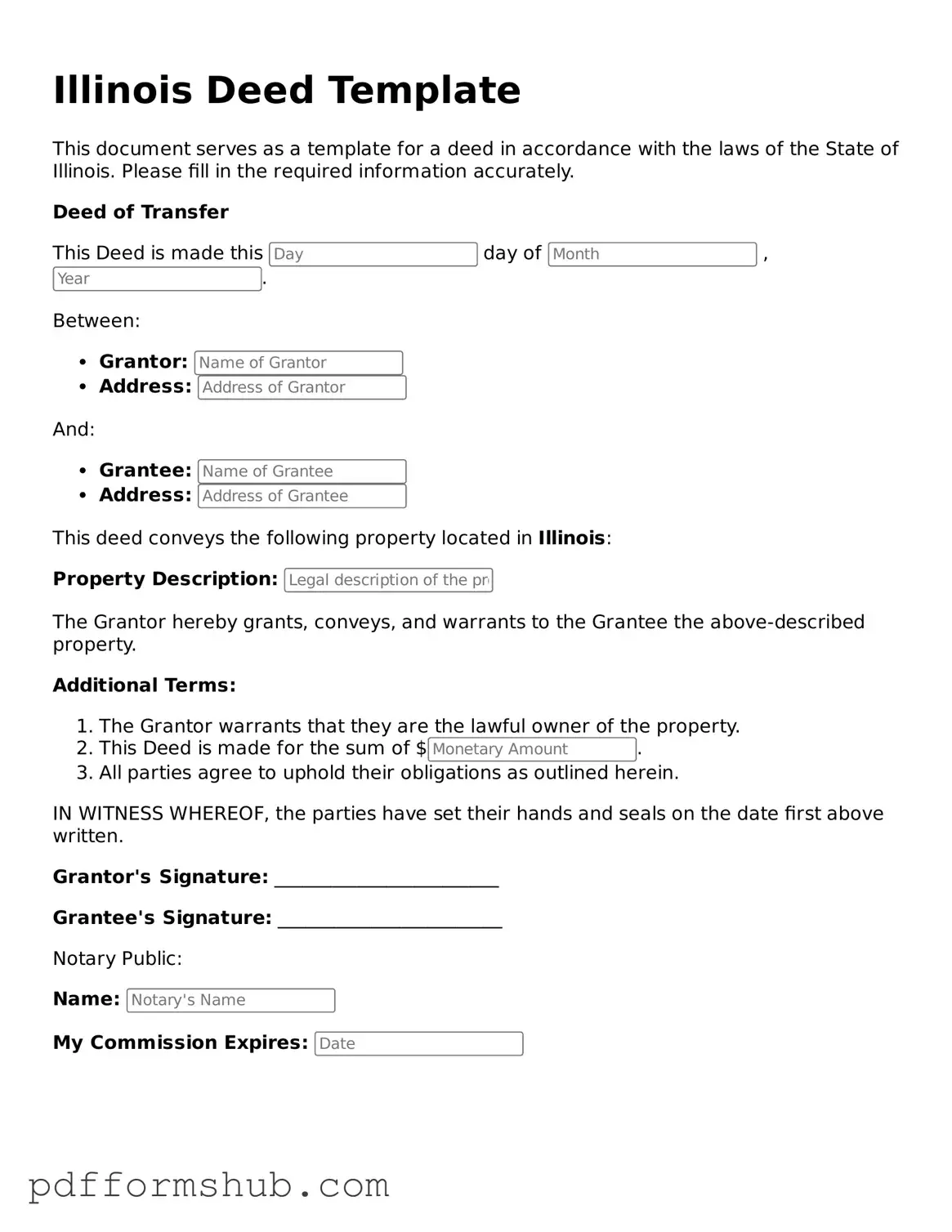

Attorney-Verified Deed Form for Illinois State

The Illinois Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Illinois. This form outlines the details of the transaction, including the names of the parties involved and a description of the property being conveyed. For those looking to complete a property transfer, filling out the Illinois Deed form is essential; click the button below to get started.

Customize Form

Attorney-Verified Deed Form for Illinois State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Deed online without printing hassles.