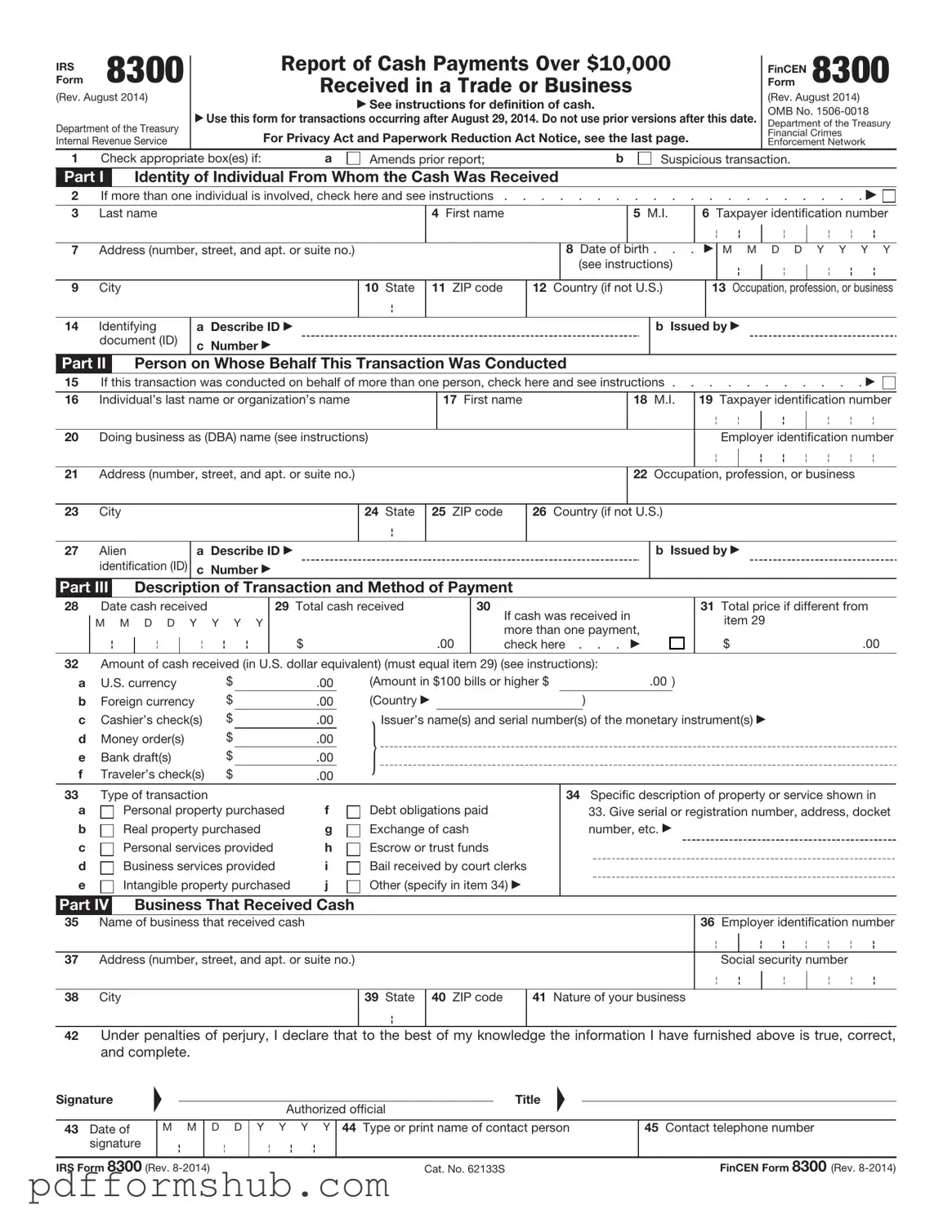

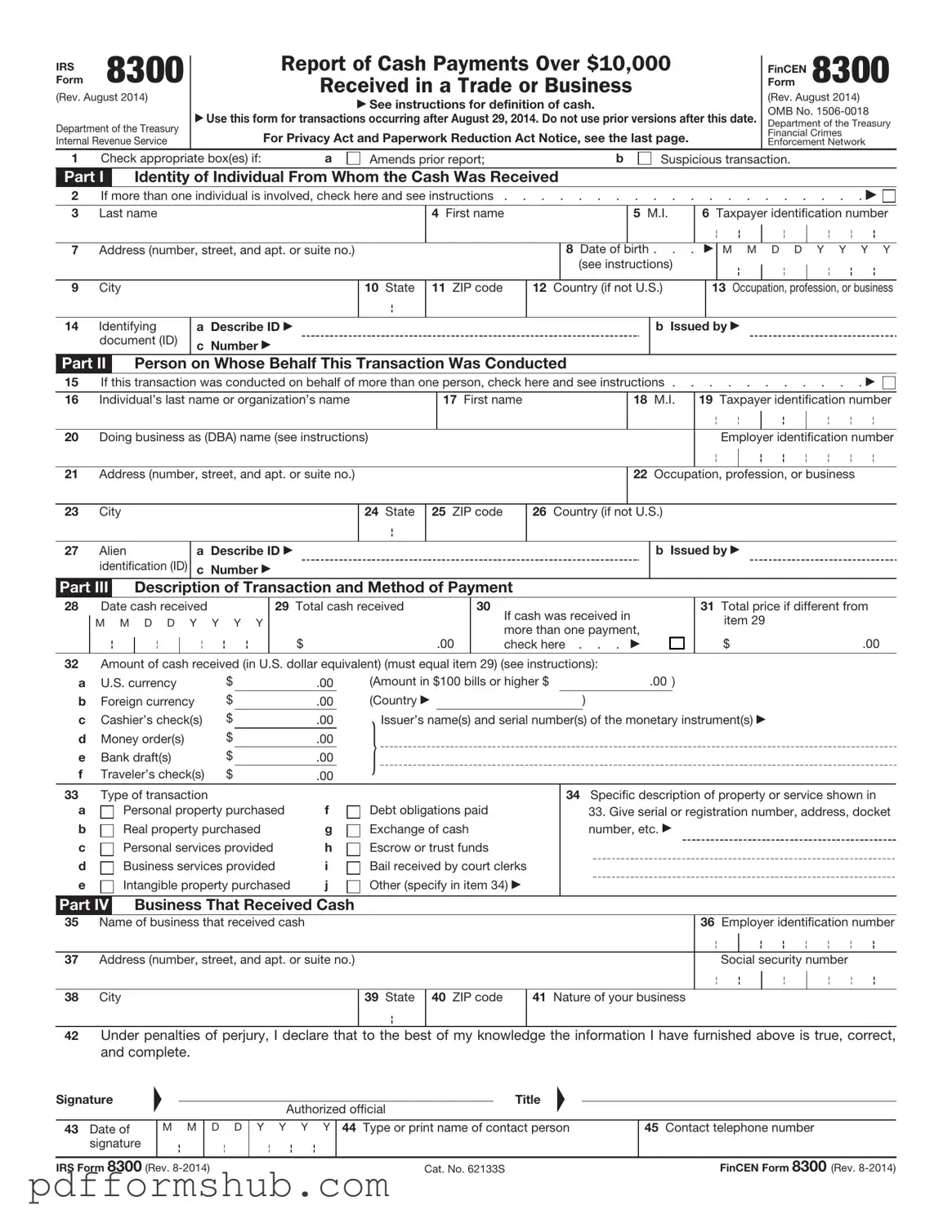

Fill in Your IRS 8300 Form

The IRS Form 8300 is a document that businesses must file when they receive more than $10,000 in cash from a single transaction or related transactions. This form helps the IRS track large cash transactions to prevent money laundering and other illegal activities. Understanding how to accurately complete this form is essential for compliance, so take the next step and fill it out by clicking the button below.

Customize Form

Fill in Your IRS 8300 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 8300 online without printing hassles.