-

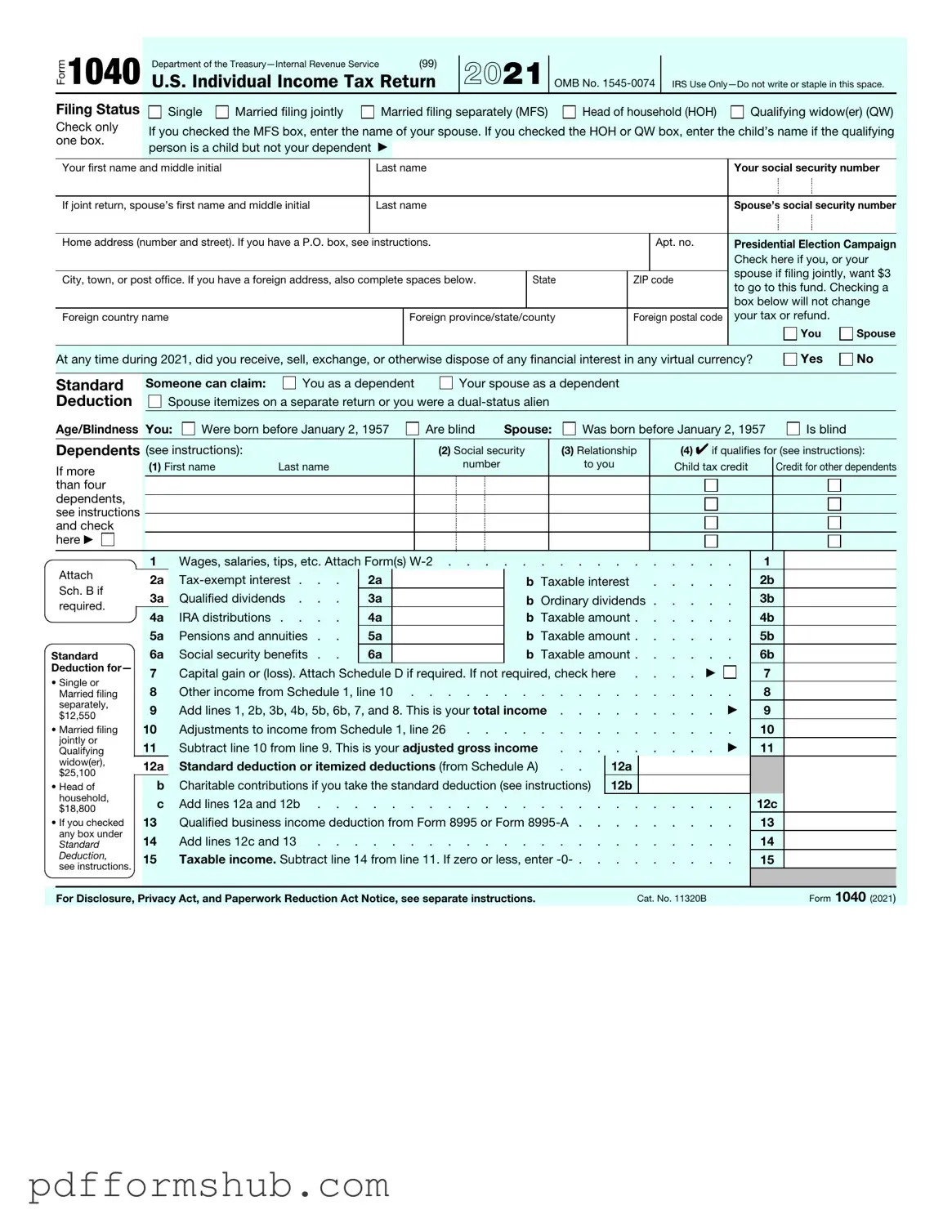

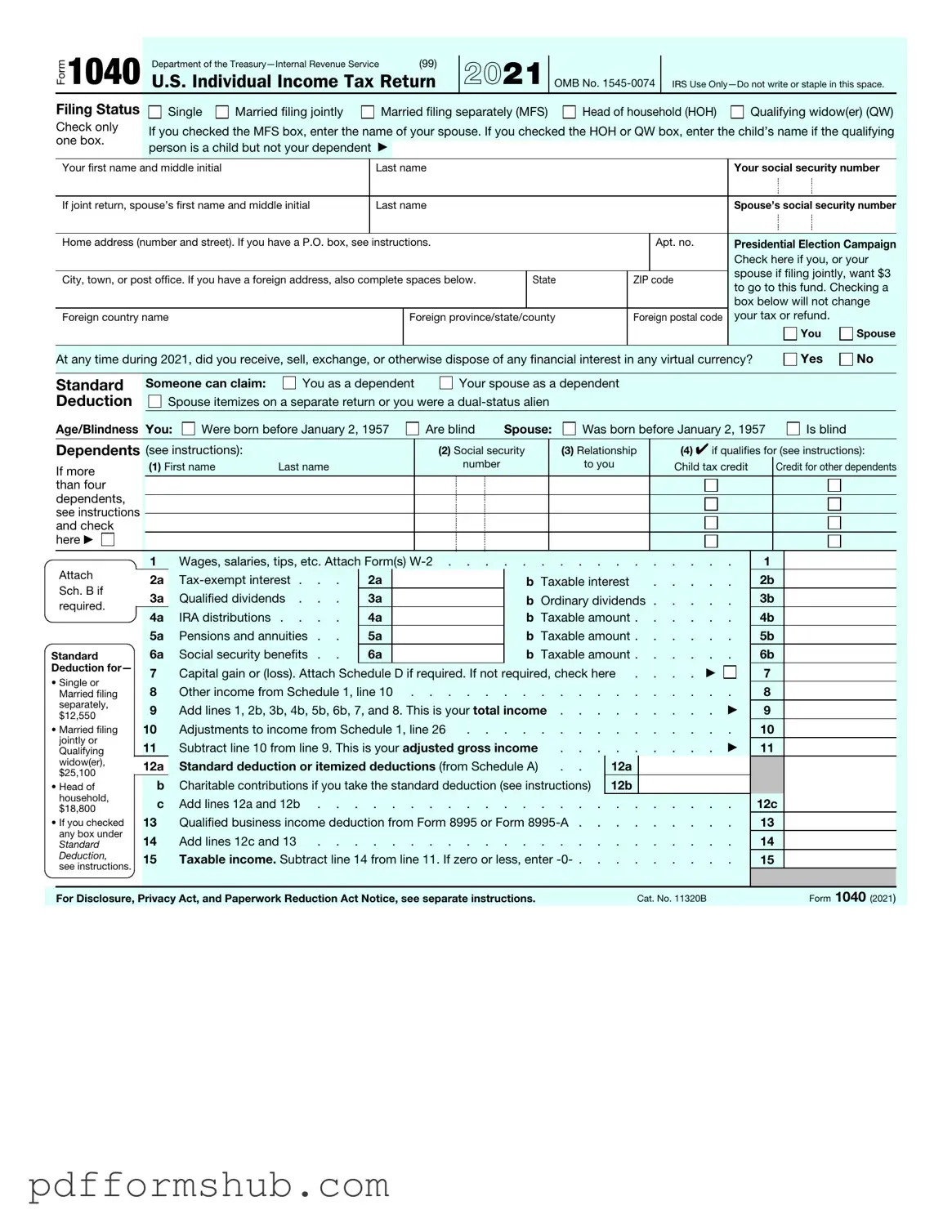

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return form used by U.S. taxpayers to report their income, calculate their tax liability, and claim any applicable deductions and credits. It is essential for filing your federal income tax return each year.

-

Who needs to file the 1040 form?

Generally, anyone who earns income in the United States must file a tax return. This includes individuals who are self-employed, employees, or receive income from other sources. Specific income thresholds determine whether you must file, and these thresholds can vary based on your filing status, age, and type of income.

-

What are the different versions of the 1040 form?

There are several versions of the 1040 form: the standard 1040, the 1040-SR for seniors, and the 1040-NR for non-resident aliens. Each version serves a specific group of taxpayers and has unique requirements. The standard 1040 is the most commonly used form.

-

What information do I need to complete the 1040 form?

To complete the 1040 form, gather information about your income, such as W-2s from employers, 1099s for freelance work, and any other income documentation. You will also need details about your deductions, credits, and personal information, including your Social Security number and that of your dependents.

-

How do I file the 1040 form?

You can file the 1040 form either electronically or by mail. Electronic filing is often quicker and may result in faster refunds. If you choose to file by mail, ensure you send your completed form to the correct address based on your state of residence.

-

What are the deadlines for filing the 1040 form?

The typical deadline for filing your 1040 form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions can be requested, allowing you to file up to six months later, but any taxes owed are still due by the original deadline.

-

What if I make a mistake on my 1040 form?

If you discover an error after submitting your 1040 form, you can file an amended return using Form 1040-X. This form allows you to correct mistakes, such as errors in income, filing status, or deductions. Make sure to file the amendment as soon as possible to avoid potential penalties.

-

Can I claim deductions on my 1040 form?

Yes, you can claim various deductions on your 1040 form. Taxpayers can choose between the standard deduction and itemizing their deductions. The standard deduction is a fixed amount based on your filing status, while itemized deductions may include expenses such as mortgage interest, medical expenses, and charitable contributions.

-

What are tax credits, and can I claim them on my 1040 form?

Tax credits directly reduce the amount of tax you owe and can be claimed on your 1040 form. Some common credits include the Earned Income Tax Credit (EITC) and the Child Tax Credit. Unlike deductions, which reduce your taxable income, credits provide a dollar-for-dollar reduction in your tax bill.

-

Where can I find help with my 1040 form?

Help is available through various sources. The IRS website offers resources, including instructions for the 1040 form and frequently asked questions. Additionally, tax preparation services and certified public accountants (CPAs) can provide personalized assistance for completing your tax return.