Attorney-Verified Loan Agreement Form for Illinois State

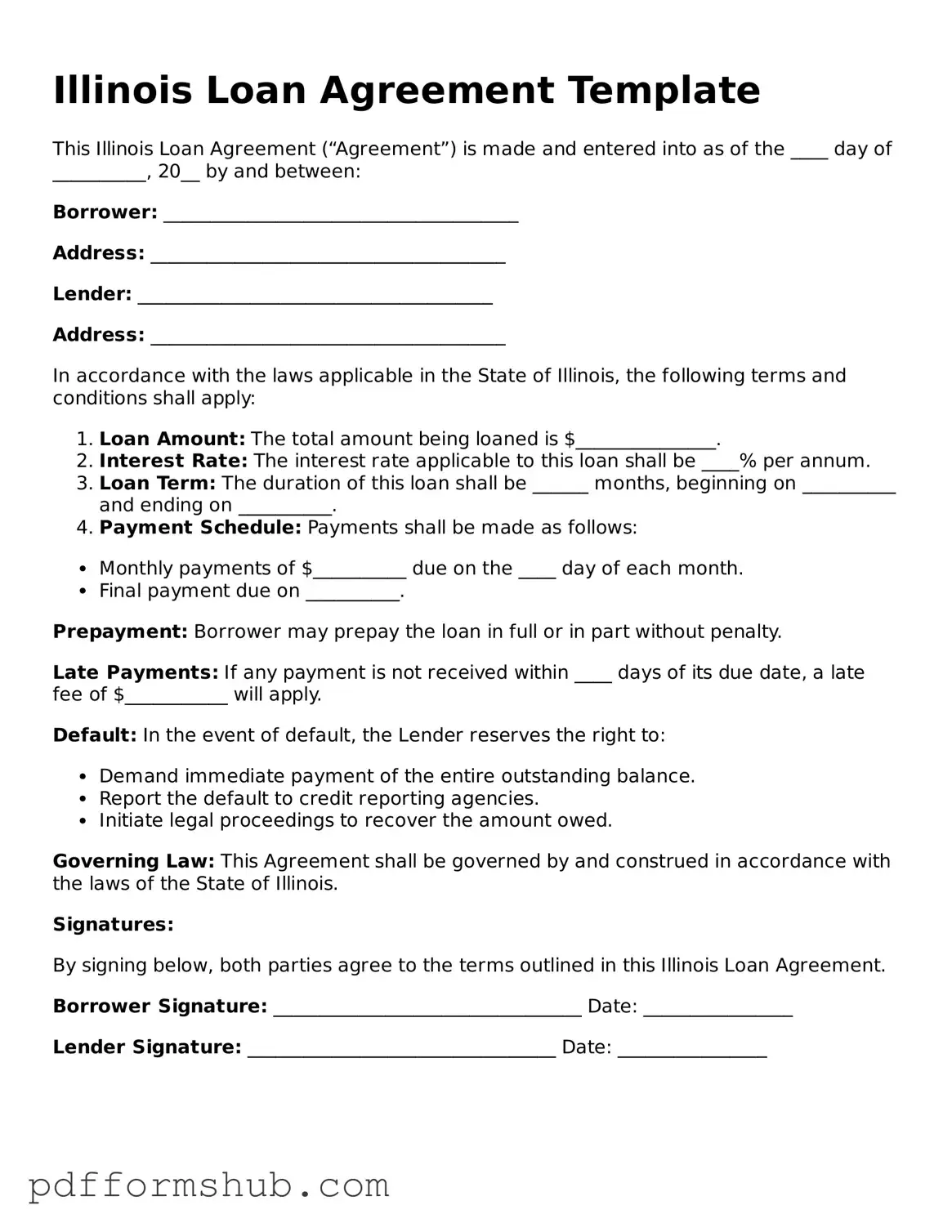

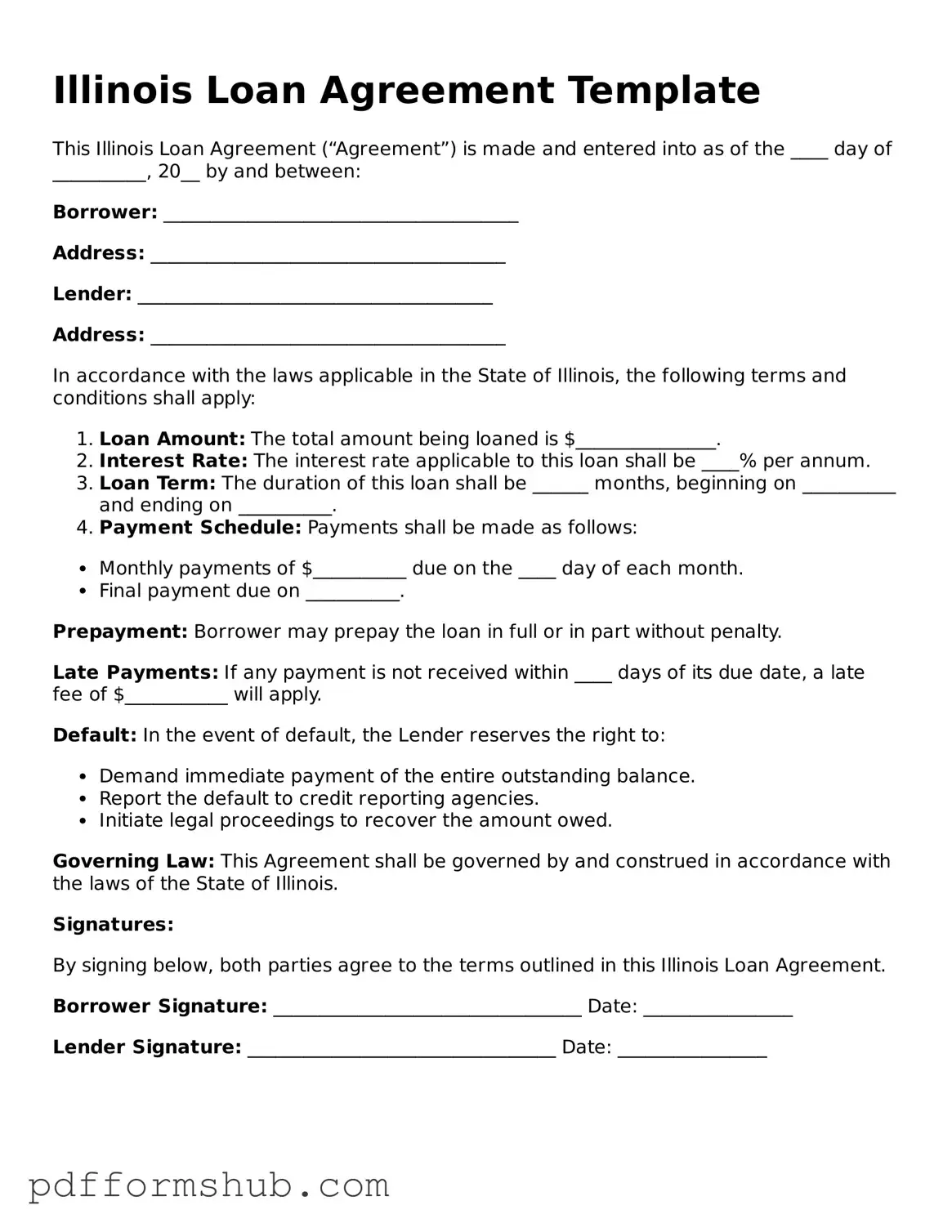

The Illinois Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form serves to protect both parties by clearly defining the responsibilities and expectations associated with the loan. To ensure a smooth transaction, consider filling out the form by clicking the button below.

Customize Form

Attorney-Verified Loan Agreement Form for Illinois State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Loan Agreement online without printing hassles.