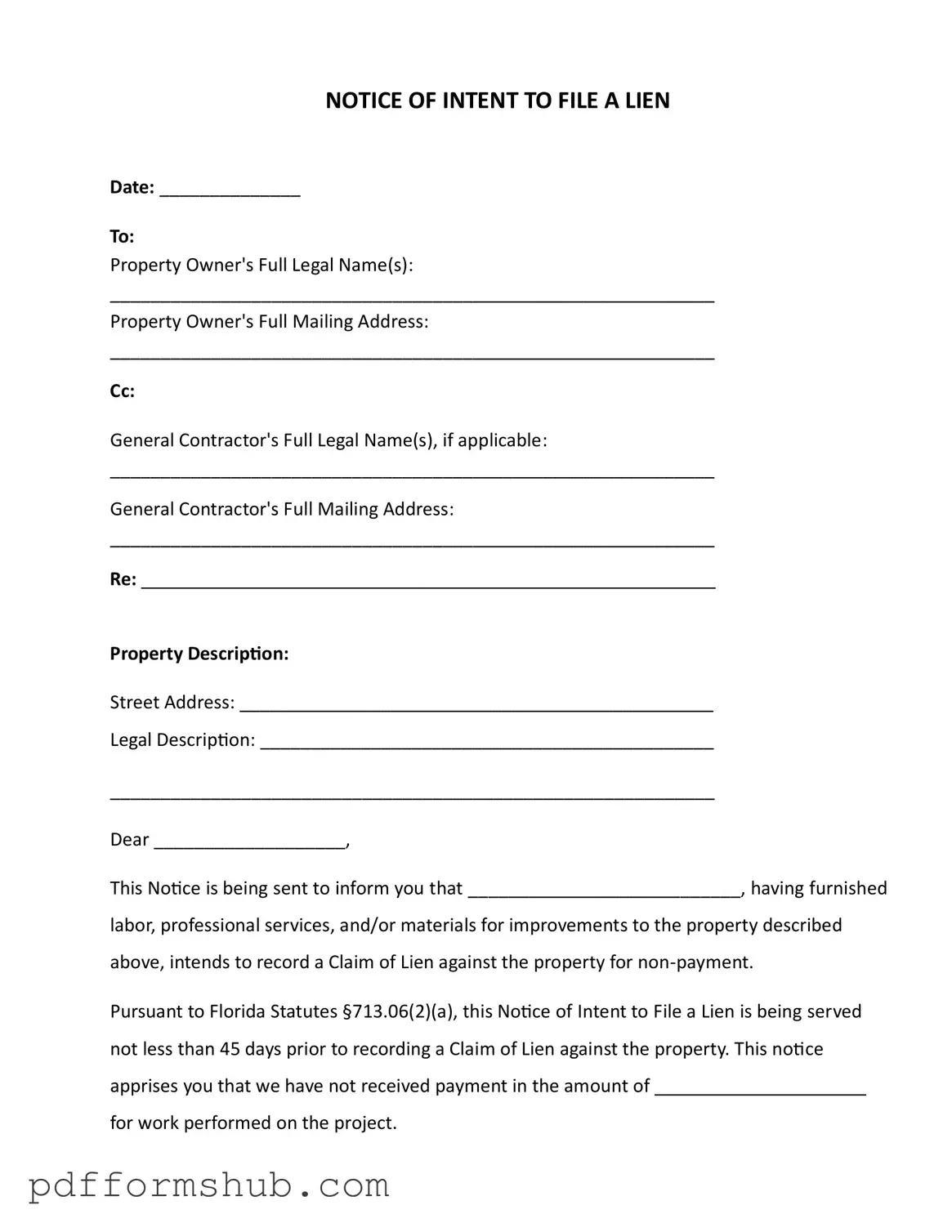

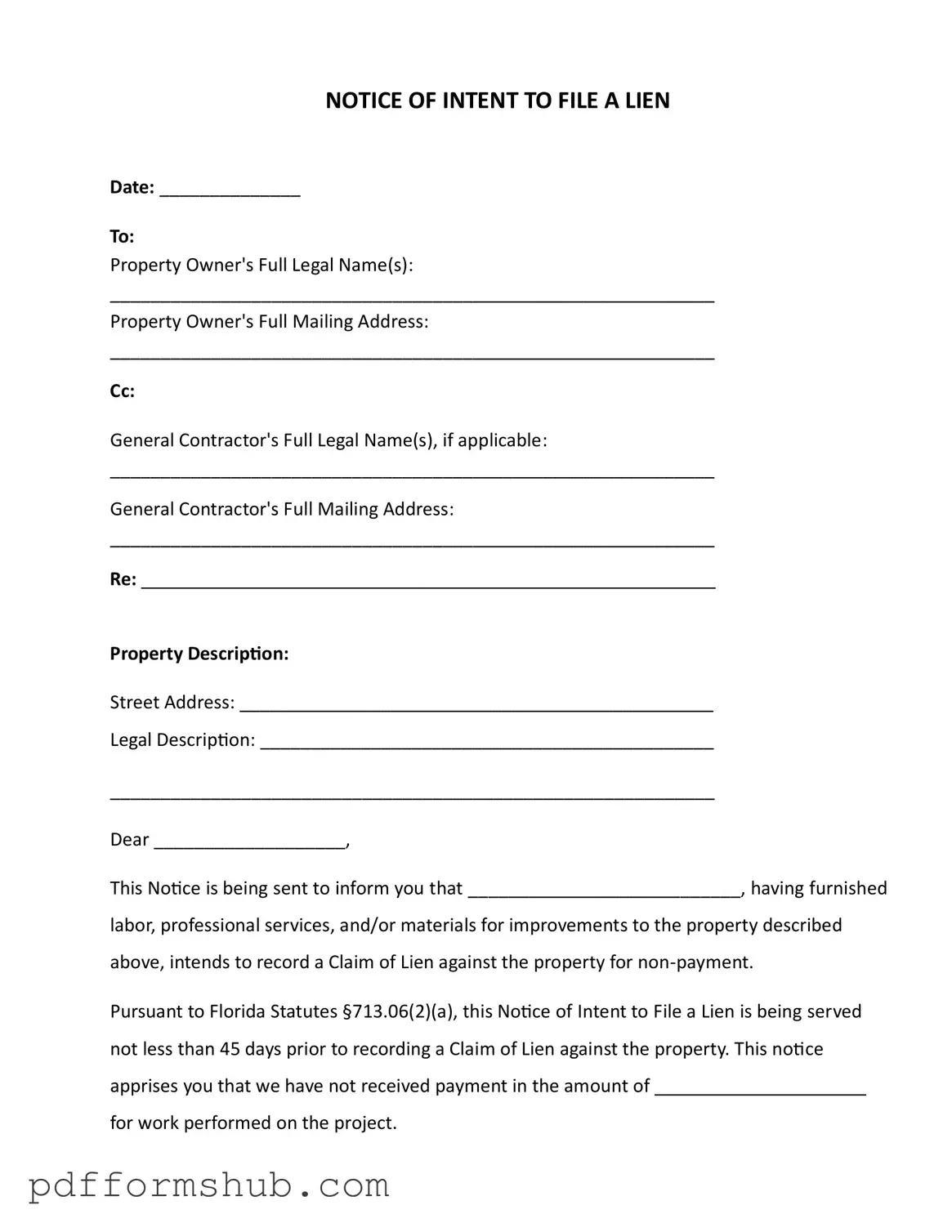

Fill in Your Intent To Lien Florida Form

The Intent to Lien Florida form serves as a formal notification to property owners that a contractor or supplier intends to file a lien against their property due to non-payment for services or materials rendered. This notice is crucial as it alerts property owners of potential legal actions that may follow if the outstanding payment is not addressed. It is important to take this notice seriously to avoid complications, such as foreclosure proceedings or additional legal fees.

If you need to fill out the Intent to Lien Florida form, please click the button below.

Customize Form

Fill in Your Intent To Lien Florida Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Intent To Lien Florida online without printing hassles.