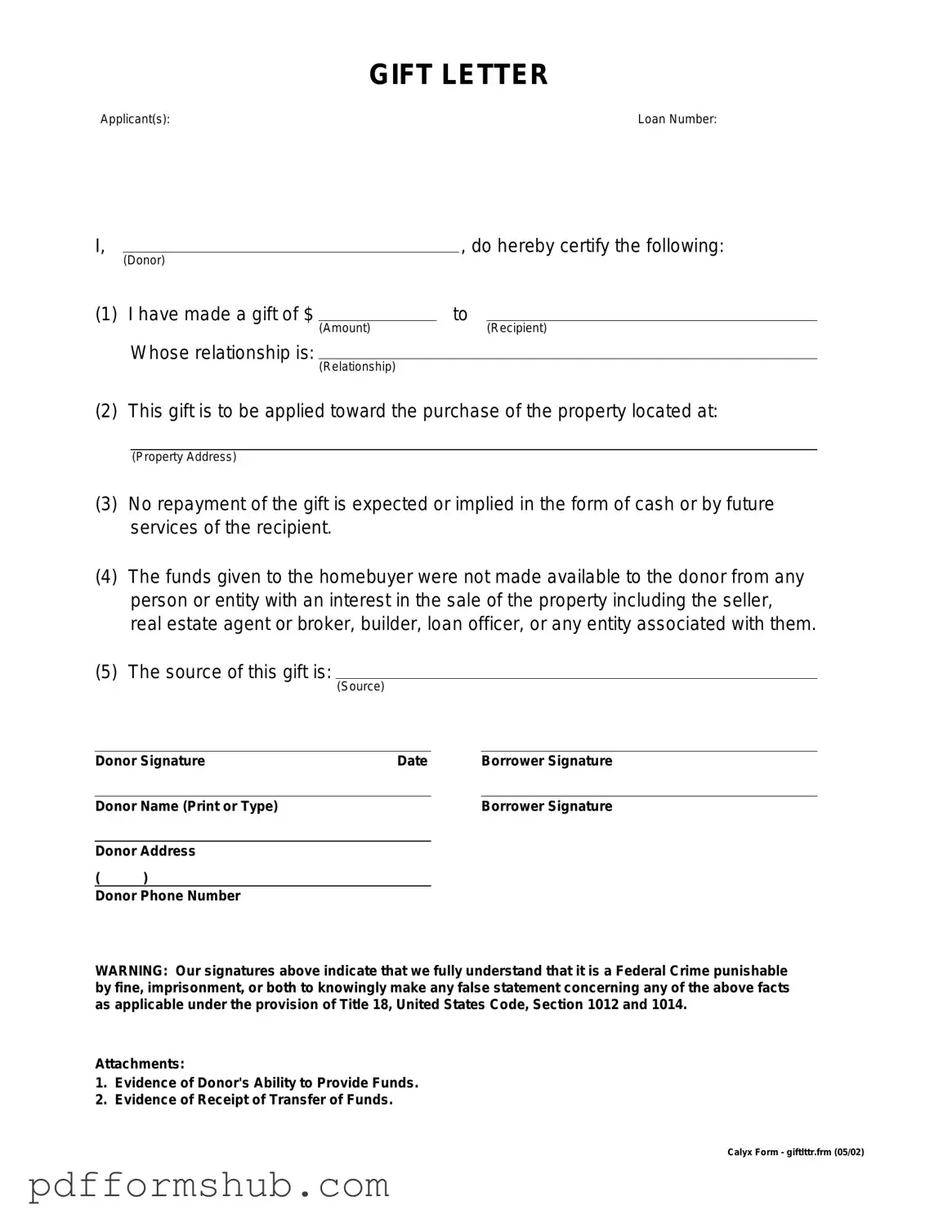

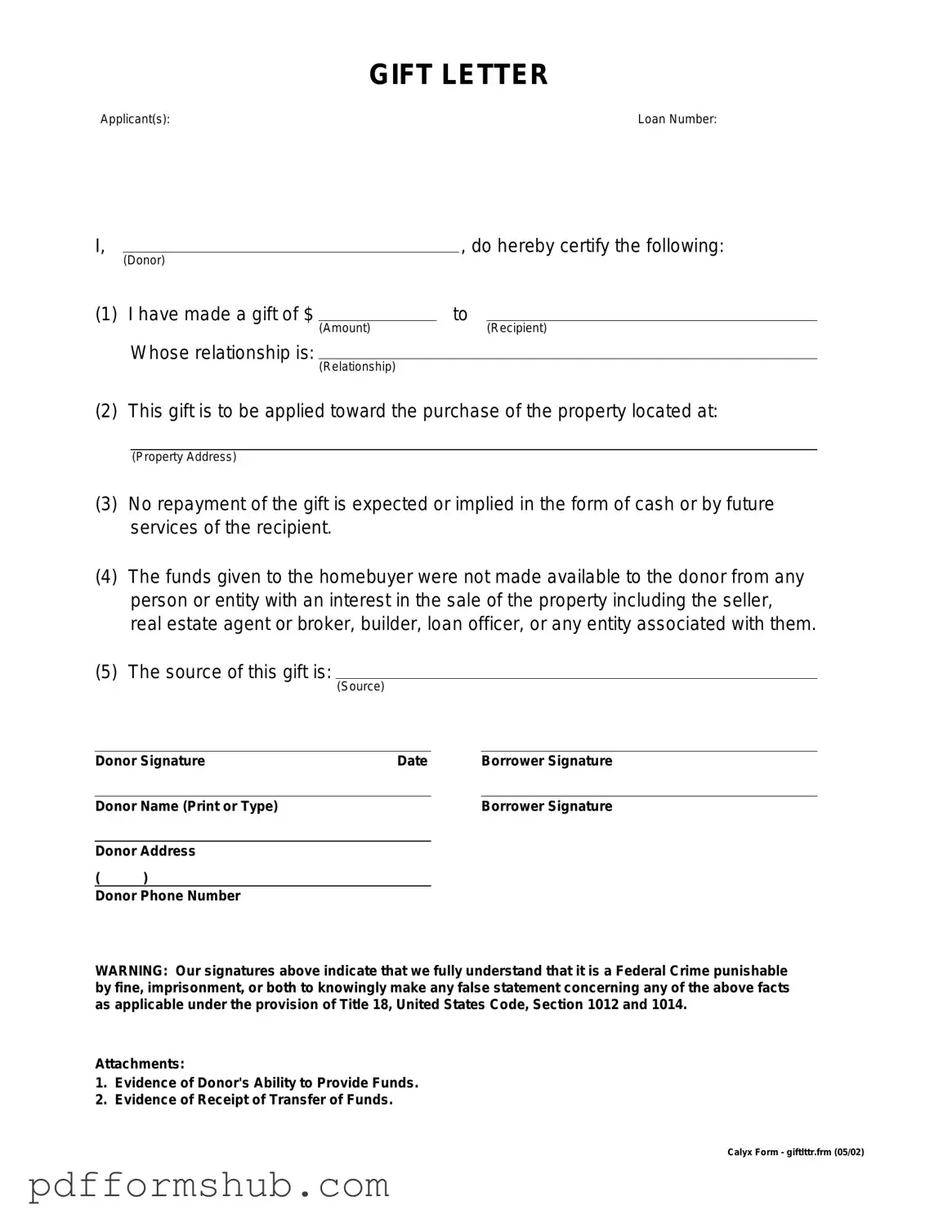

Fill in Your Gift Letter Form

A Gift Letter form is a document used to confirm that a monetary gift has been given to an individual, often for the purpose of assisting with a home purchase or other significant financial transaction. This letter provides clarity to lenders about the source of funds, ensuring that the gift is not a loan that requires repayment. Understanding how to properly fill out this form is essential for a smooth transaction; start by clicking the button below to get started.

Customize Form

Fill in Your Gift Letter Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Gift Letter online without printing hassles.