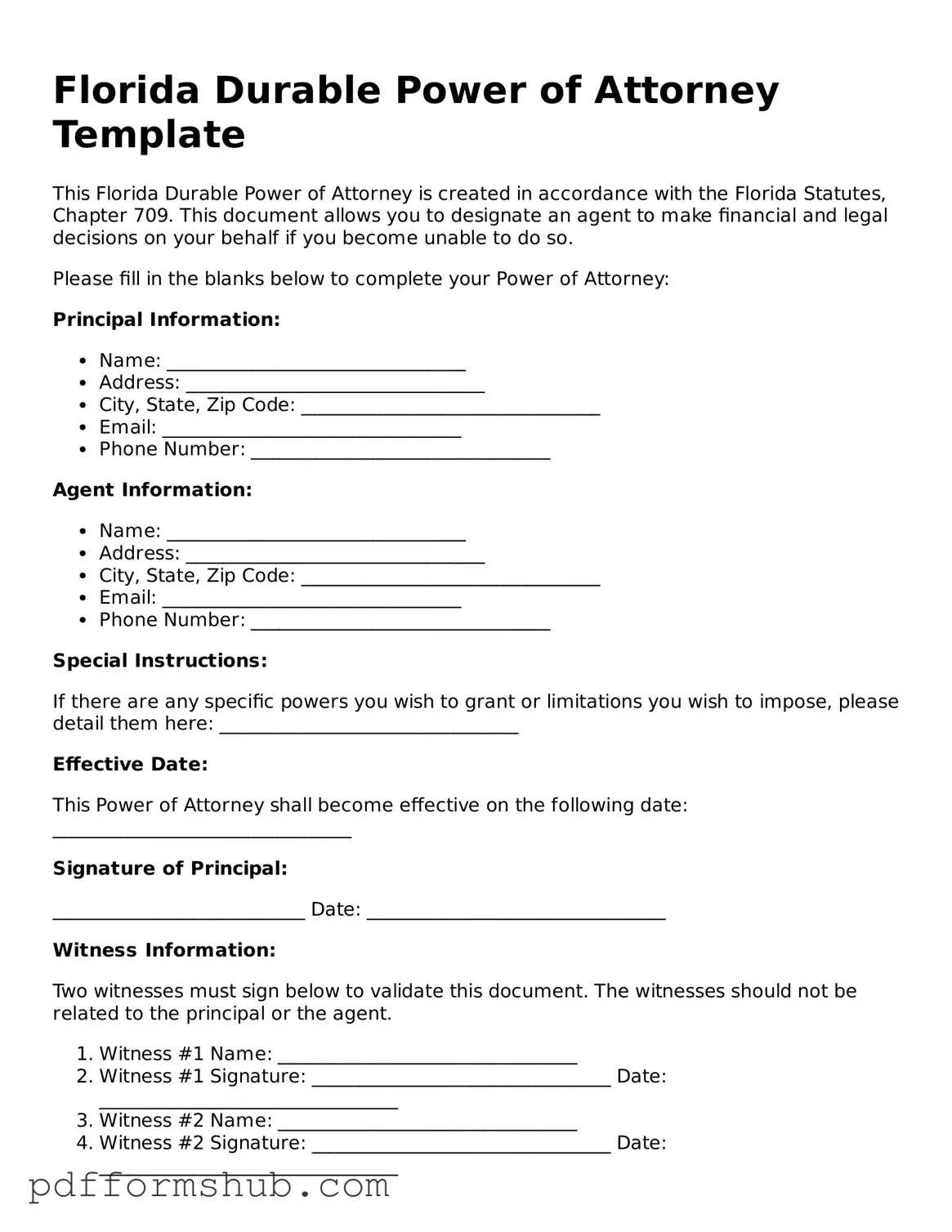

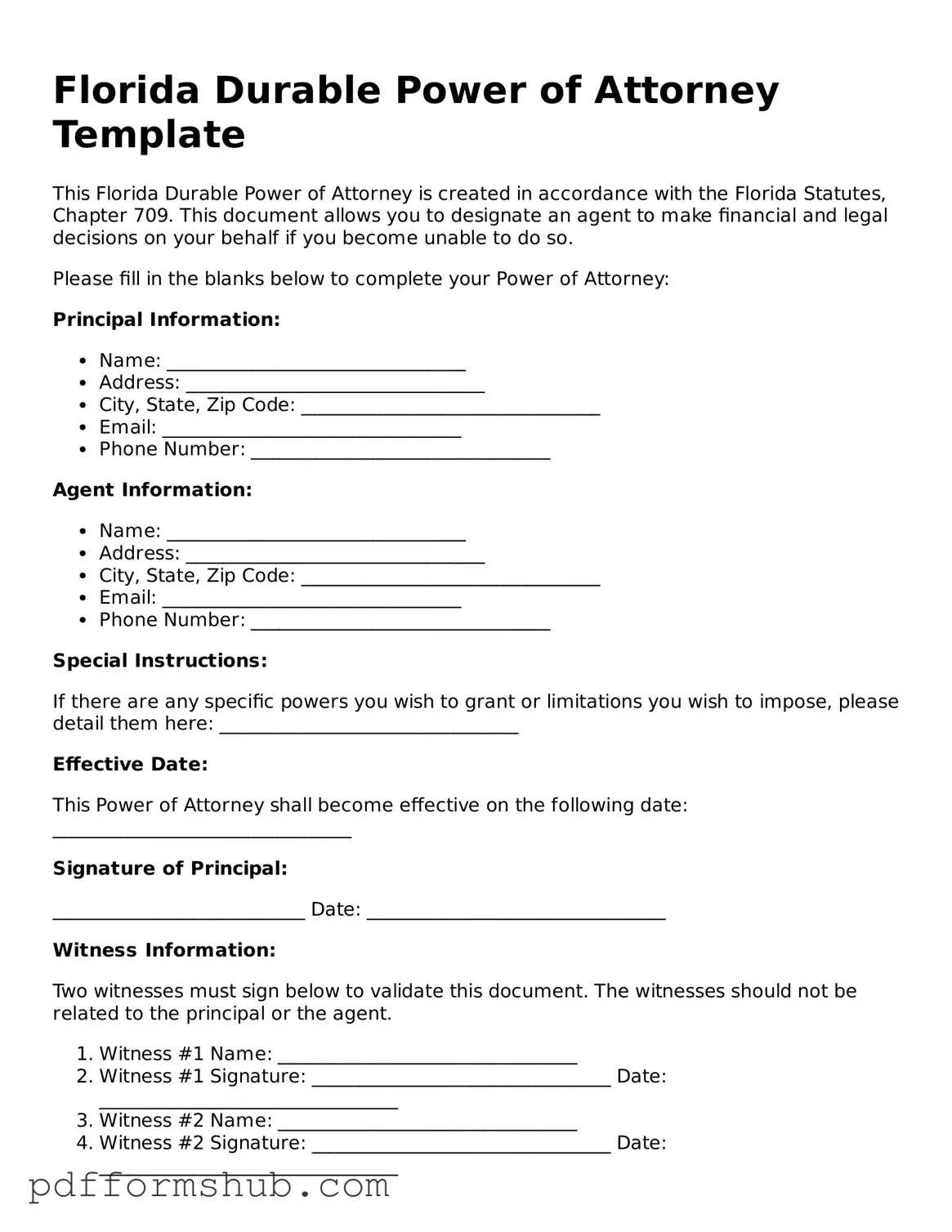

Attorney-Verified Power of Attorney Form for Florida State

A Florida Power of Attorney form is a legal document that allows one person to act on behalf of another in financial or legal matters. This form can be crucial for managing affairs when someone is unable to do so themselves. To get started on securing your interests, fill out the form by clicking the button below.

Customize Form

Attorney-Verified Power of Attorney Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Power of Attorney online without printing hassles.