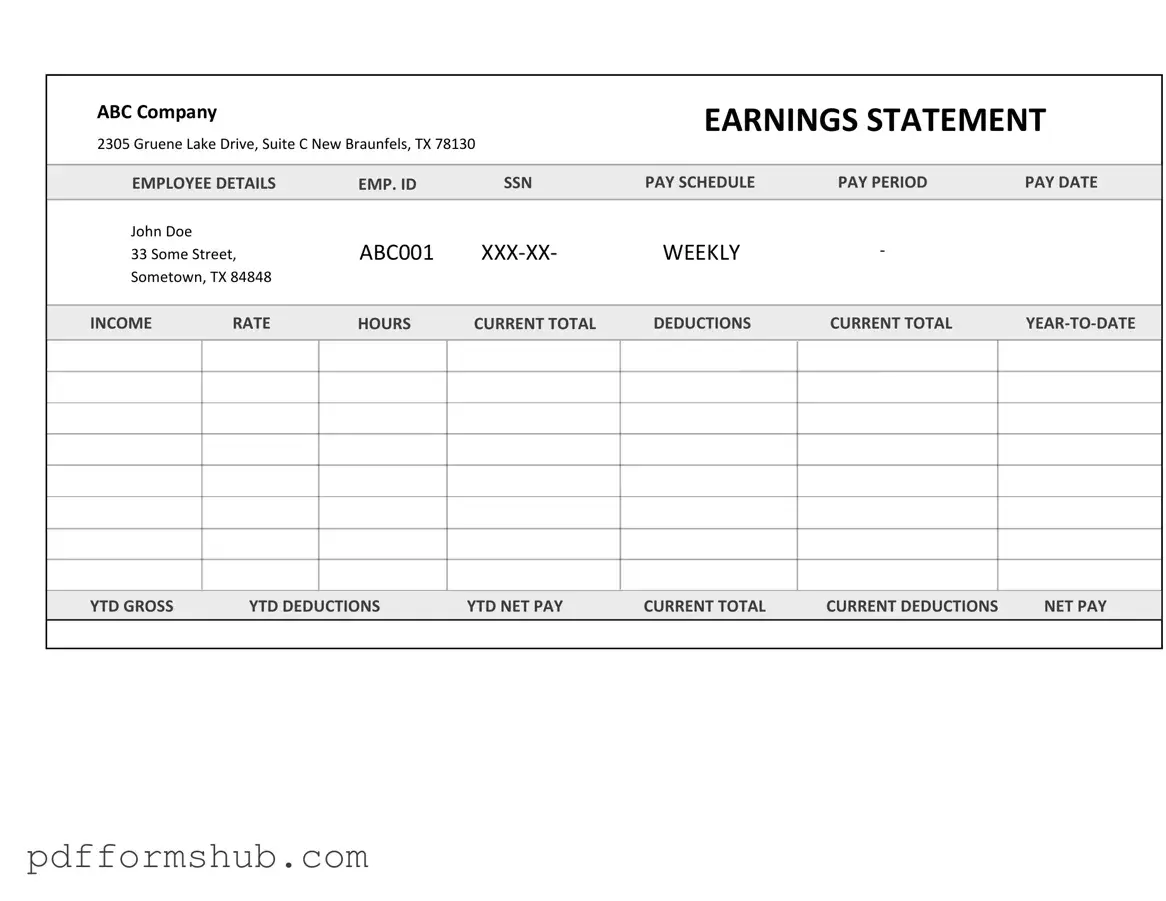

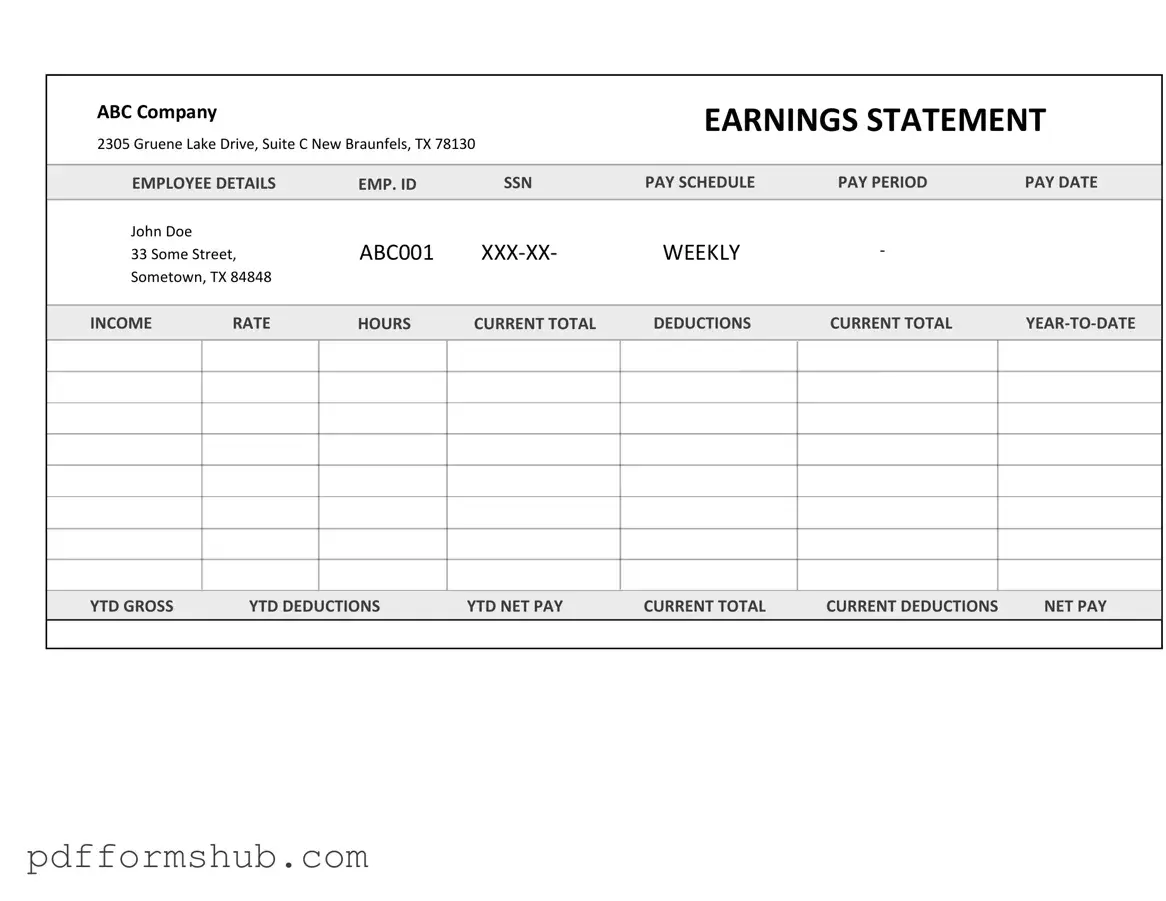

Fill in Your Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form is a document that outlines the payment details for services rendered by an independent contractor. This form provides essential information such as payment amount, date of service, and any deductions that may apply. Understanding how to properly fill out this form is crucial for both contractors and clients to ensure transparency and compliance.

To get started, please fill out the form by clicking the button below.

Customize Form

Fill in Your Independent Contractor Pay Stub Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Independent Contractor Pay Stub online without printing hassles.