-

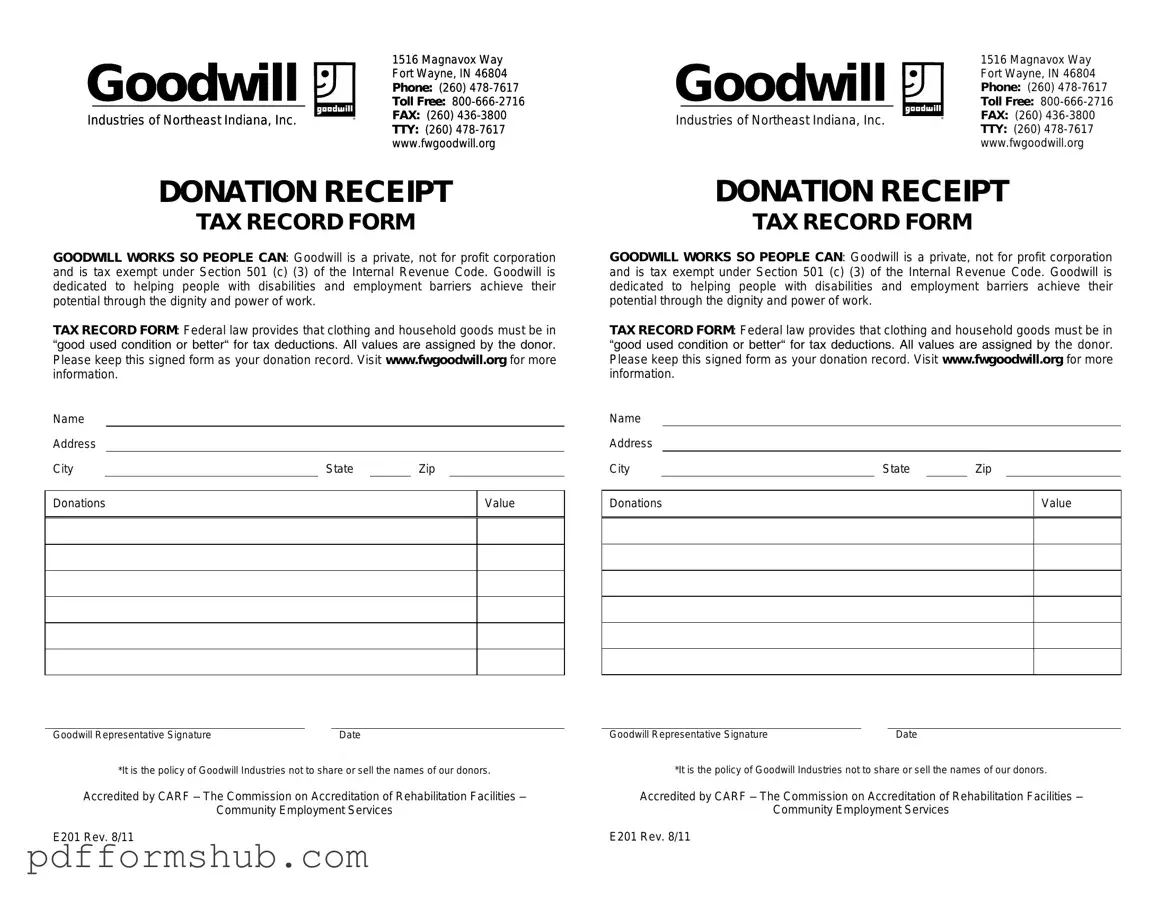

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors when they contribute items to Goodwill Industries. This form serves as proof of donation and can be used for tax purposes. It typically lists the donated items and their estimated value.

-

How do I obtain a Goodwill donation receipt?

When you make a donation at a Goodwill location, you can request a receipt from the staff. They will provide you with a form that details your donation. It’s important to ask for this receipt at the time of donation, as it may not be available later.

-

What information is included on the receipt?

The receipt typically includes:

- Your name and address

- The date of the donation

- A description of the items donated

- An estimated value of the items

- The name of the Goodwill location

-

Do I need to list the value of my donated items?

Yes, while the receipt provides an estimated value, it is your responsibility to determine the fair market value of your donated items. Goodwill may provide guidelines on how to assess value, but ultimately, it is up to you to establish what the items are worth.

-

Can I donate items without receiving a receipt?

Yes, you can donate items without receiving a receipt. However, if you plan to claim a tax deduction, it is highly recommended to obtain a receipt. The IRS requires documentation for any charitable contributions claimed on your tax return.

-

What if I lose my donation receipt?

If you lose your receipt, it may be difficult to obtain a duplicate. Goodwill typically does not keep records of individual donations, so it’s best to keep your receipt in a safe place. Consider taking a photo of the receipt for your records.

-

Can I claim a tax deduction for my donations?

Yes, you can claim a tax deduction for your donations to Goodwill, provided you have the necessary documentation. The IRS allows deductions for charitable contributions, but you must itemize your deductions on your tax return.

-

Are there limits on the amount I can deduct?

There are limits to how much you can deduct based on your income and the type of property donated. Generally, you can deduct up to 50% of your adjusted gross income for donations to qualified charities, including Goodwill. For specific limits, consult a tax professional.

-

What types of items can I donate?

Goodwill accepts a wide range of items, including clothing, furniture, household goods, electronics, and more. However, certain items may be restricted due to safety regulations or local laws. Always check with your local Goodwill for their specific donation guidelines.

-

Can I donate items in any condition?

Goodwill prefers items that are gently used and in working condition. While they may accept some items that are not in perfect shape, they cannot accept items that are damaged, broken, or unsanitary. It’s best to donate items that you would be comfortable receiving.