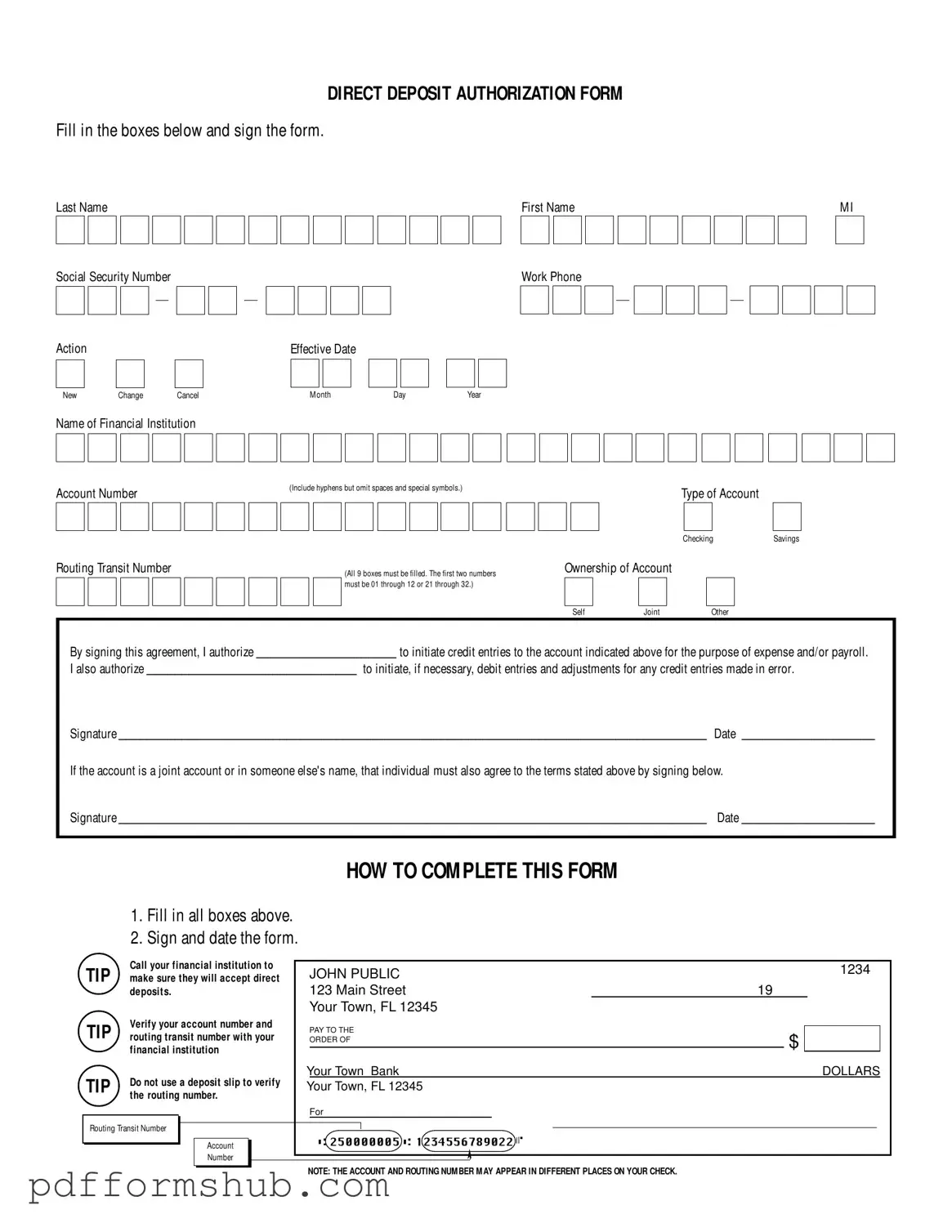

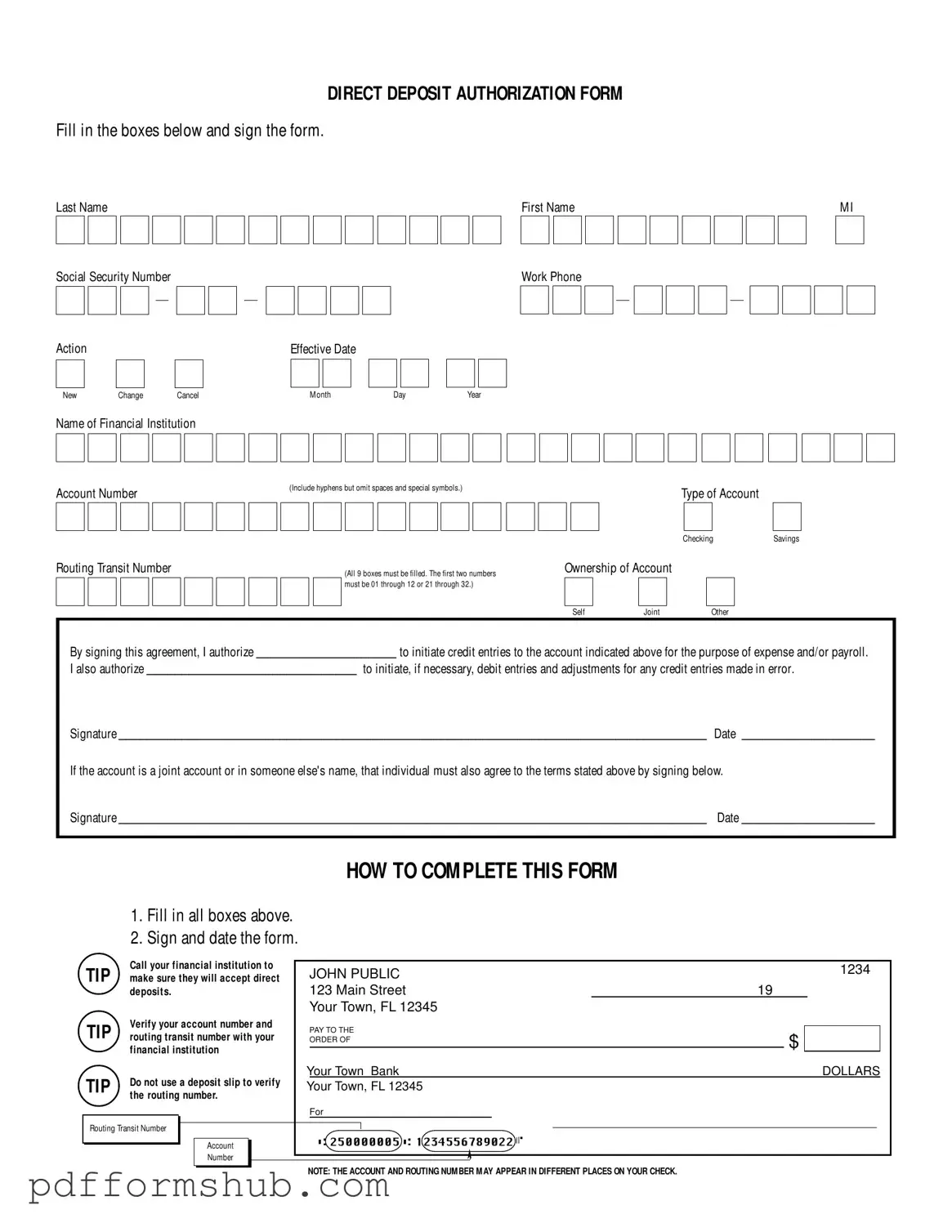

Fill in Your Generic Direct Deposit Form

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. This streamlined process ensures timely payments while reducing the need for paper checks. To get started, fill out the form by clicking the button below.

Customize Form

Fill in Your Generic Direct Deposit Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Generic Direct Deposit online without printing hassles.