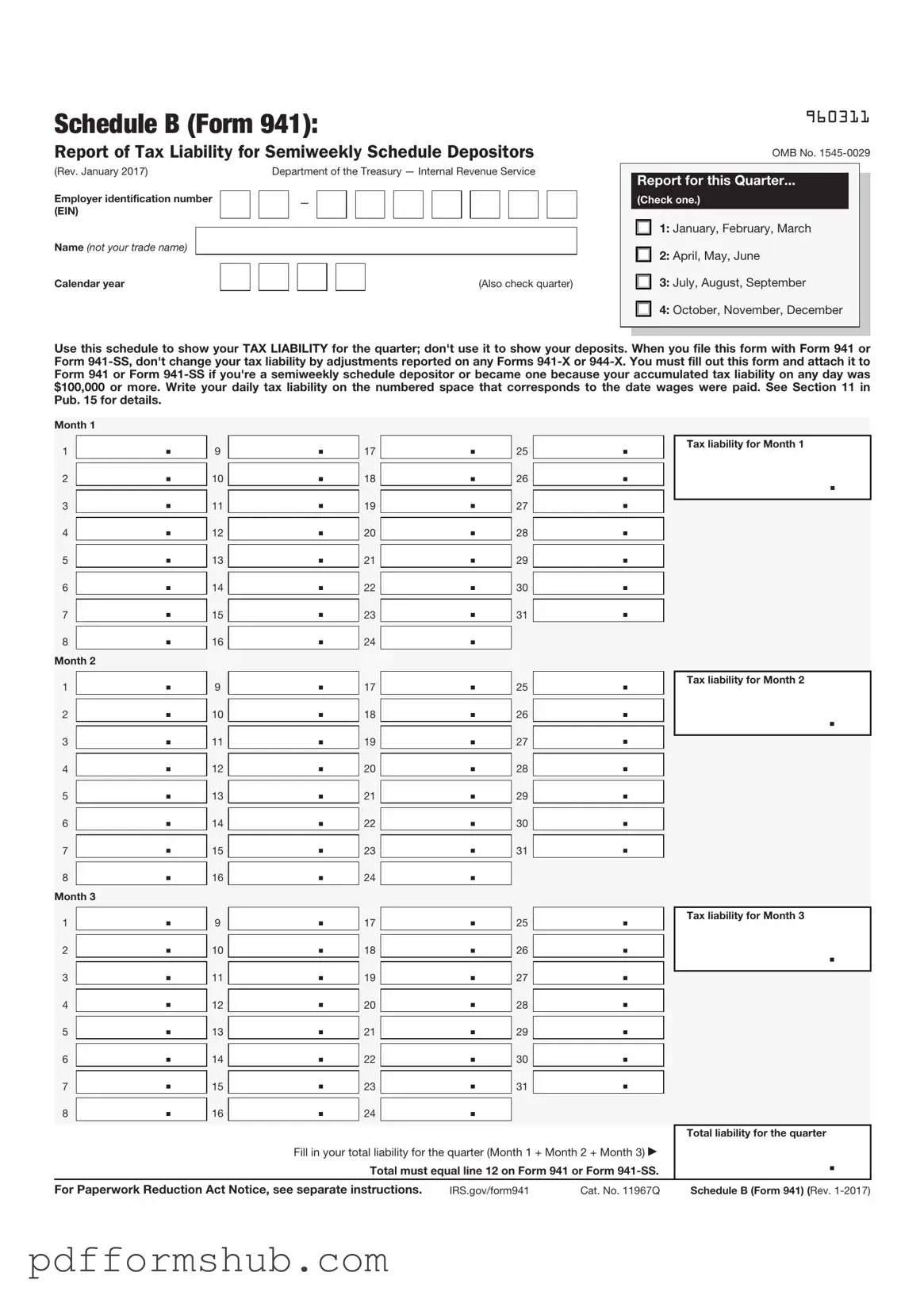

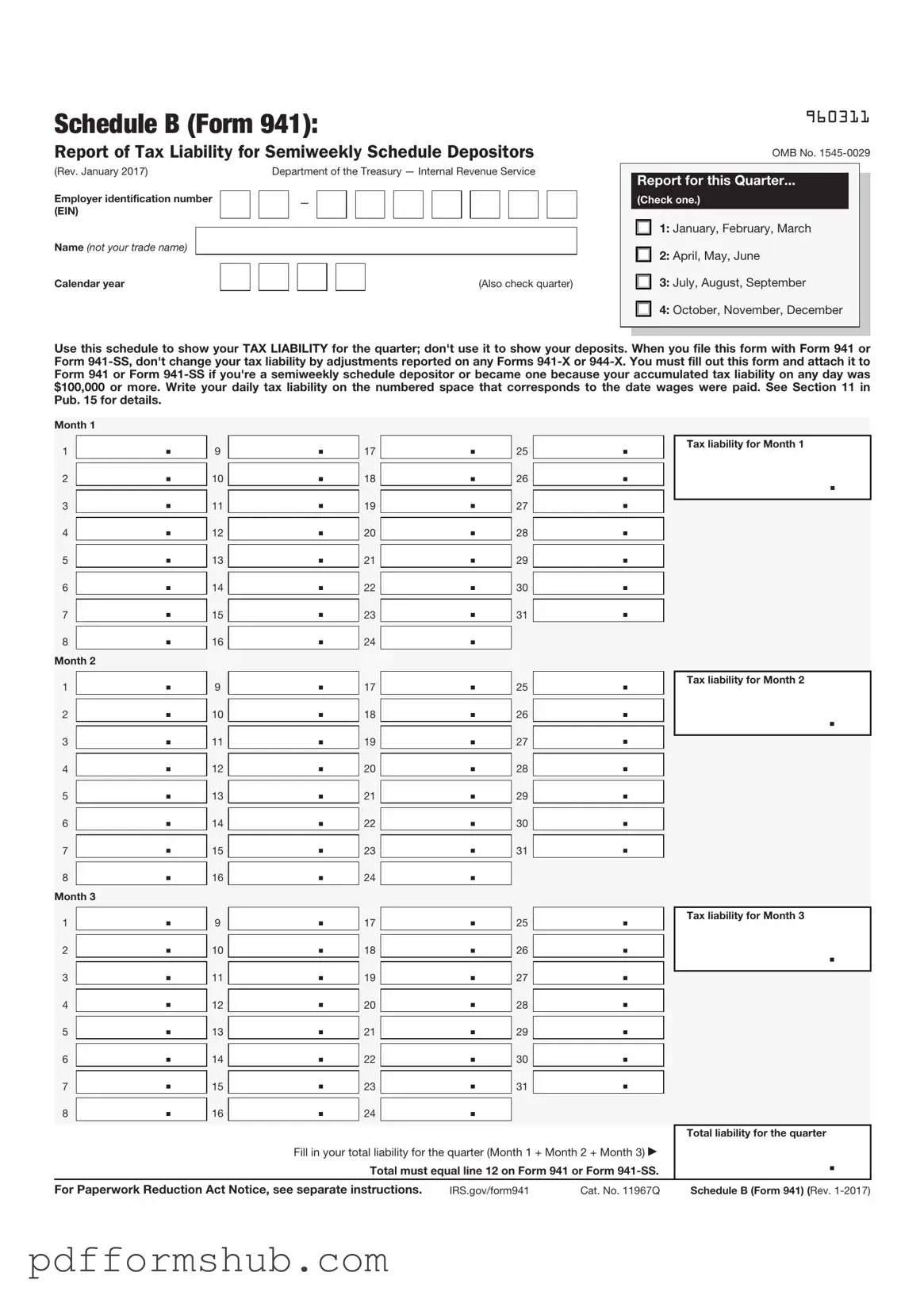

Fill in Your IRS Schedule B 941 Form

The IRS Schedule B (Form 941) is a crucial document that employers use to report their federal income tax withholding and Social Security and Medicare taxes. This form provides the IRS with important information about the wages paid to employees and the taxes withheld from those wages. Understanding how to fill out this form correctly is essential for compliance and avoiding penalties, so take the first step by clicking the button below to get started.

Customize Form

Fill in Your IRS Schedule B 941 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS Schedule B 941 online without printing hassles.