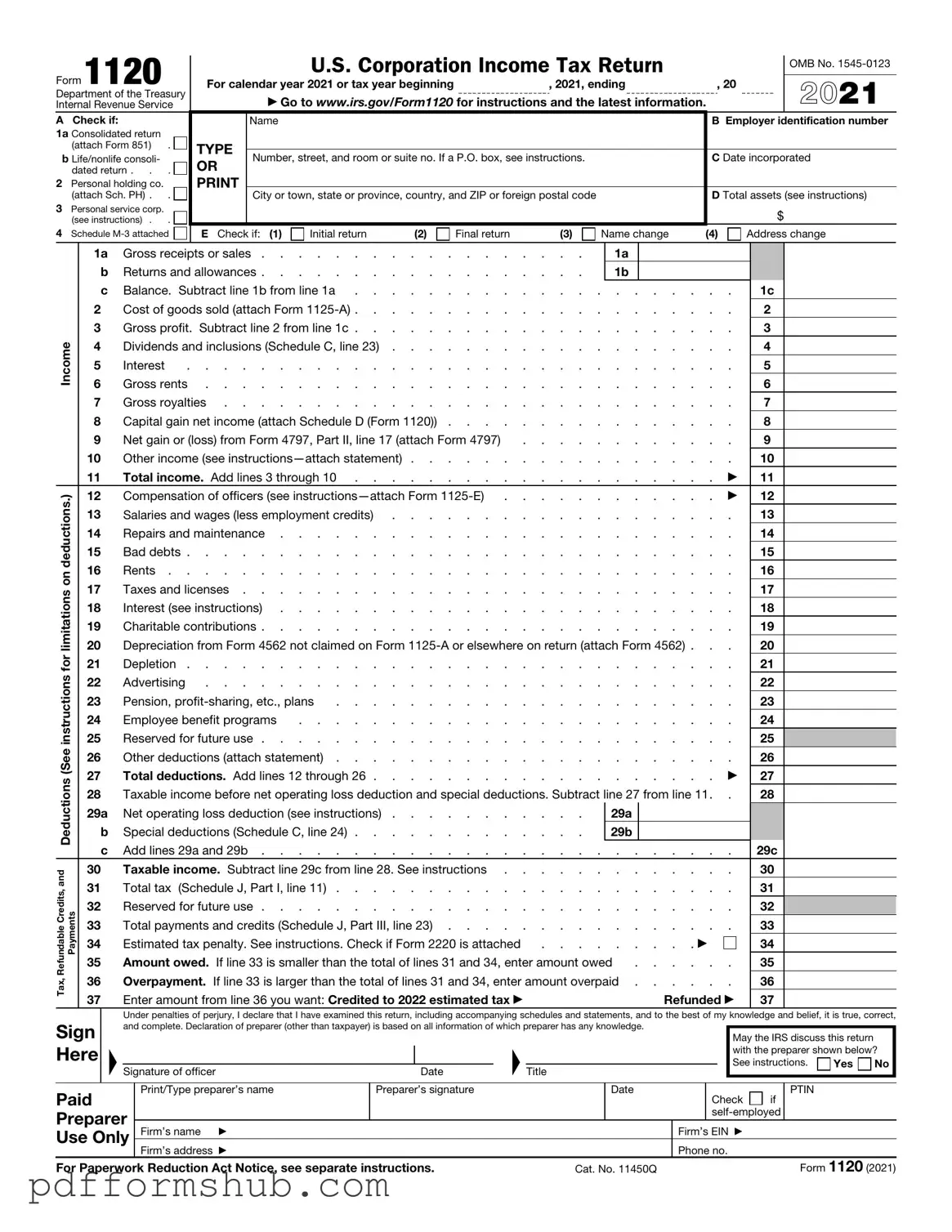

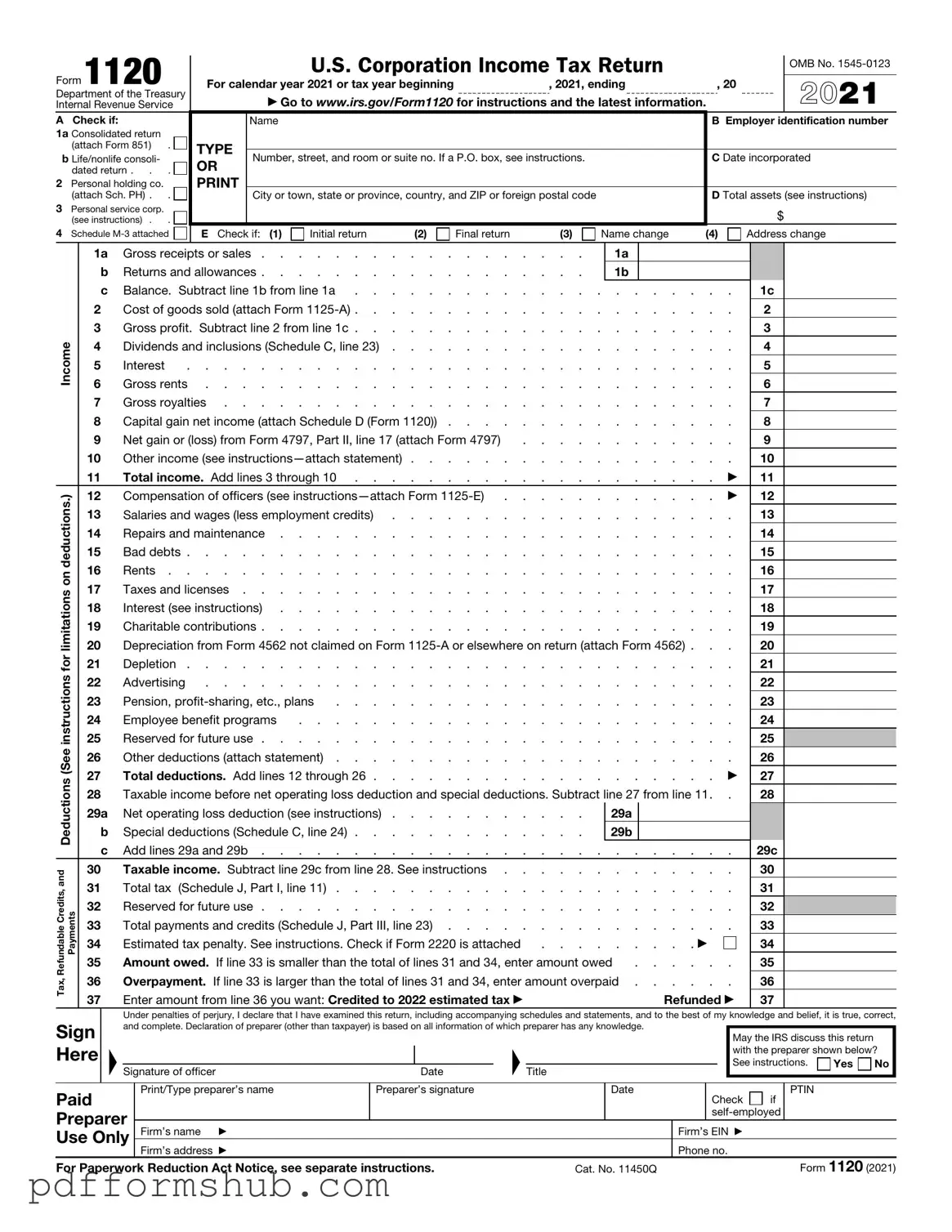

Fill in Your IRS 1120 Form

The IRS 1120 form is a tax document that corporations in the United States use to report their income, gains, losses, and deductions to the Internal Revenue Service. This form is essential for corporations to determine their tax liability and ensure compliance with federal tax laws. If you need to fill out this form, click the button below for assistance.

Customize Form

Fill in Your IRS 1120 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete IRS 1120 online without printing hassles.