Attorney-Verified Real Estate Purchase Agreement Form for Florida State

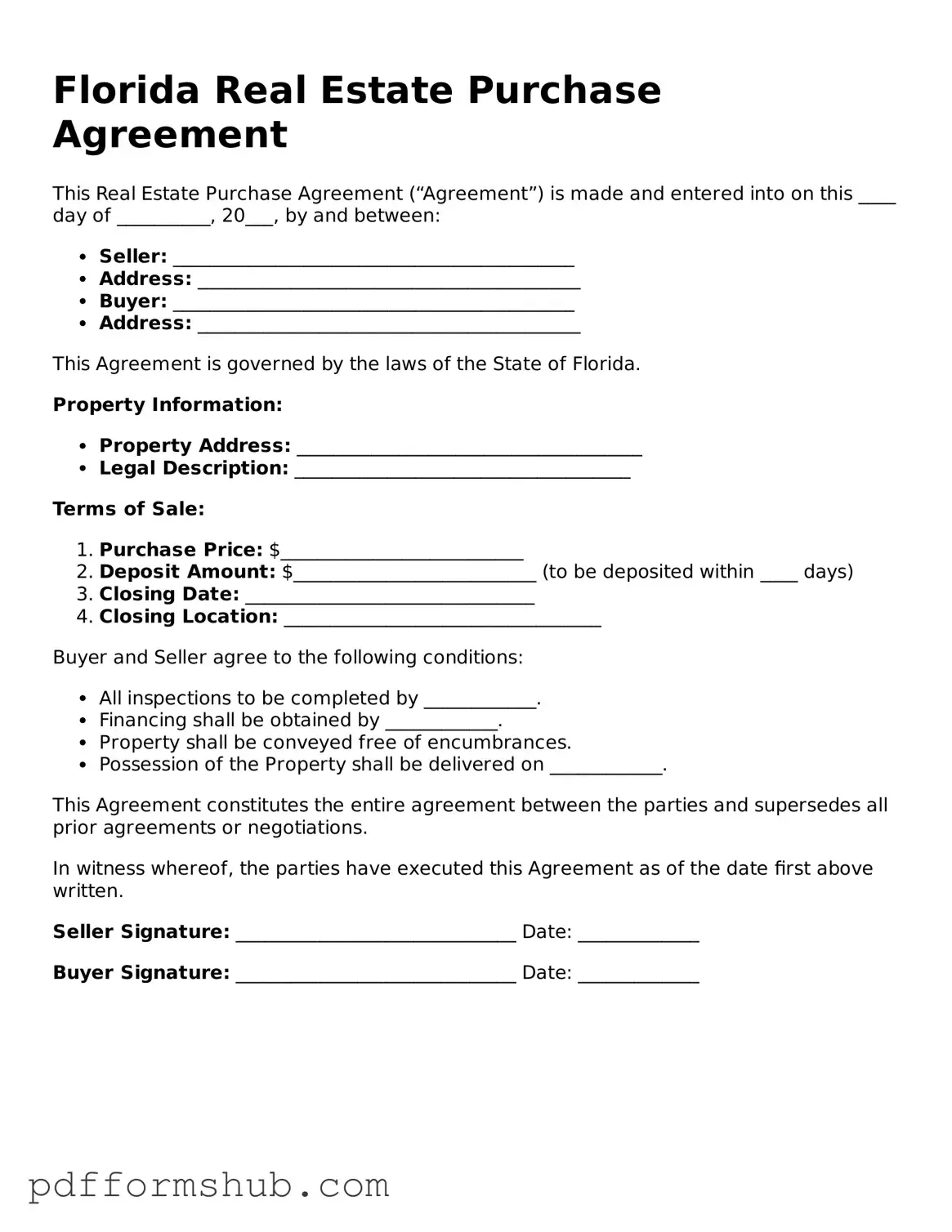

The Florida Real Estate Purchase Agreement form serves as a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This essential agreement helps to protect the interests of both parties involved in the transaction, ensuring clarity and mutual understanding. To facilitate your real estate dealings, consider filling out the form by clicking the button below.

Customize Form

Attorney-Verified Real Estate Purchase Agreement Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Real Estate Purchase Agreement online without printing hassles.