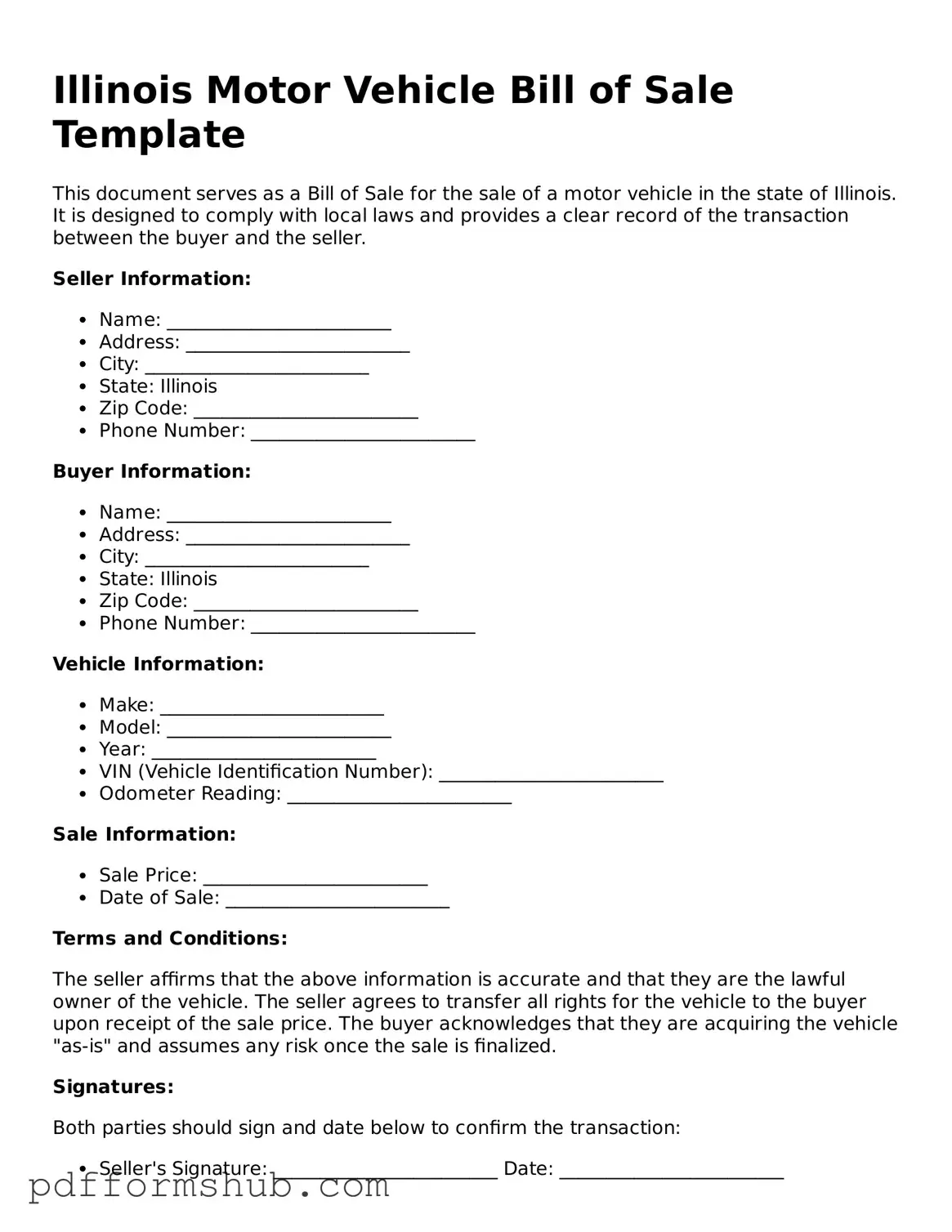

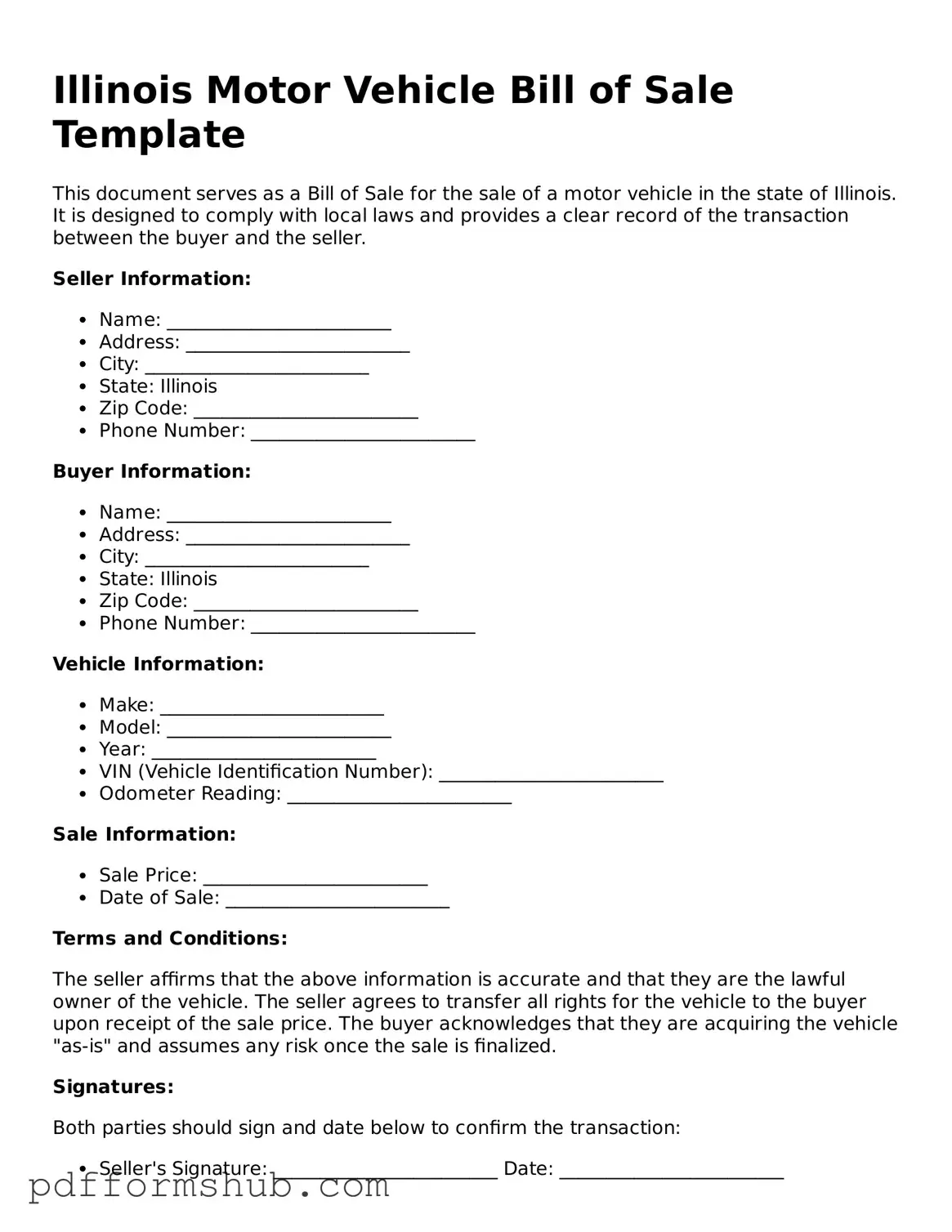

Attorney-Verified Motor Vehicle Bill of Sale Form for Illinois State

The Illinois Motor Vehicle Bill of Sale form is a legal document used to record the sale of a vehicle between a buyer and a seller. This form serves as proof of the transaction and includes essential details such as the vehicle's description, sale price, and the parties involved. For a smooth transaction, consider filling out the form by clicking the button below.

Customize Form

Attorney-Verified Motor Vehicle Bill of Sale Form for Illinois State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Motor Vehicle Bill of Sale online without printing hassles.