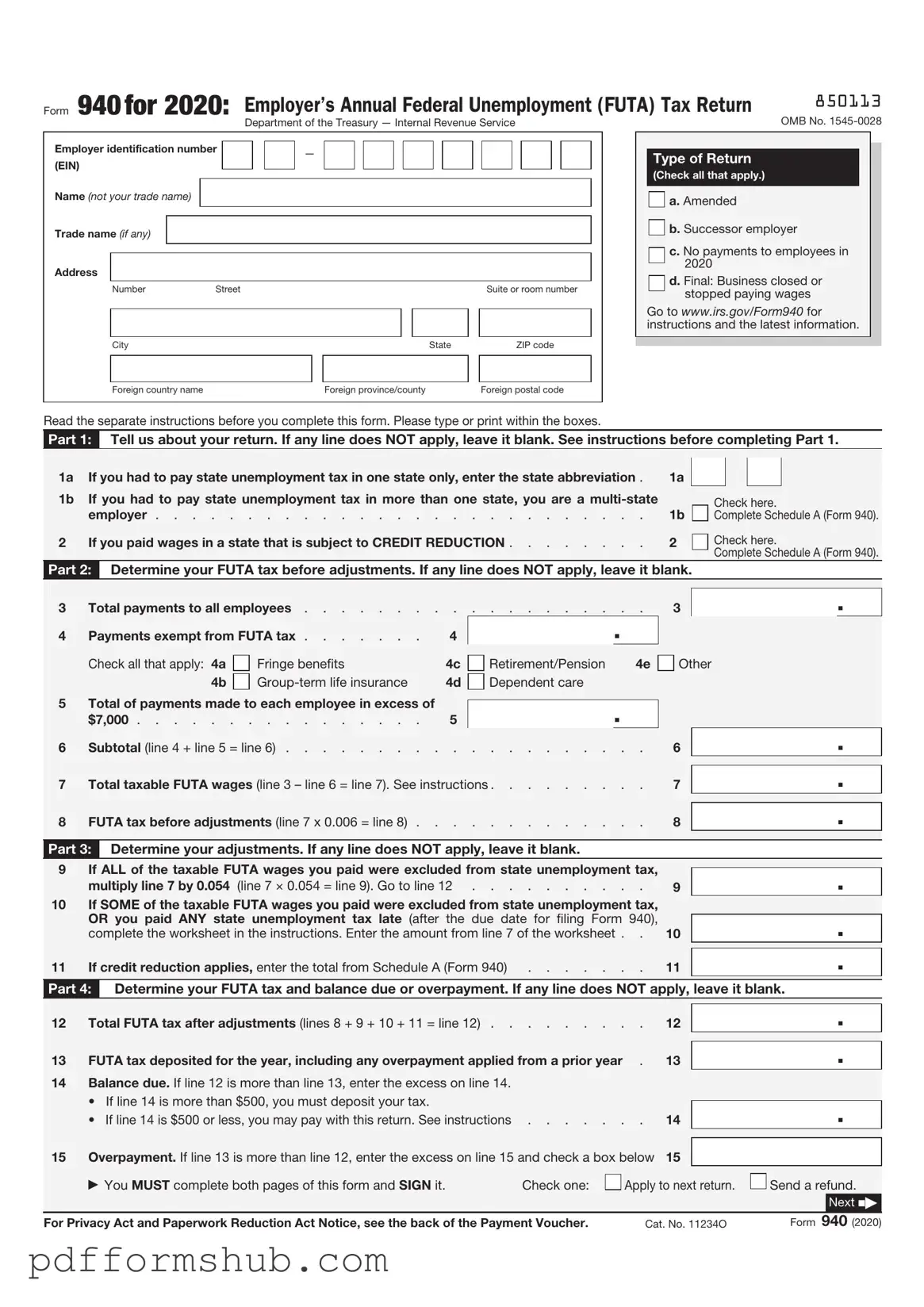

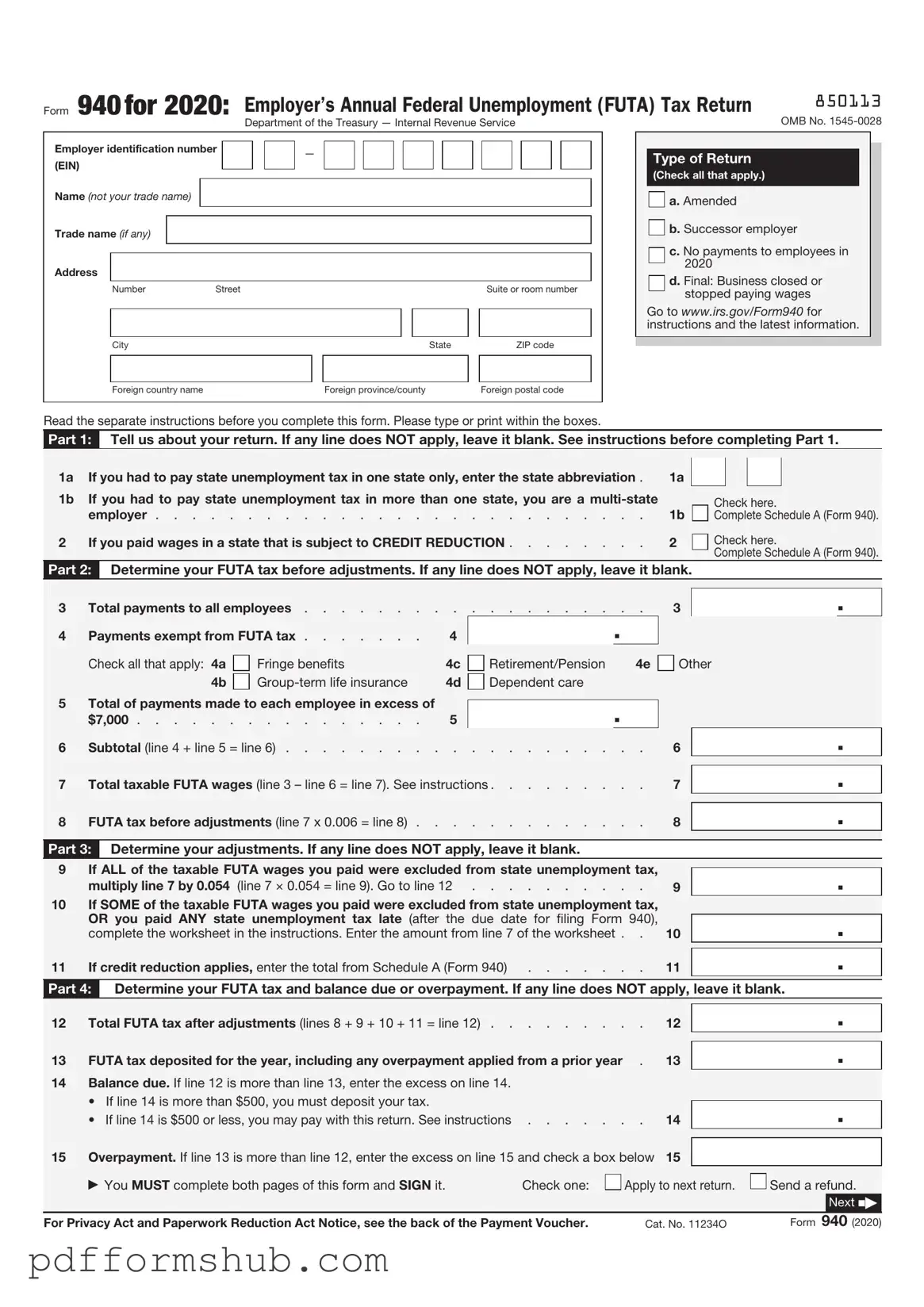

Fill in Your IRS 940 Form

The IRS 940 form is an annual tax return used by employers to report their Federal Unemployment Tax Act (FUTA) liabilities. This form helps the IRS track unemployment taxes owed by businesses, ensuring compliance with federal regulations. Understanding its requirements is crucial for employers to avoid penalties and maintain proper records.

Ready to fill out the IRS 940 form? Click the button below to get started!

Customize Form

Fill in Your IRS 940 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 940 online without printing hassles.