Fill in Your IRS 2553 Form

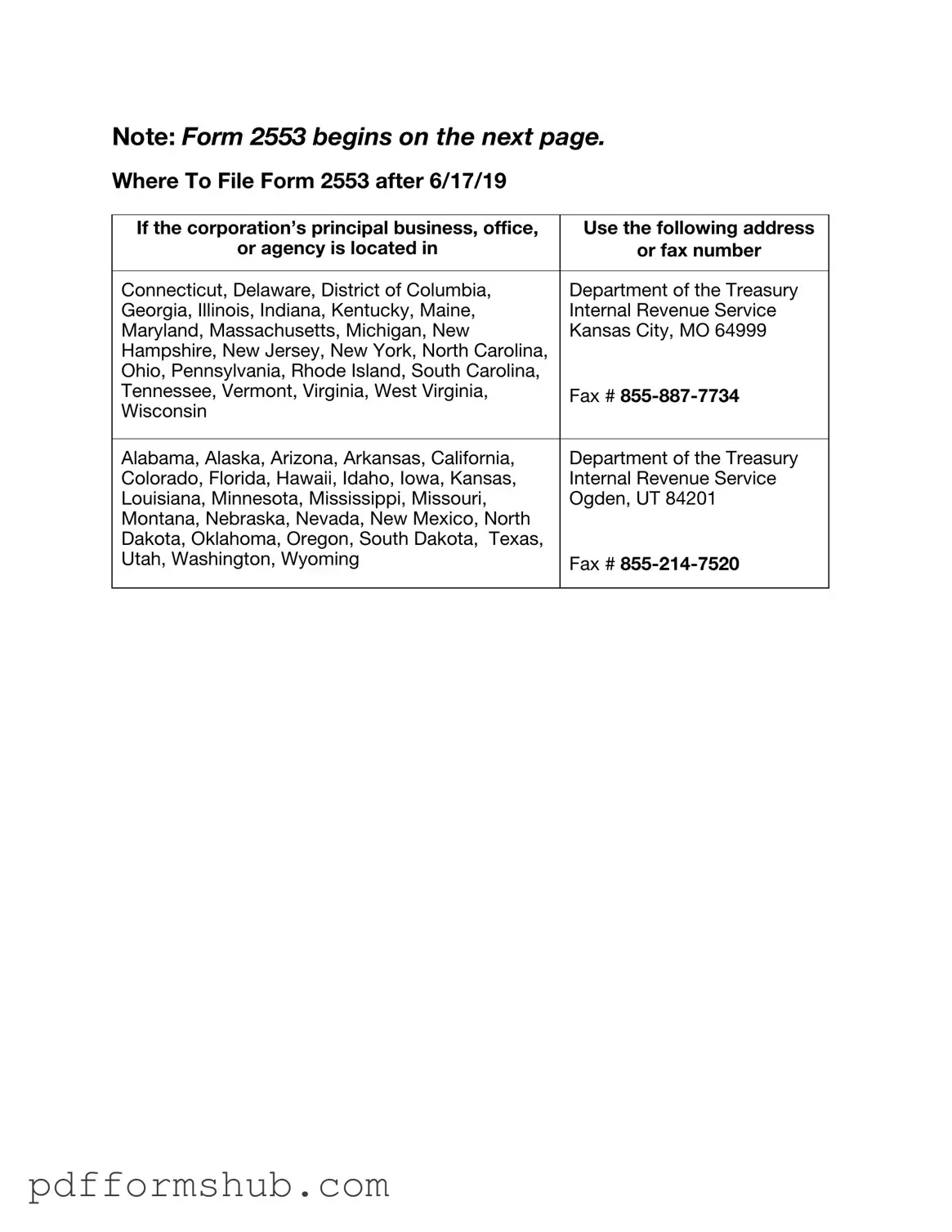

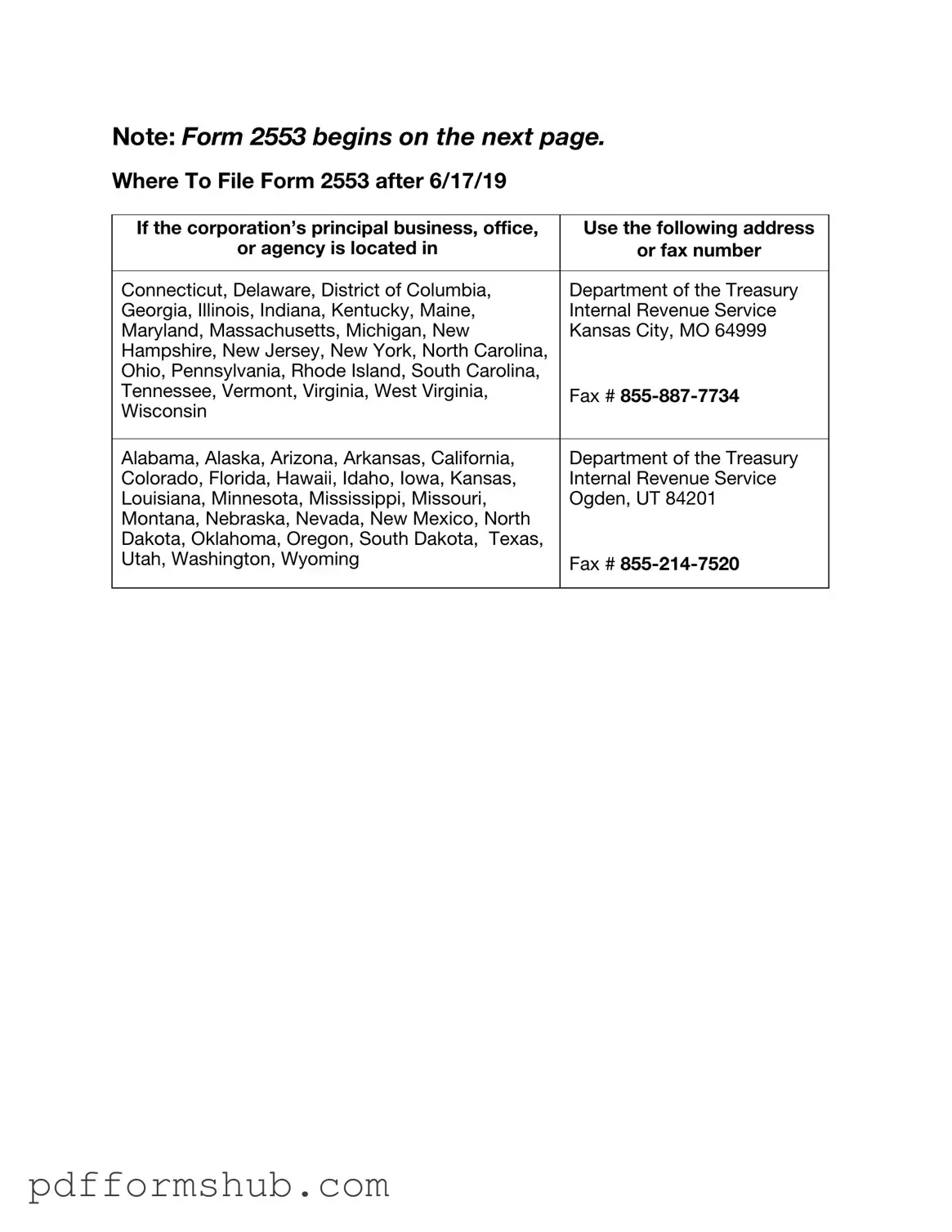

The IRS Form 2553 is a crucial document that allows eligible small businesses to elect to be taxed as an S corporation. This election can provide significant tax benefits, enabling business owners to avoid double taxation on corporate income. Understanding how to properly fill out this form is essential for maximizing your business's financial advantages; click the button below to get started!

Customize Form

Fill in Your IRS 2553 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 2553 online without printing hassles.