Attorney-Verified Transfer-on-Death Deed Form for Florida State

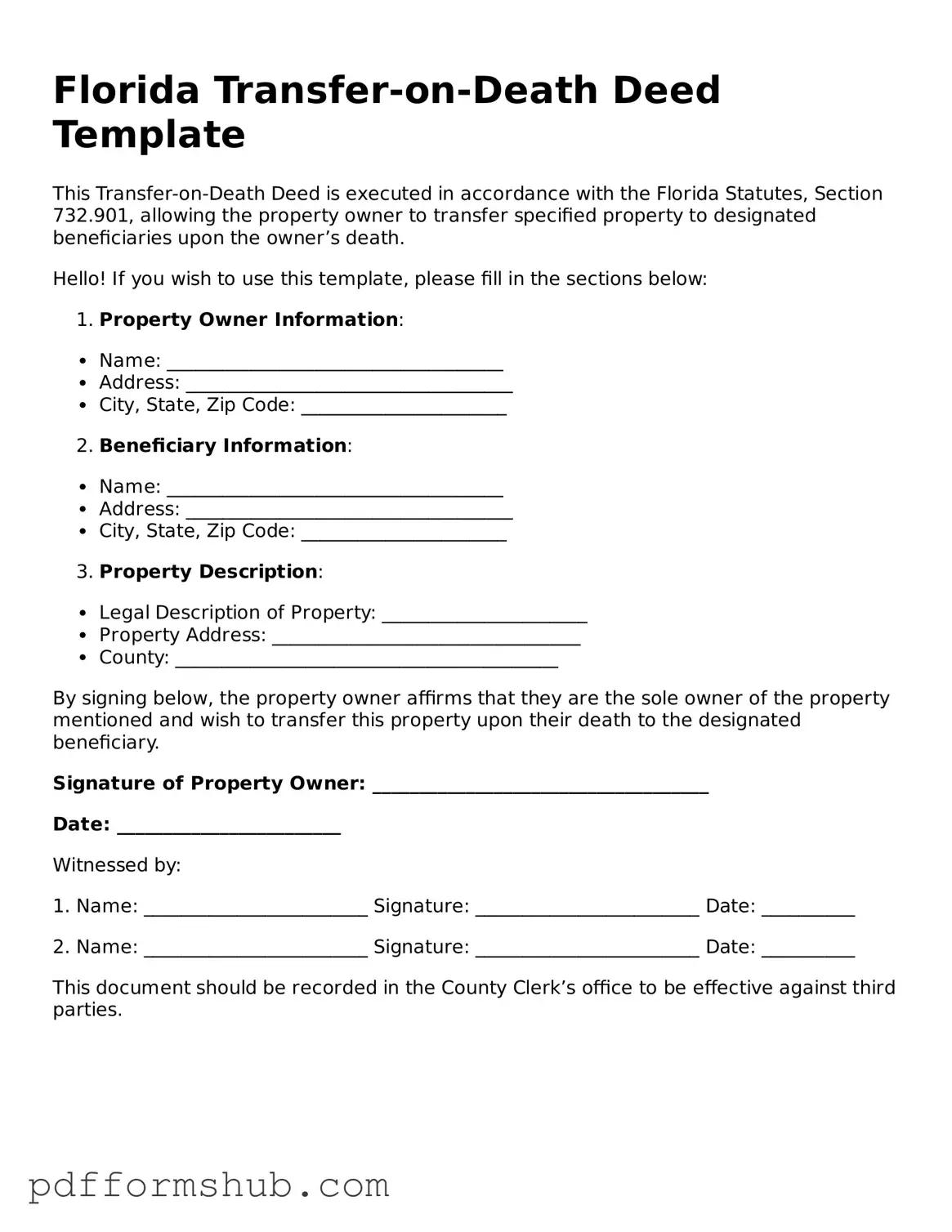

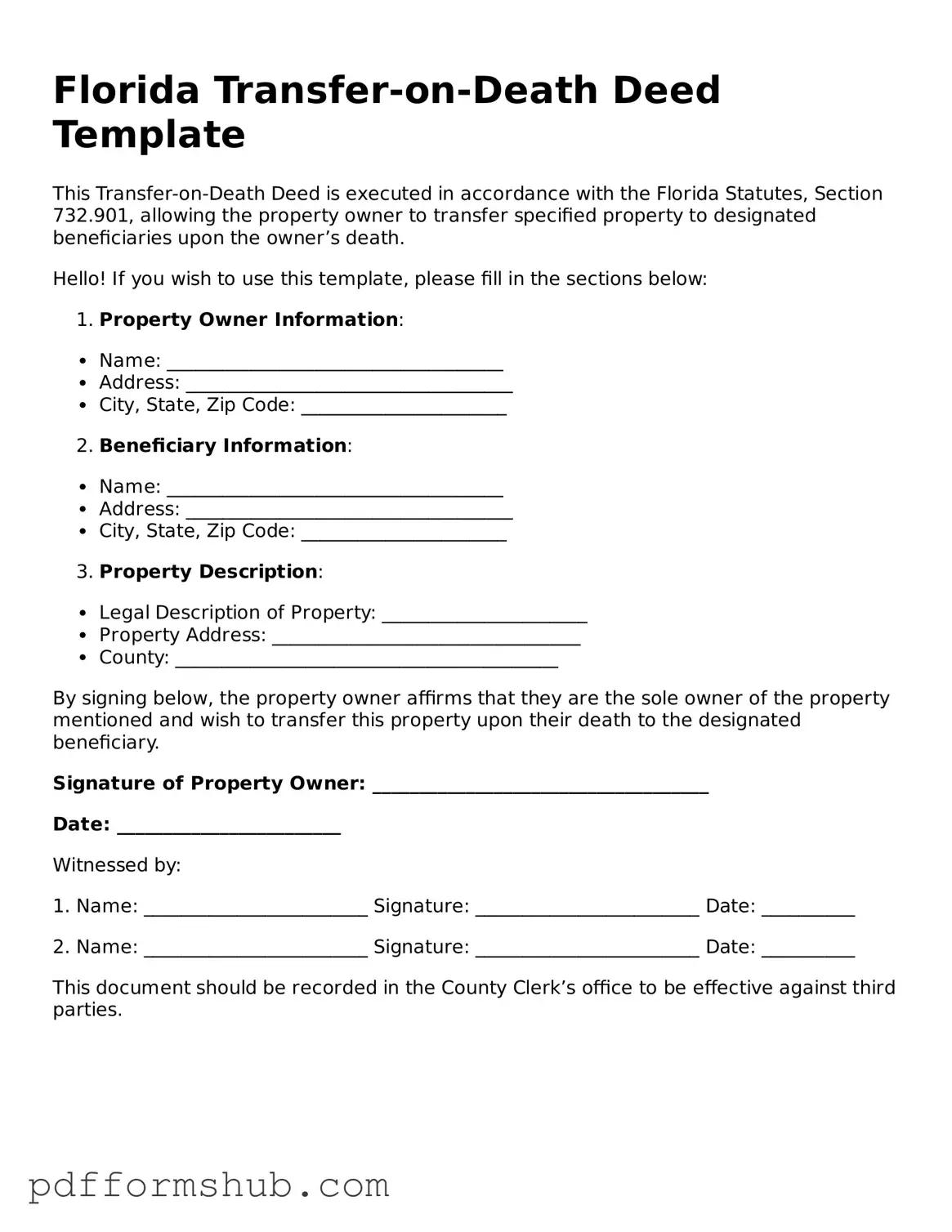

The Florida Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the probate process. This tool provides a straightforward way for individuals to ensure their property is passed on according to their wishes. For those interested in utilizing this beneficial form, filling it out is a crucial step—click the button below to get started.

Customize Form

Attorney-Verified Transfer-on-Death Deed Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Transfer-on-Death Deed online without printing hassles.