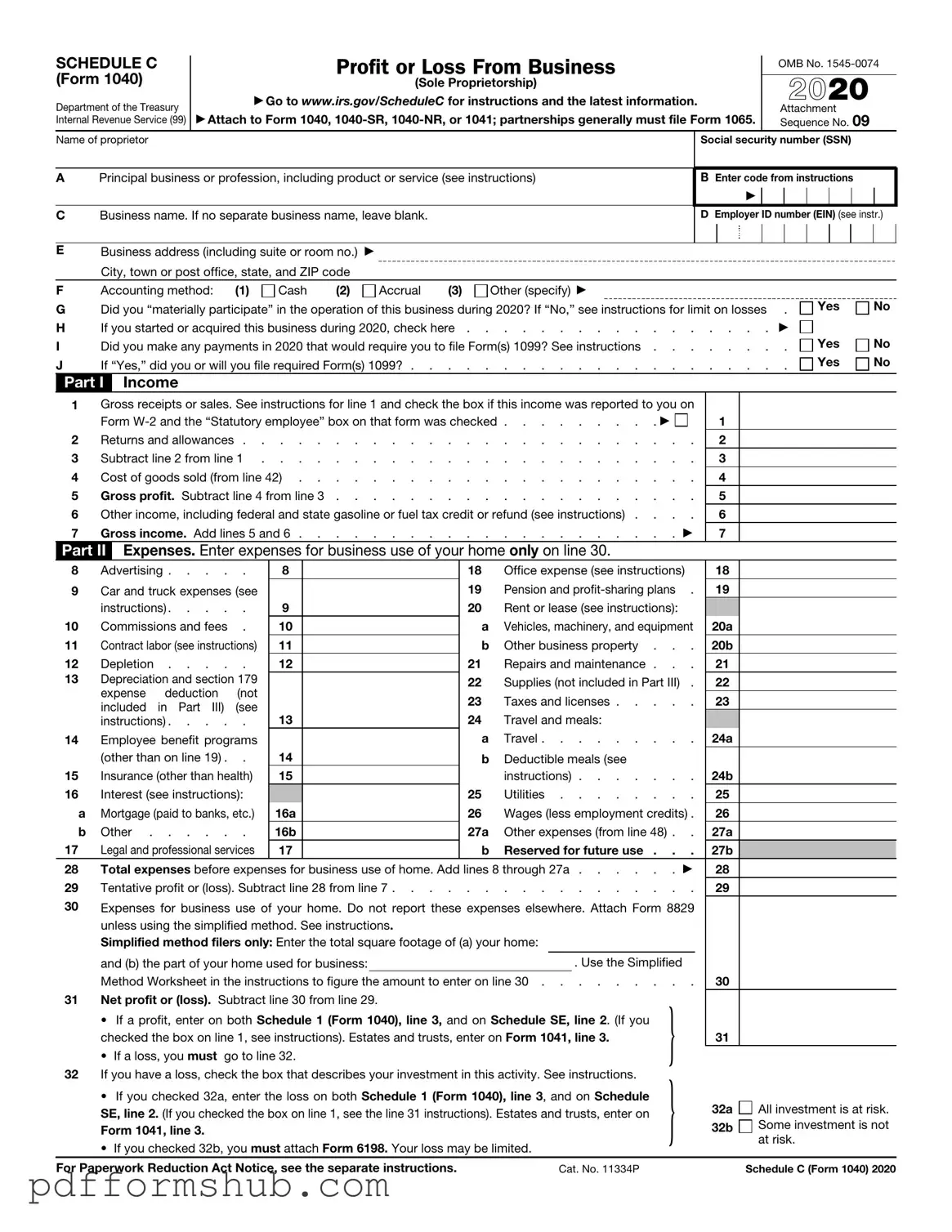

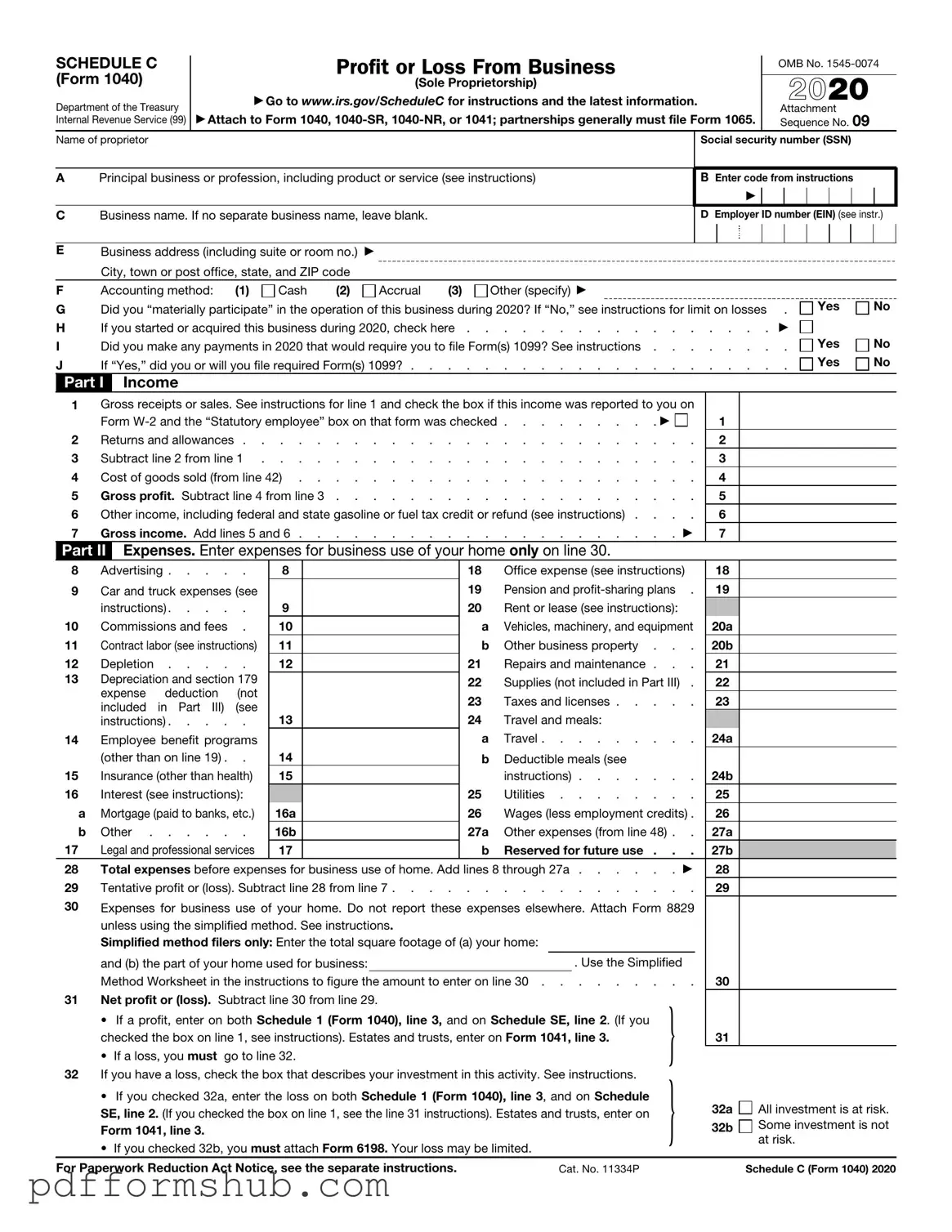

Fill in Your IRS Schedule C 1040 Form

The IRS Schedule C 1040 form is used by sole proprietors to report income or loss from their business activities. This form provides a detailed account of business expenses and profits, allowing individuals to accurately calculate their taxable income. Completing this form is essential for ensuring compliance with tax regulations.

To get started on filling out the form, click the button below.

Customize Form

Fill in Your IRS Schedule C 1040 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS Schedule C 1040 online without printing hassles.