Attorney-Verified Prenuptial Agreement Form for Florida State

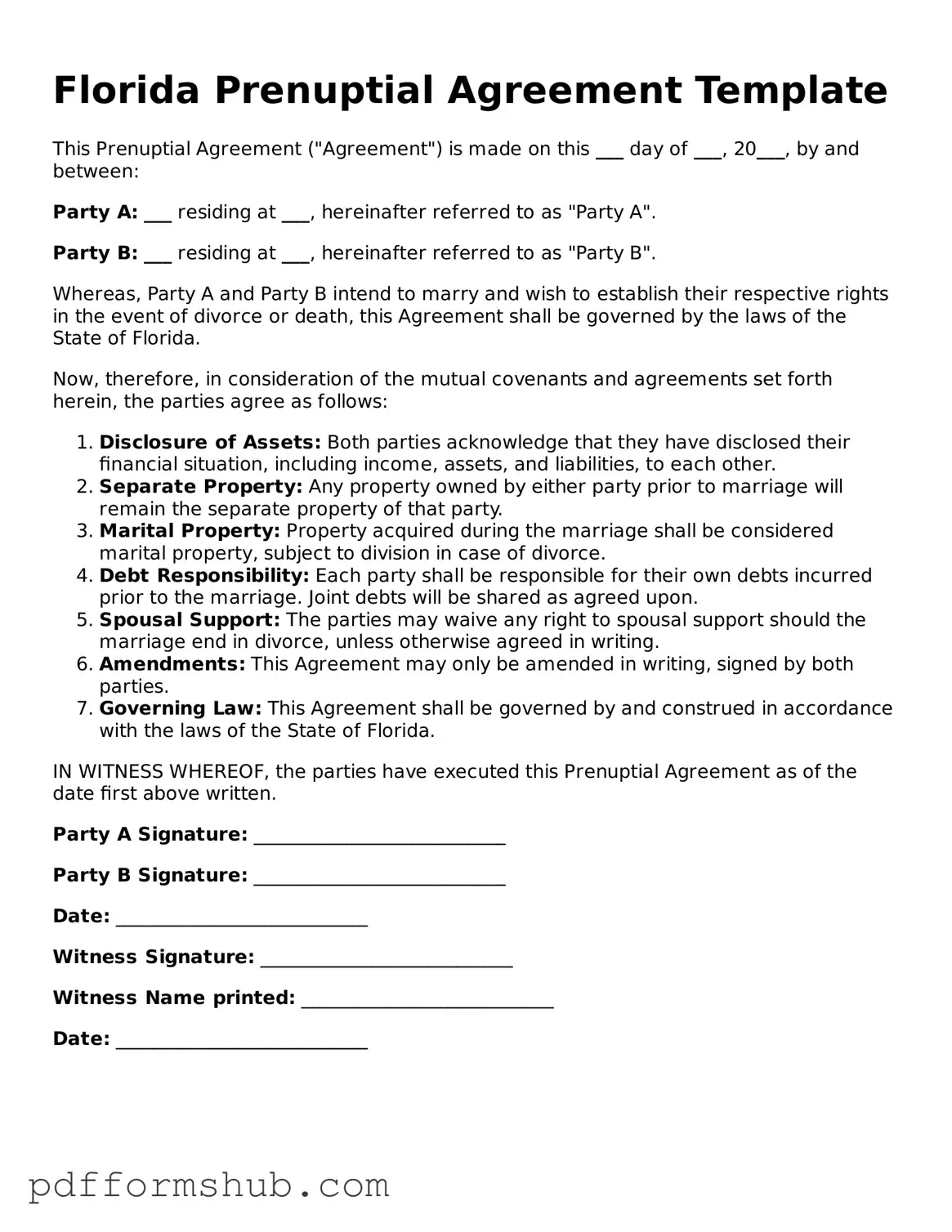

A Florida Prenuptial Agreement form is a legal document that outlines the financial and property rights of each spouse in the event of divorce or separation. This agreement can help clarify expectations and protect individual assets, providing peace of mind for both parties. To get started on your own prenuptial agreement, fill out the form by clicking the button below.

Customize Form

Attorney-Verified Prenuptial Agreement Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Prenuptial Agreement online without printing hassles.