Attorney-Verified Affidavit of Gift Form for Florida State

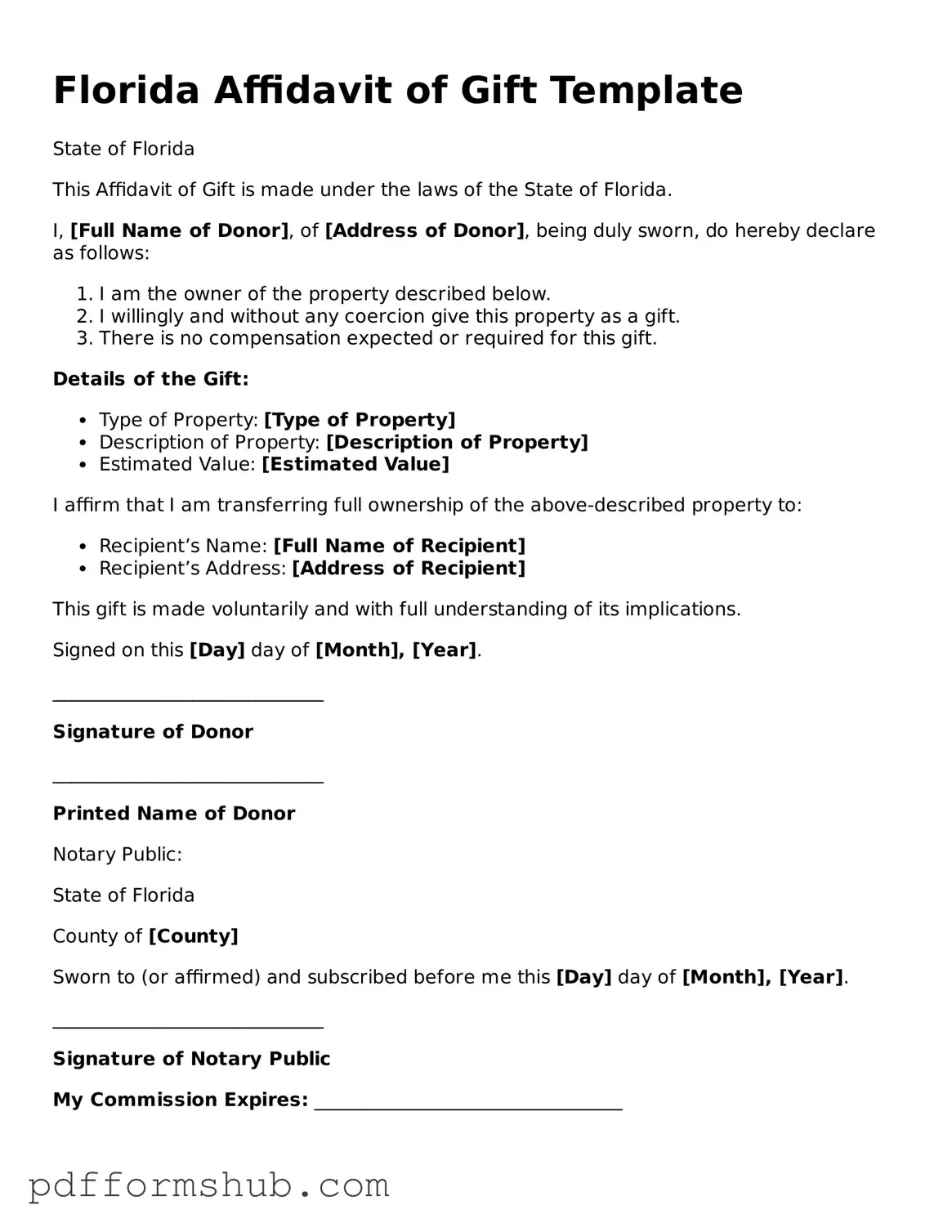

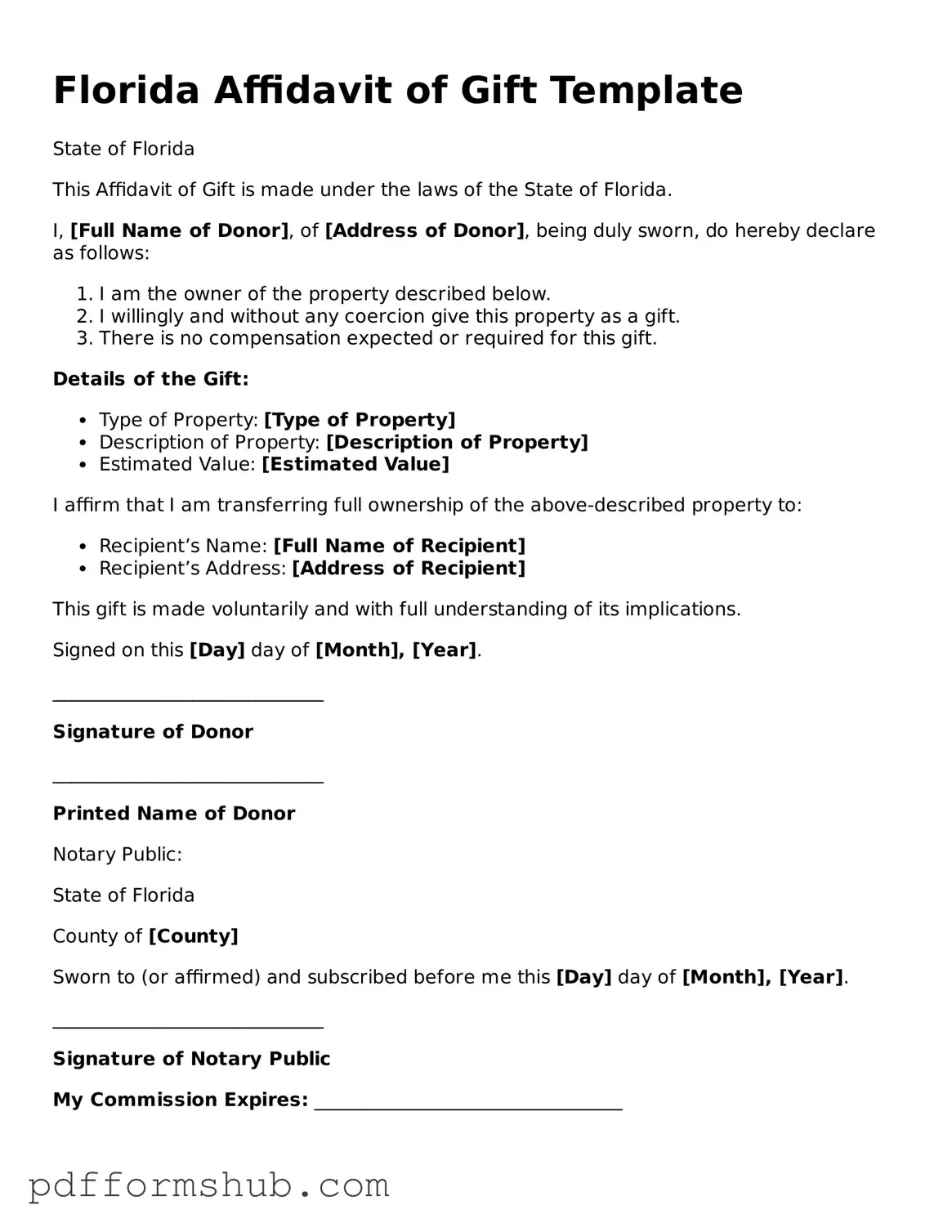

The Florida Affidavit of Gift form is a legal document used to declare the transfer of property or assets as a gift. This form helps ensure that the transfer is recognized and documented properly, protecting both the giver and the recipient. If you're ready to make a gift official, fill out the form by clicking the button below.

Customize Form

Attorney-Verified Affidavit of Gift Form for Florida State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Affidavit of Gift online without printing hassles.