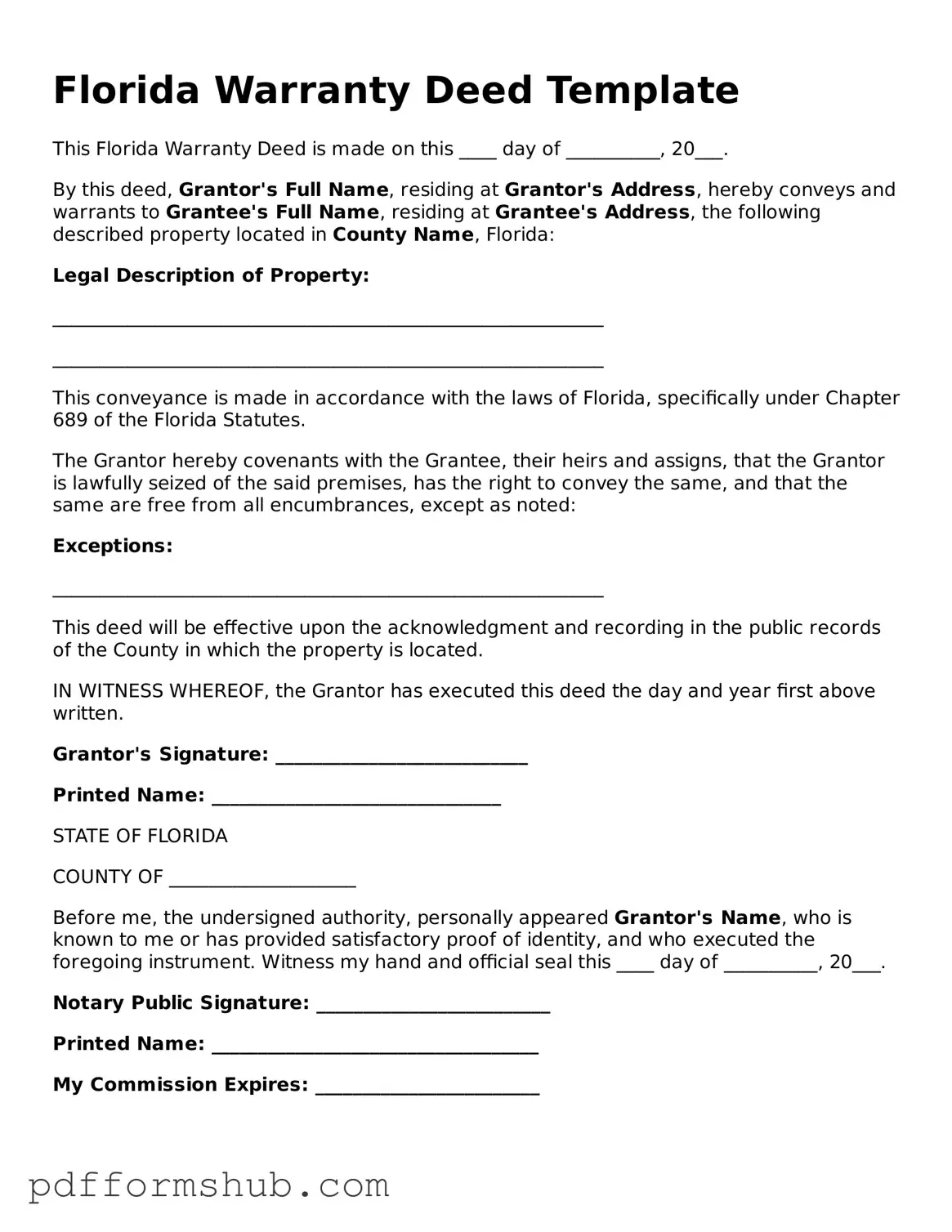

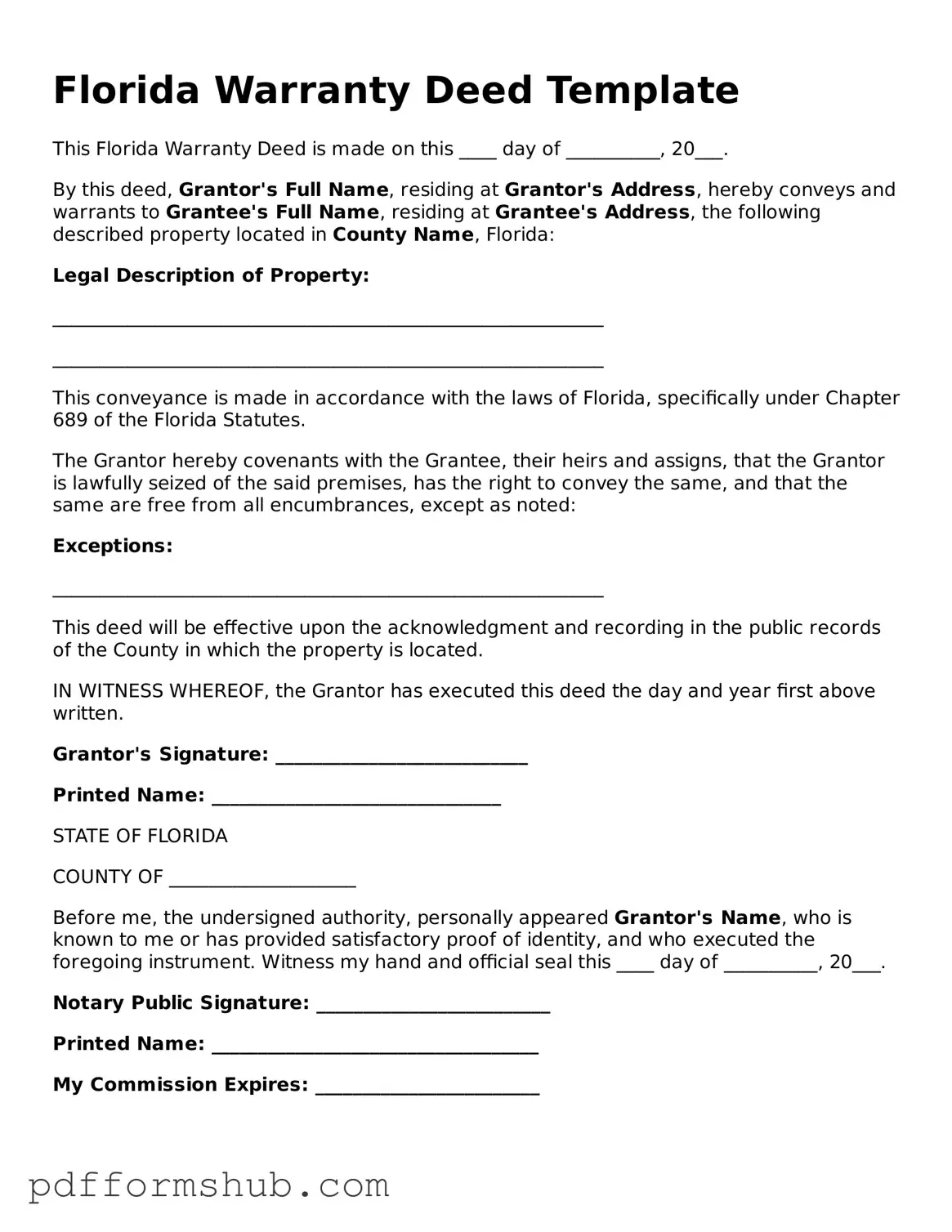

Attorney-Verified Deed Form for Florida State

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Florida. This form is essential for ensuring that the transaction is recorded accurately and legally binding. If you're ready to take the next step in property ownership, fill out the form by clicking the button below.

Customize Form

Attorney-Verified Deed Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Deed online without printing hassles.