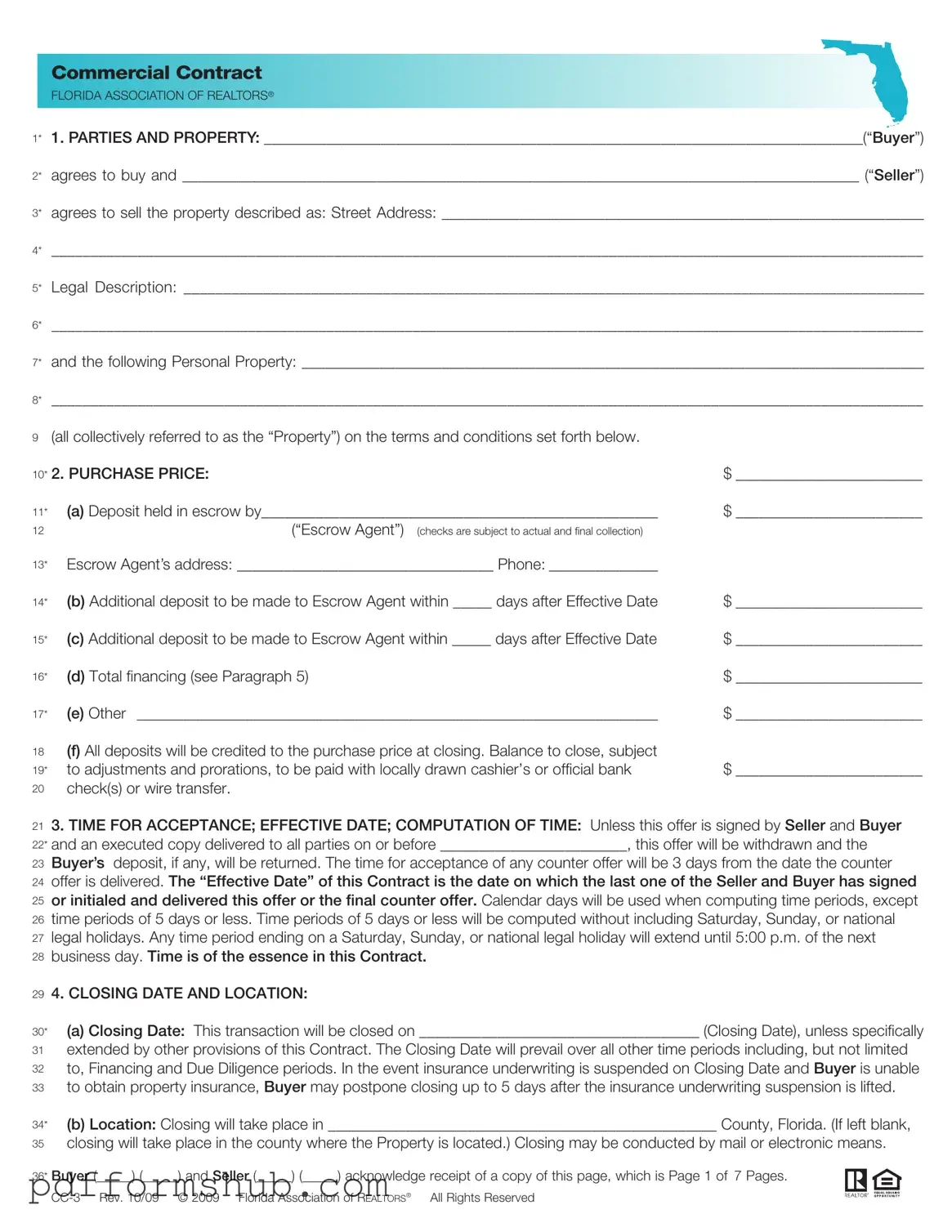

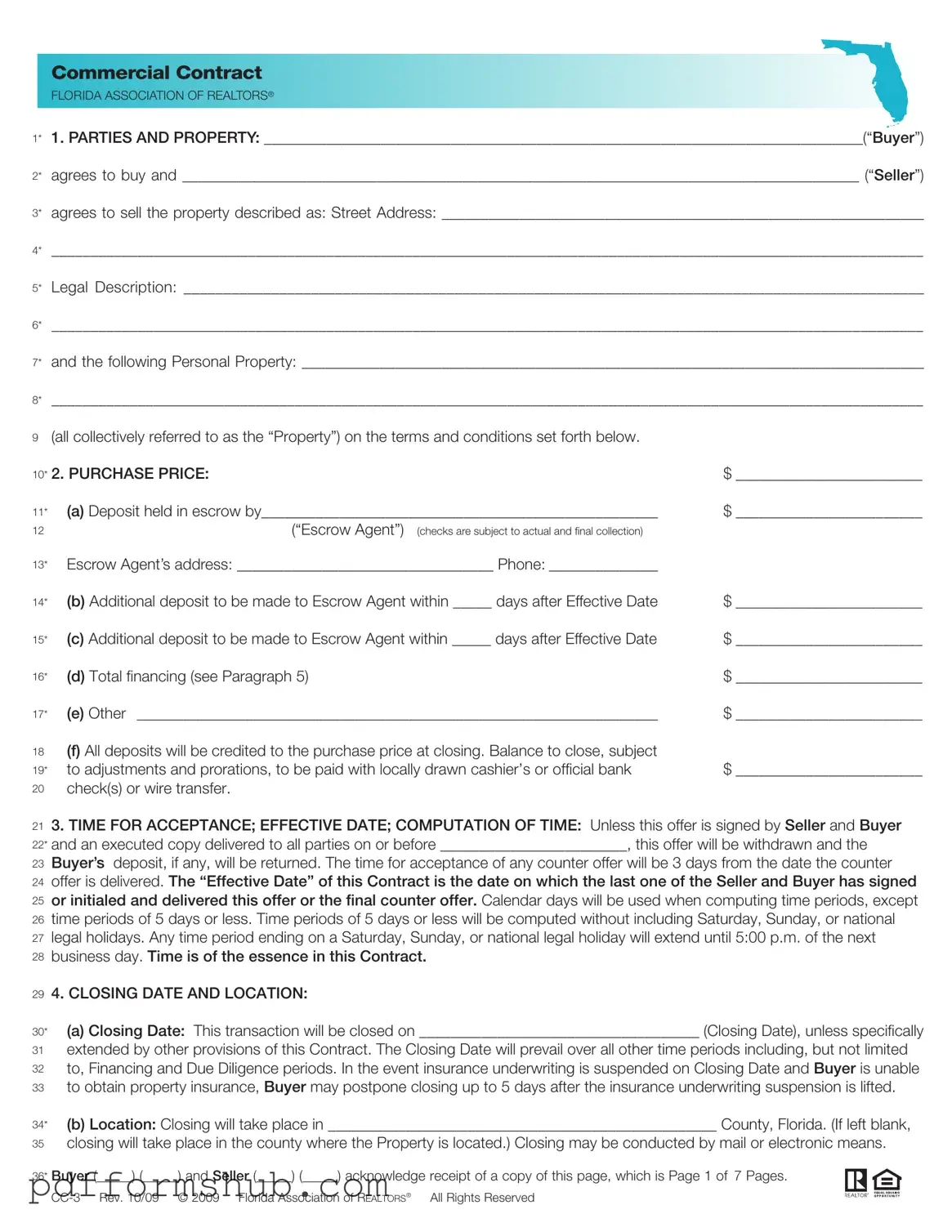

Fill in Your Florida Commercial Contract Form

The Florida Commercial Contract form is a legal document used to outline the terms of a real estate transaction between a buyer and a seller. This form details essential aspects such as the parties involved, property description, purchase price, and closing procedures. Understanding this contract is crucial for anyone engaging in commercial real estate in Florida.

Ready to get started? Fill out the form by clicking the button below.

Customize Form

Fill in Your Florida Commercial Contract Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Florida Commercial Contract online without printing hassles.