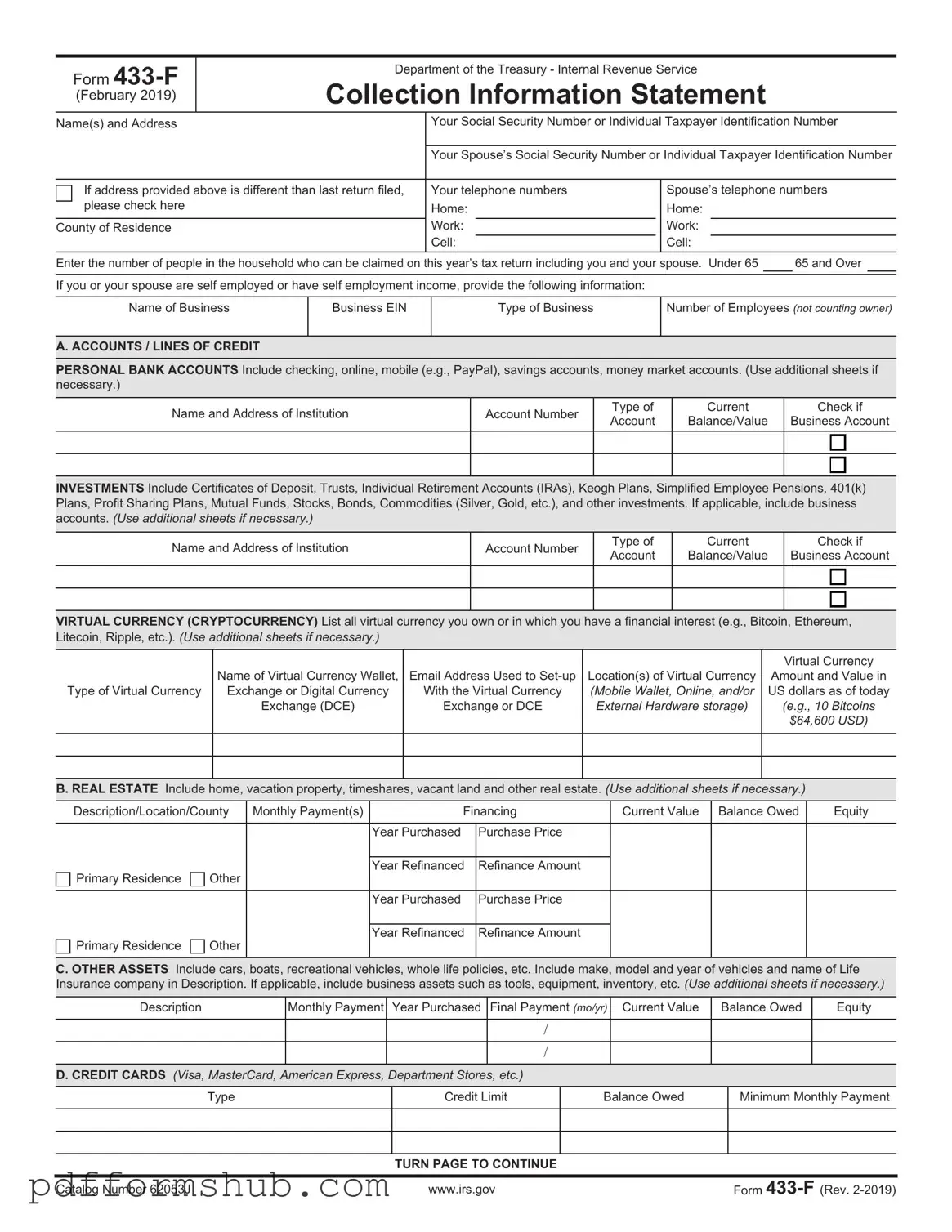

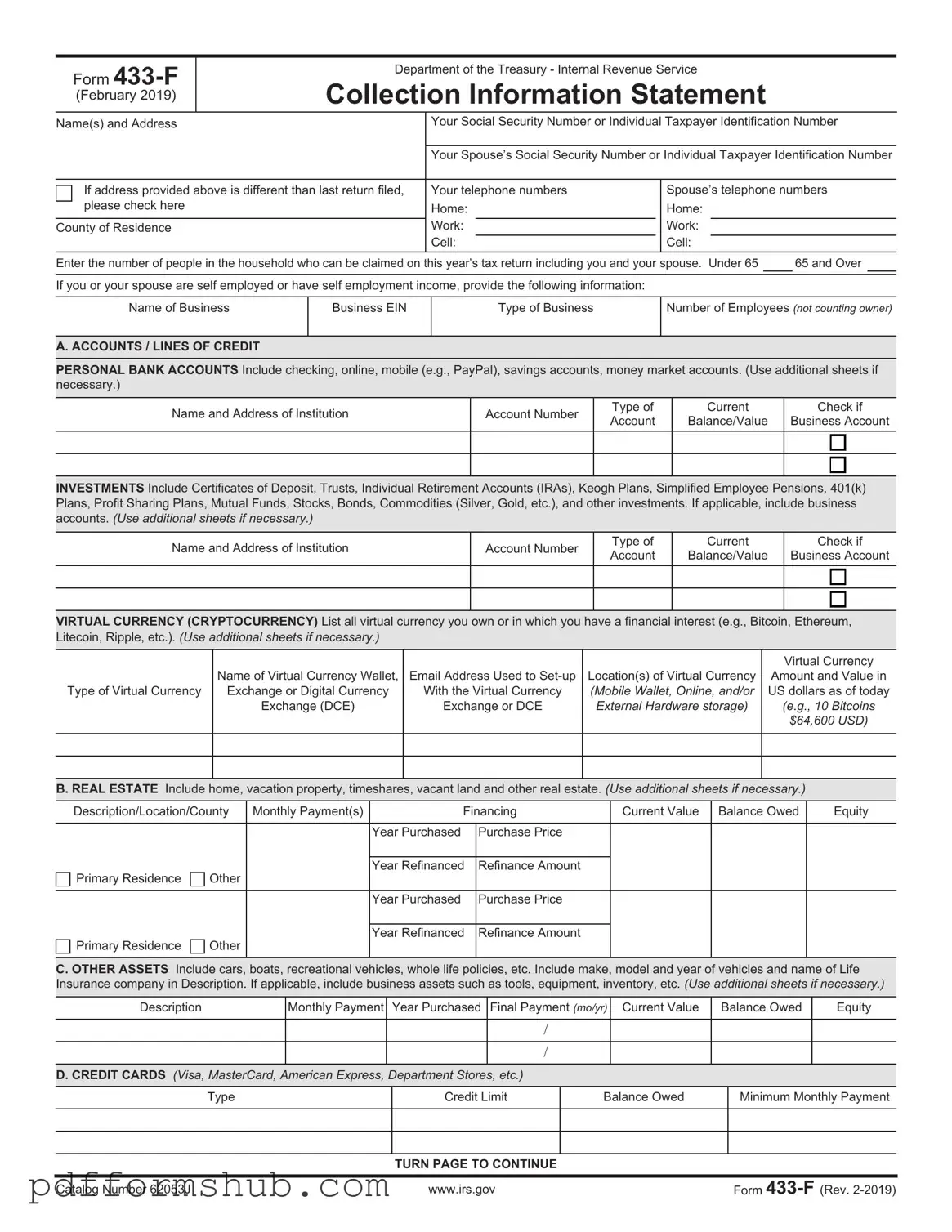

Fill in Your IRS 433-F Form

The IRS 433-F form is a financial disclosure document used by taxpayers to provide the Internal Revenue Service with a comprehensive overview of their financial situation. This form is particularly important for individuals seeking to negotiate a payment plan or settle tax debts. Understanding how to accurately complete the IRS 433-F can significantly impact your ability to manage tax obligations effectively.

Ready to take control of your tax situation? Click the button below to start filling out the IRS 433-F form.

Customize Form

Fill in Your IRS 433-F Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 433-F online without printing hassles.