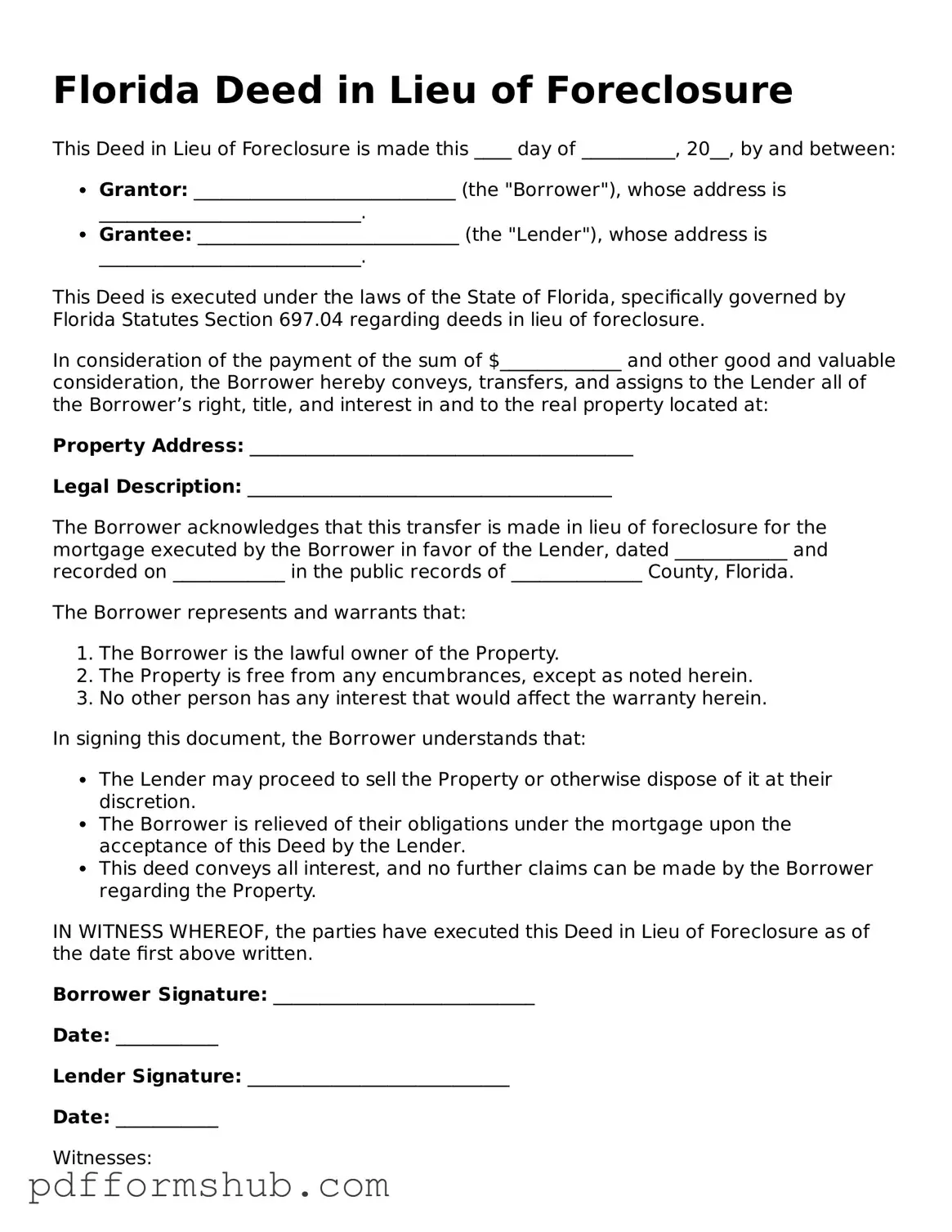

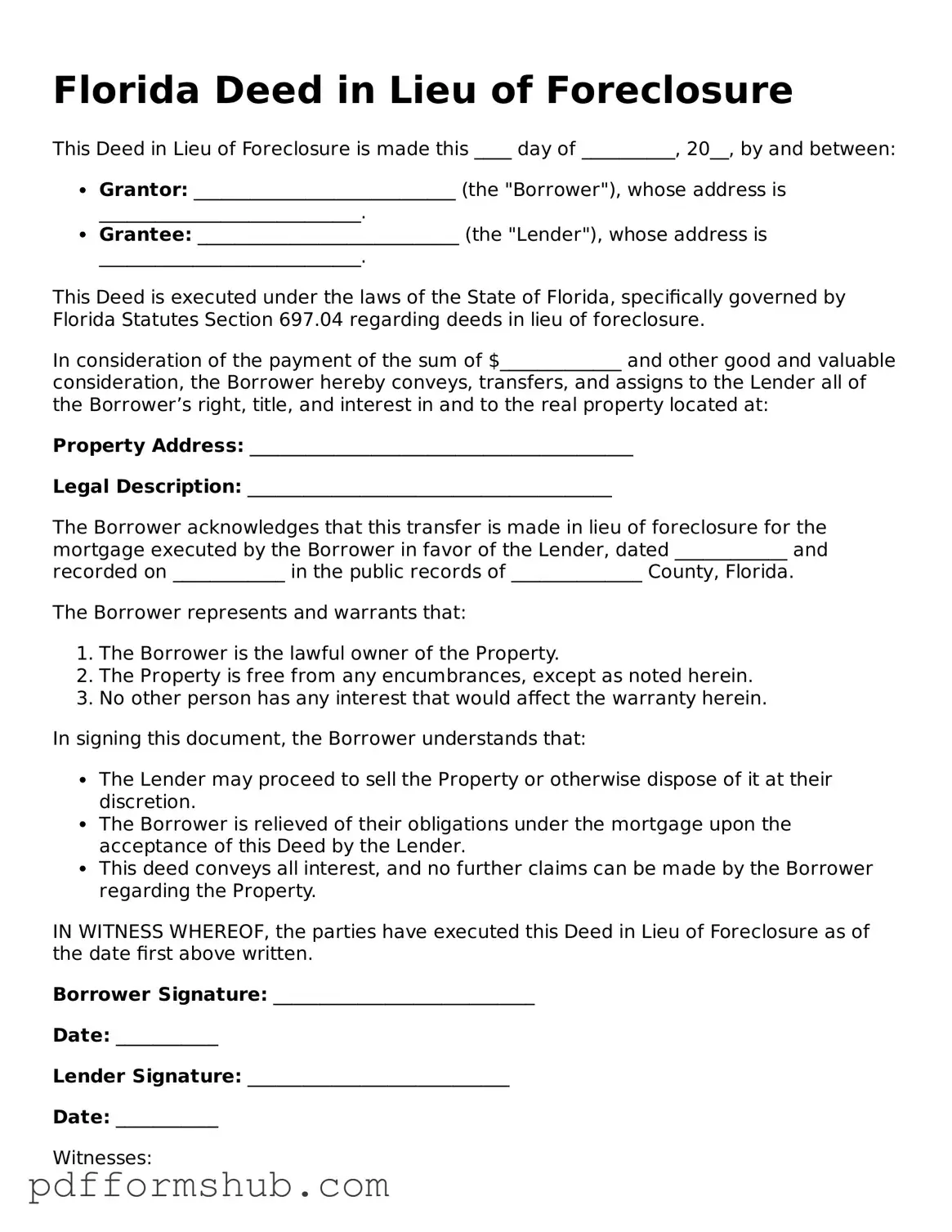

Attorney-Verified Deed in Lieu of Foreclosure Form for Florida State

A Florida Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy foreclosure process. This option can provide a fresh start for homeowners facing financial difficulties, as it typically results in less damage to their credit score compared to a traditional foreclosure. If you're considering this option, take the first step by filling out the form below.

Click the button below to get started.

Customize Form

Attorney-Verified Deed in Lieu of Foreclosure Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Deed in Lieu of Foreclosure online without printing hassles.