Attorney-Verified Promissory Note Form for Georgia State

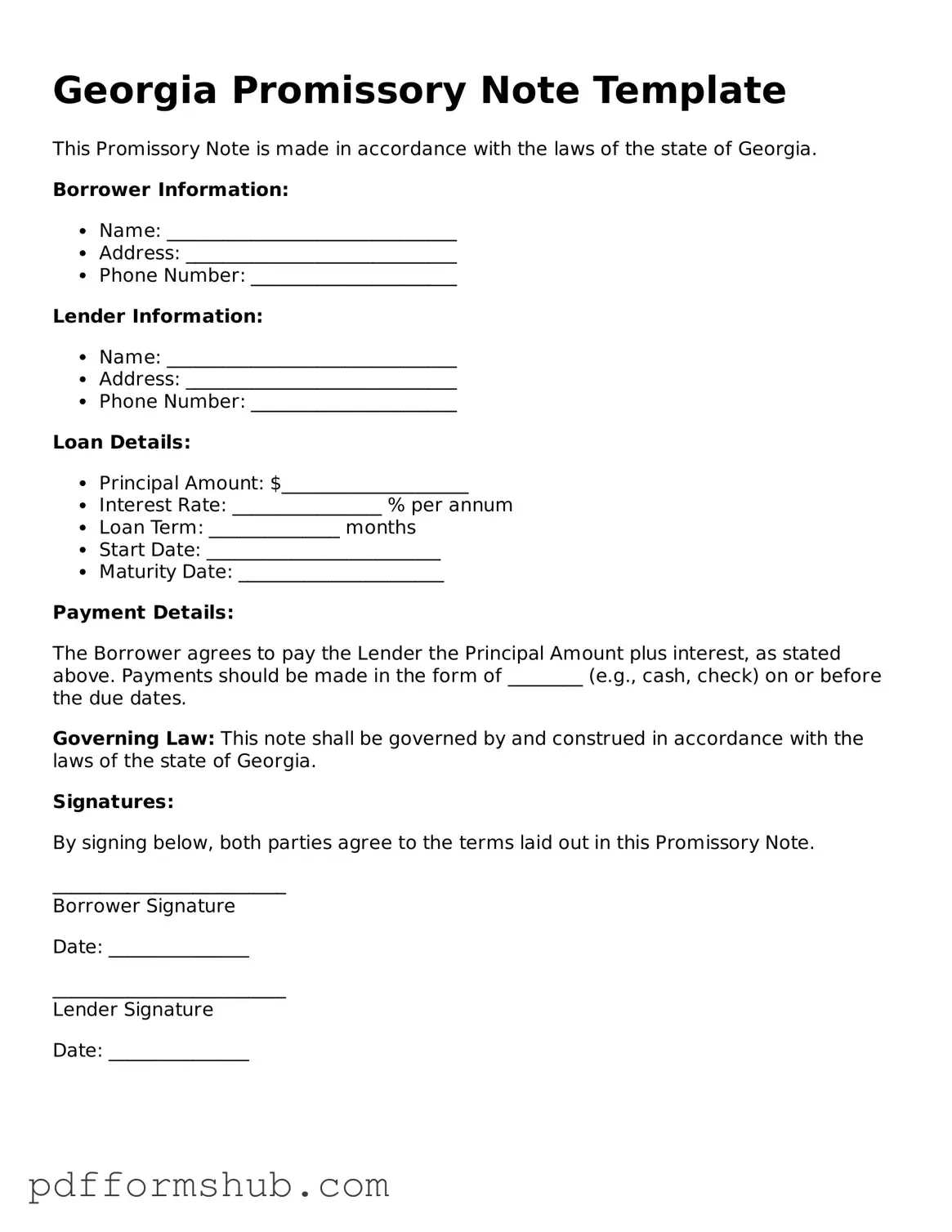

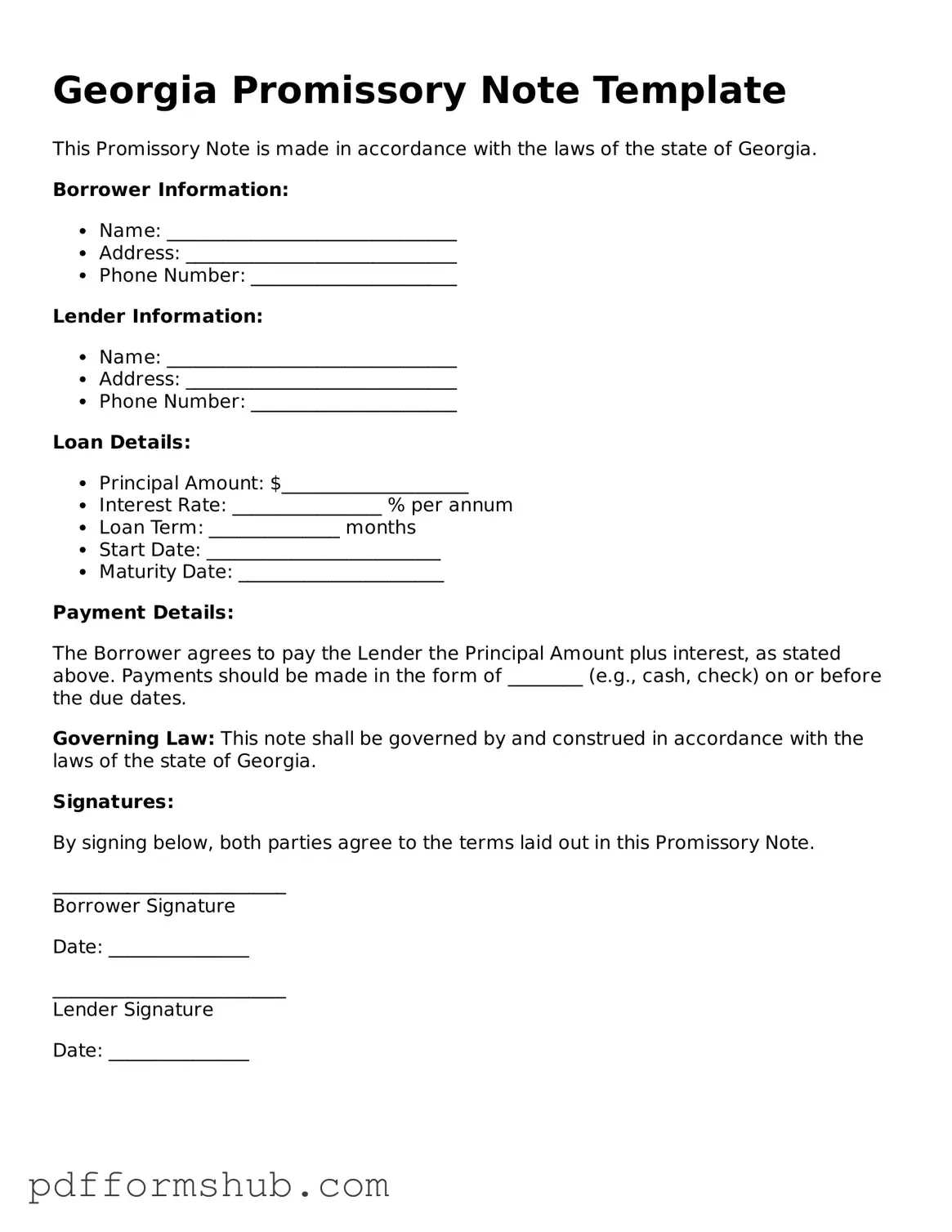

A Georgia Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a certain time. This document outlines the terms of the loan, including interest rates and payment schedules, ensuring both parties understand their obligations. If you're ready to create your own Promissory Note, fill out the form by clicking the button below.

Customize Form

Attorney-Verified Promissory Note Form for Georgia State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Promissory Note online without printing hassles.