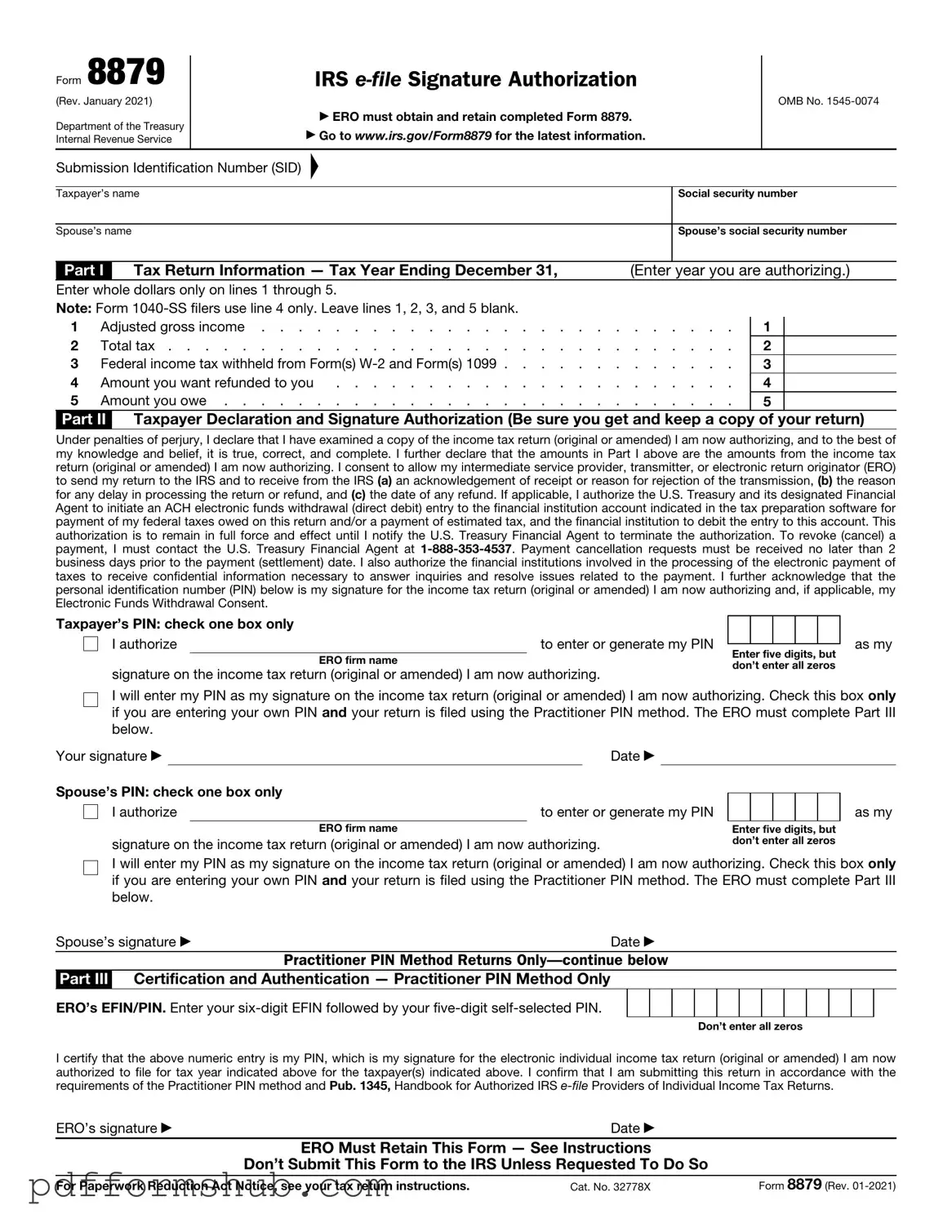

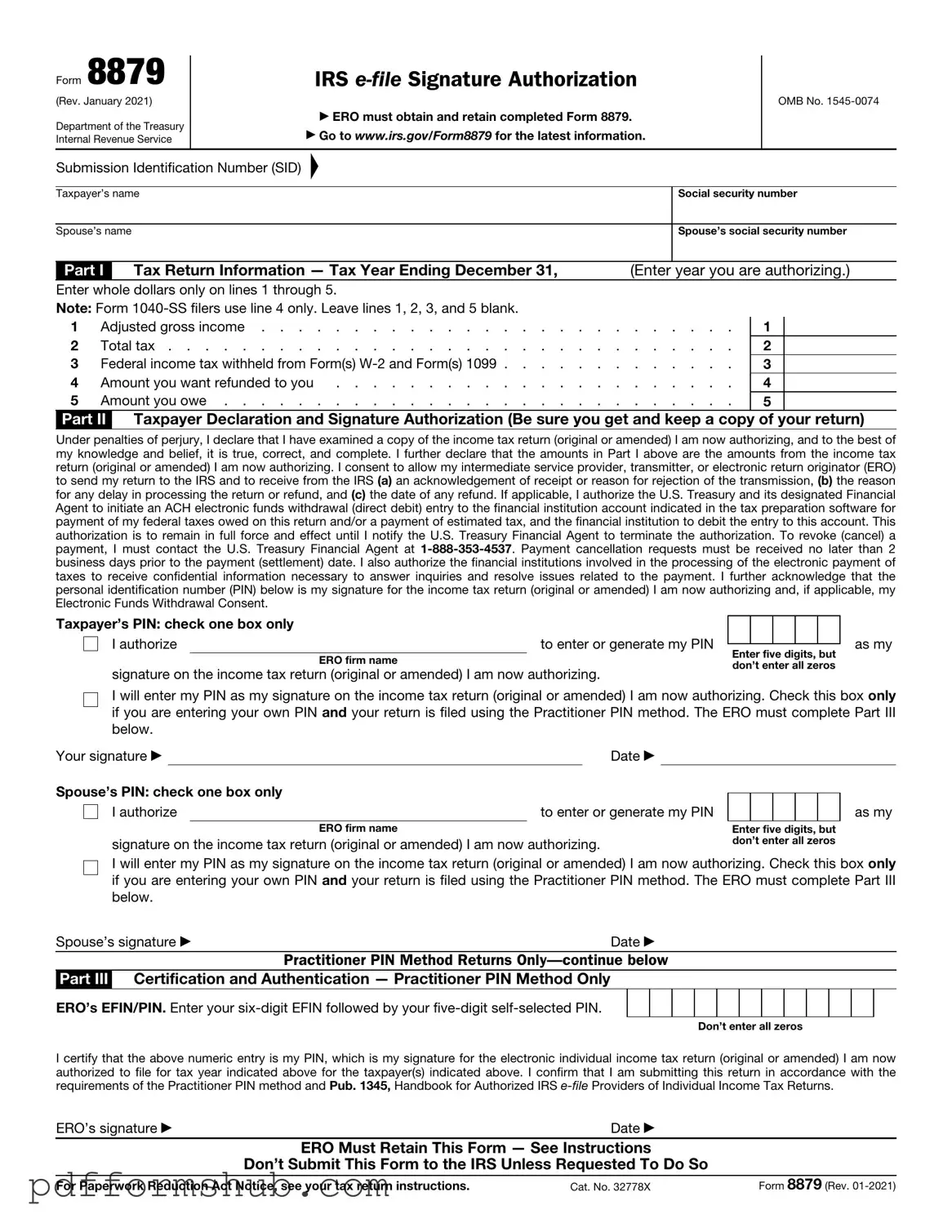

Fill in Your IRS 8879 Form

The IRS 8879 form is a crucial document used to authorize an electronic return originator to file a taxpayer's income tax return electronically. This form serves as a declaration of the taxpayer's intent to file and confirms the accuracy of the information provided. Understanding how to properly fill out and submit this form is essential for a smooth tax filing process.

Ready to get started? Fill out the form by clicking the button below.

Customize Form

Fill in Your IRS 8879 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 8879 online without printing hassles.