Attorney-Verified Promissory Note Form for Illinois State

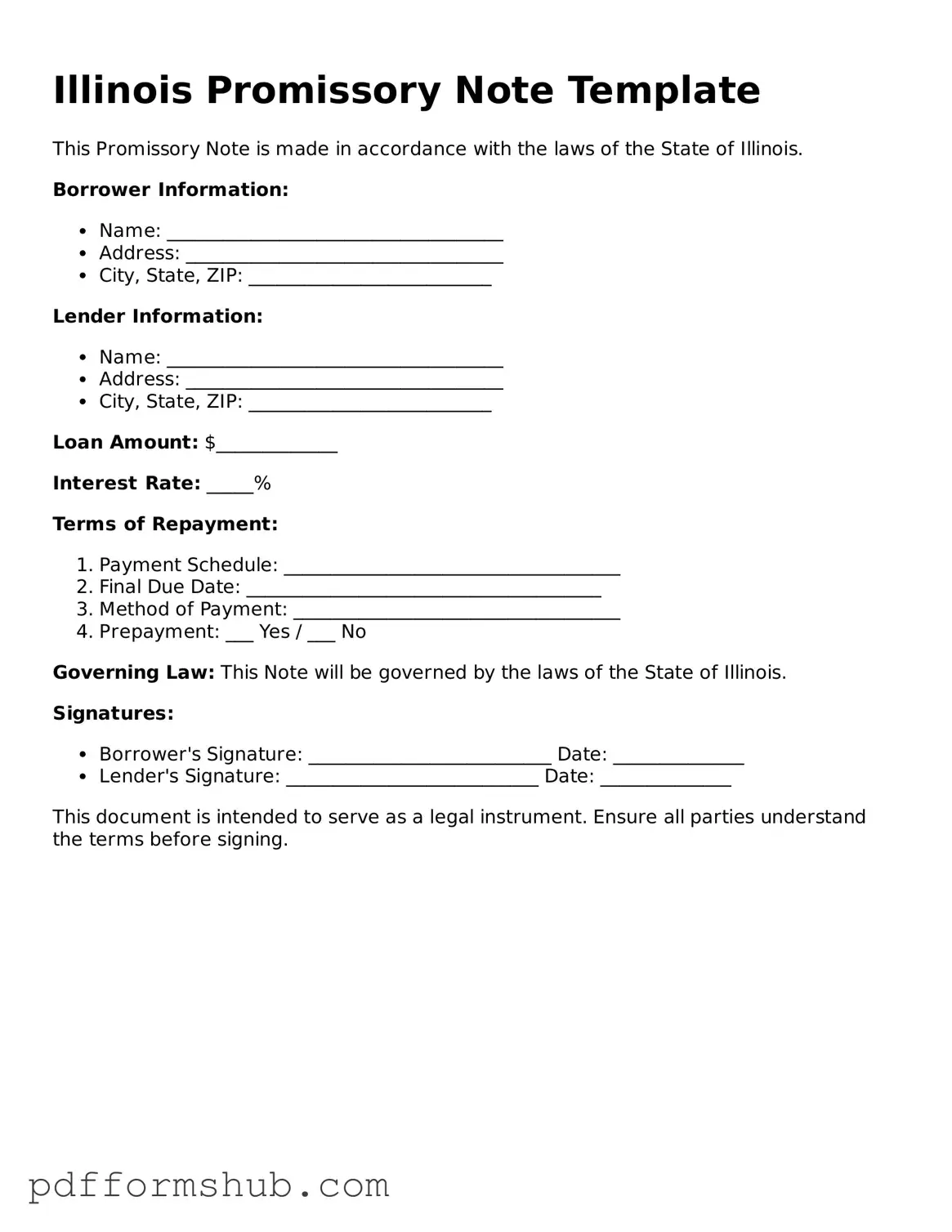

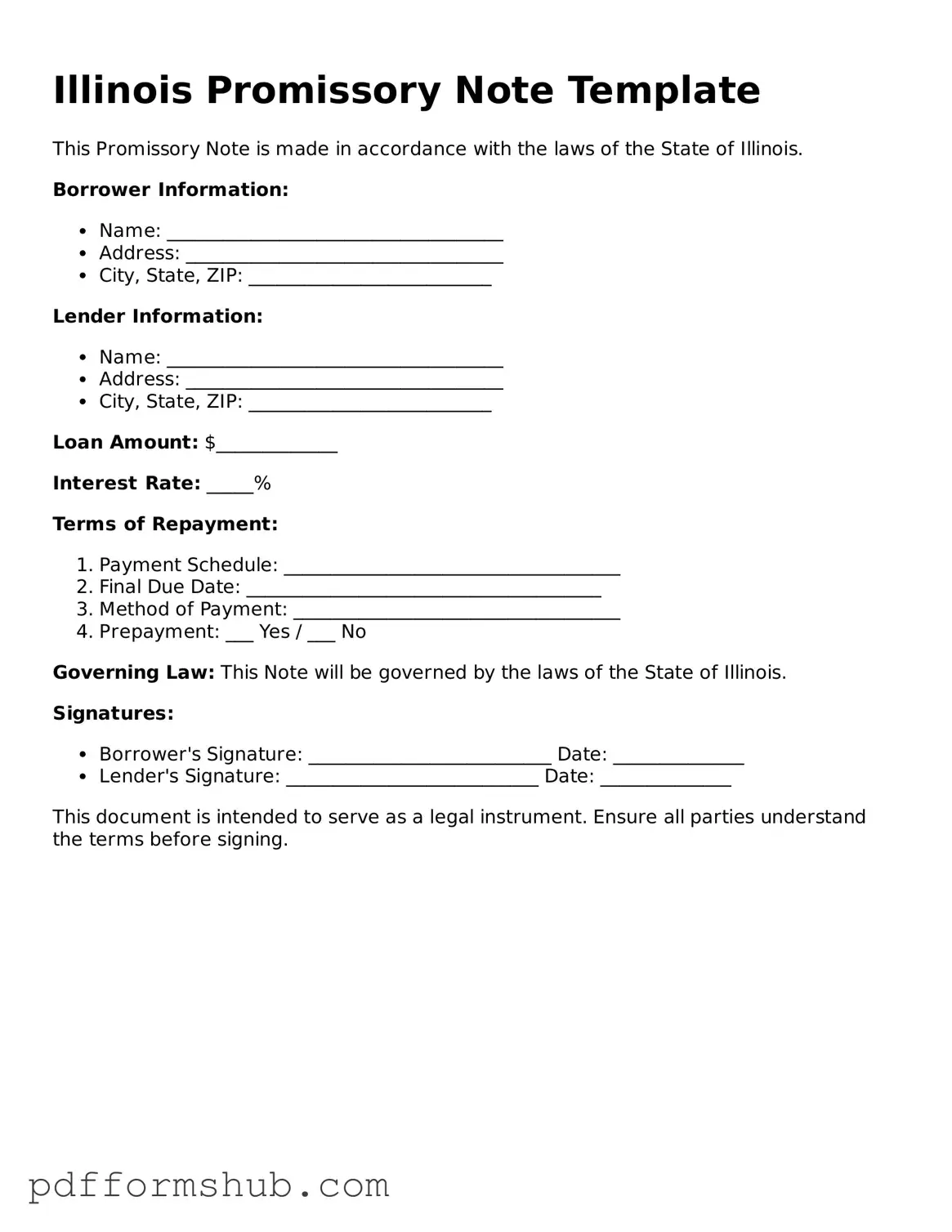

A Promissory Note in Illinois is a legal document in which one party agrees to pay a specific amount of money to another party under agreed-upon terms. This form outlines the details of the loan, including the principal amount, interest rate, and repayment schedule. Understanding this document is essential for both lenders and borrowers to ensure a clear agreement and avoid potential disputes.

Ready to fill out your Illinois Promissory Note? Click the button below to get started!

Customize Form

Attorney-Verified Promissory Note Form for Illinois State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Promissory Note online without printing hassles.