Attorney-Verified Promissory Note Form for Florida State

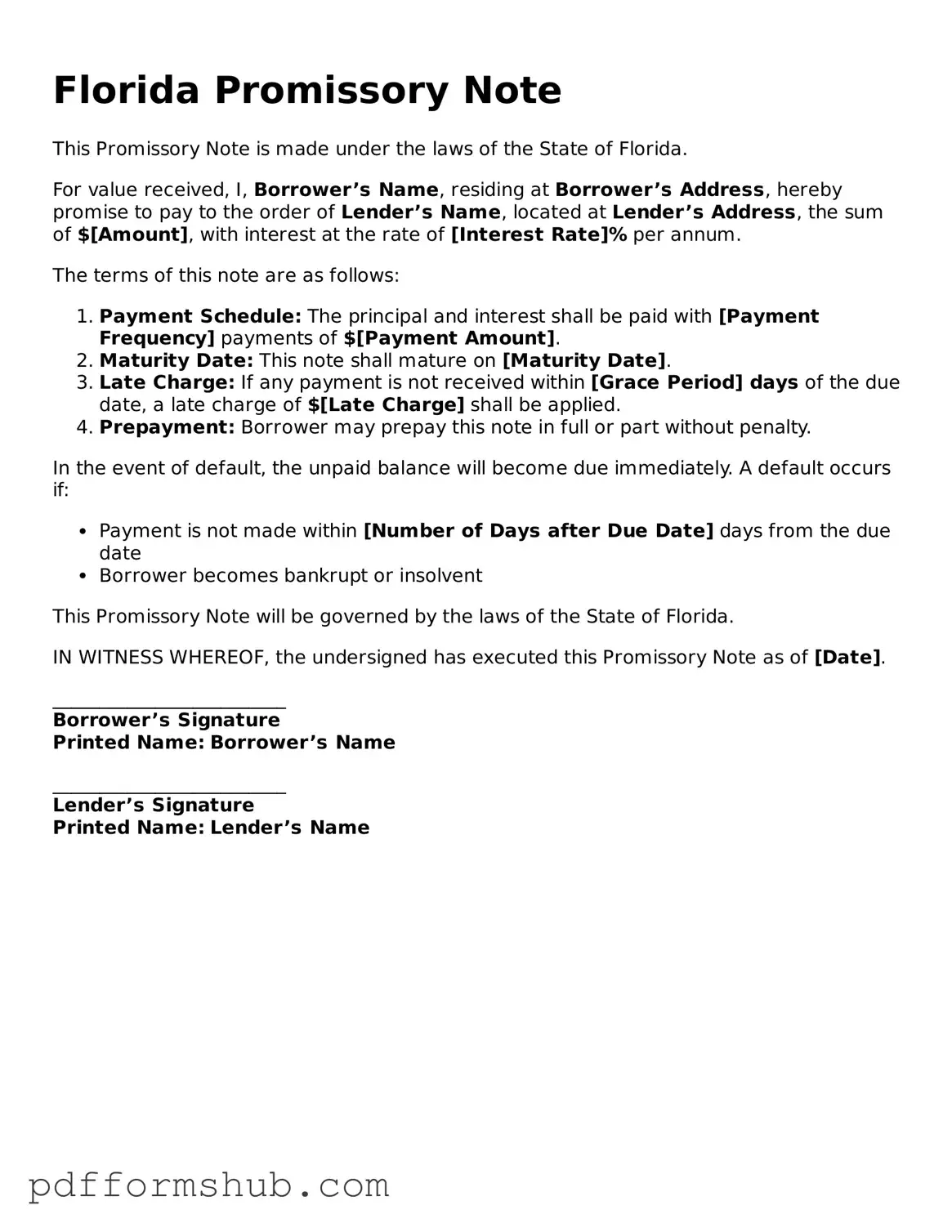

A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool for both parties, ensuring clarity and accountability in financial transactions. If you need to formalize a loan agreement, consider filling out the form by clicking the button below.

Customize Form

Attorney-Verified Promissory Note Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Promissory Note online without printing hassles.