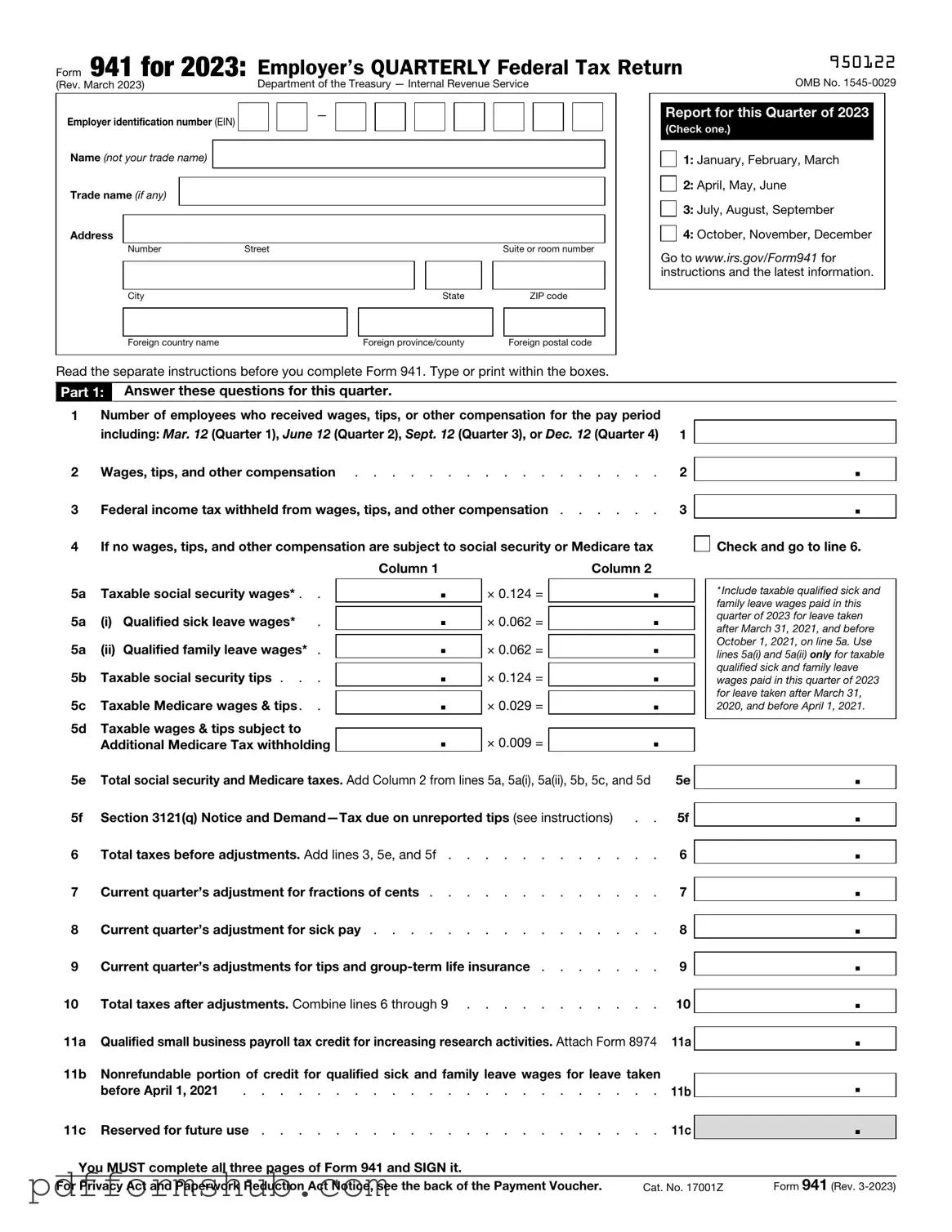

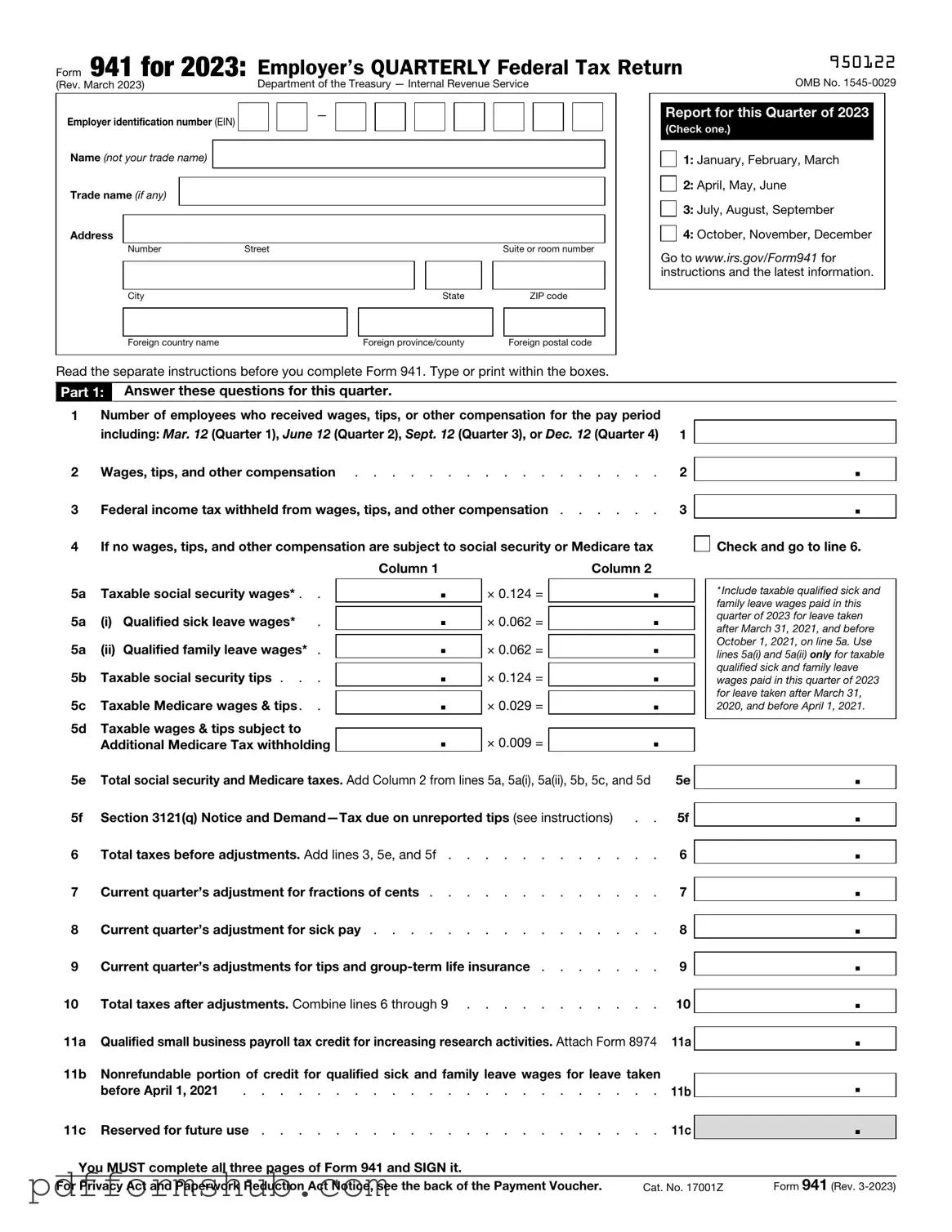

Fill in Your IRS 941 Form

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring compliance with federal tax obligations and helps employers keep track of their payroll tax liabilities. To learn more about filling out the form, click the button below.

Customize Form

Fill in Your IRS 941 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 941 online without printing hassles.