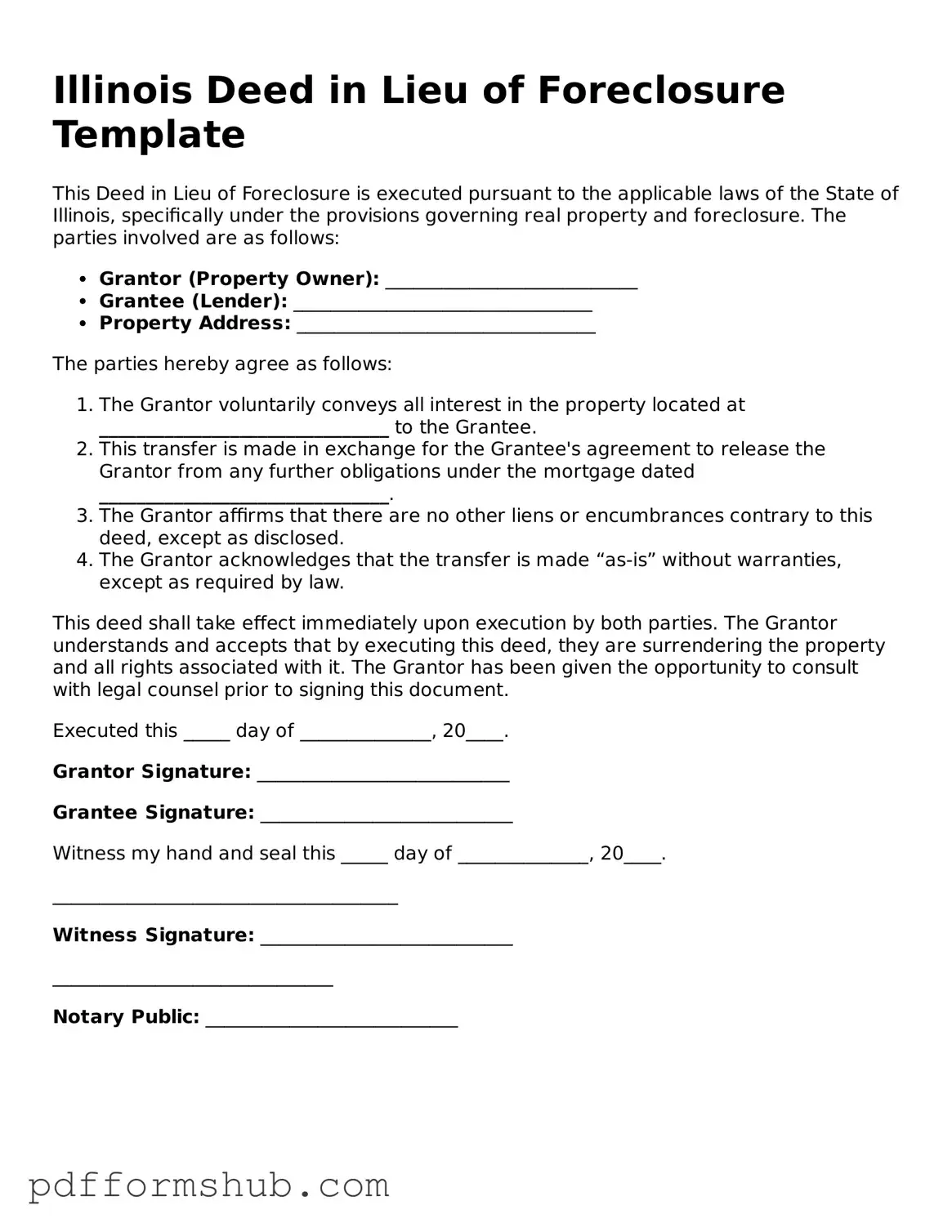

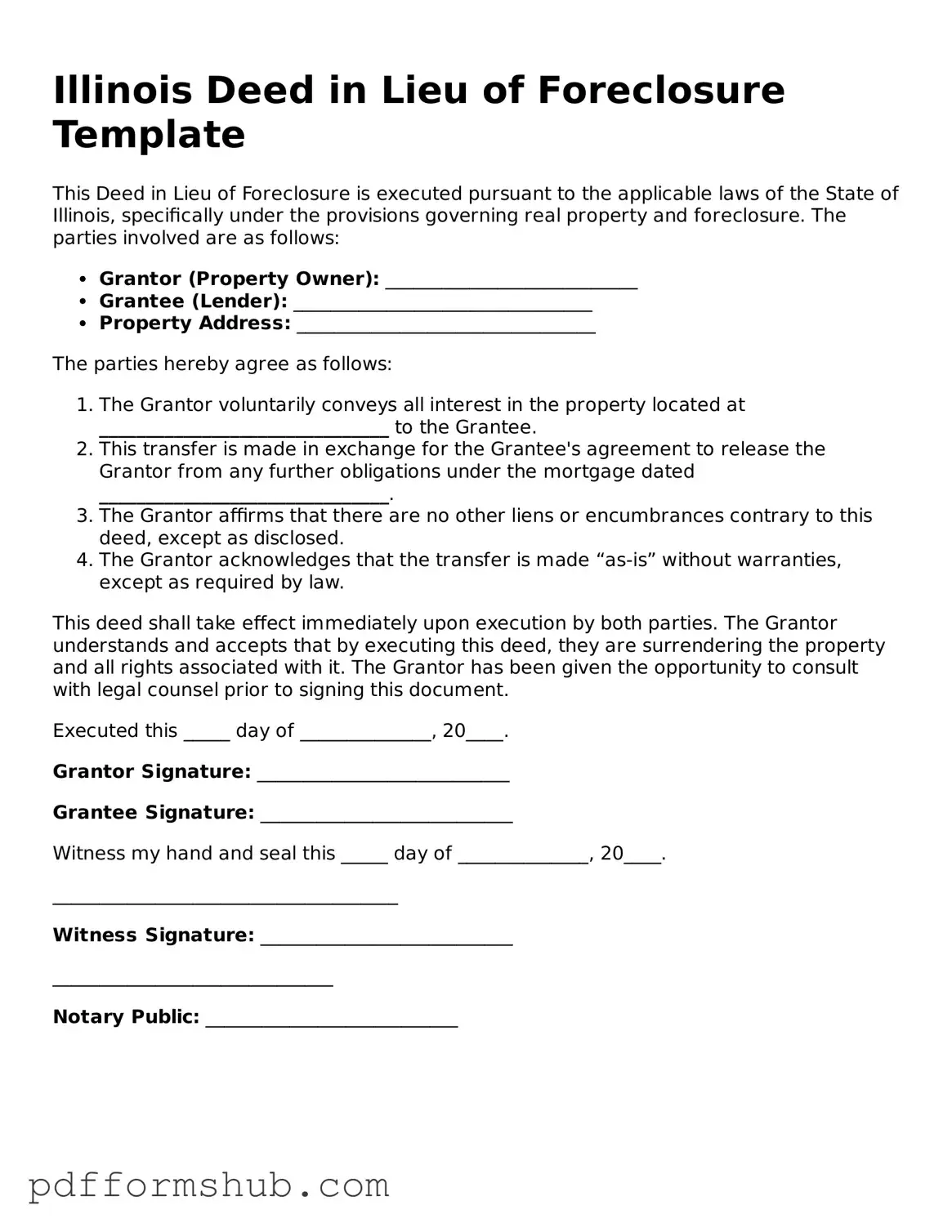

Attorney-Verified Deed in Lieu of Foreclosure Form for Illinois State

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property back to the lender, thereby avoiding the lengthy and often stressful foreclosure process. This option can provide a smoother transition for those facing financial difficulties, as it typically results in less damage to the homeowner's credit score compared to a foreclosure. For those considering this route, filling out the necessary form is a crucial first step; click the button below to get started.

Customize Form

Attorney-Verified Deed in Lieu of Foreclosure Form for Illinois State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Deed in Lieu of Foreclosure online without printing hassles.