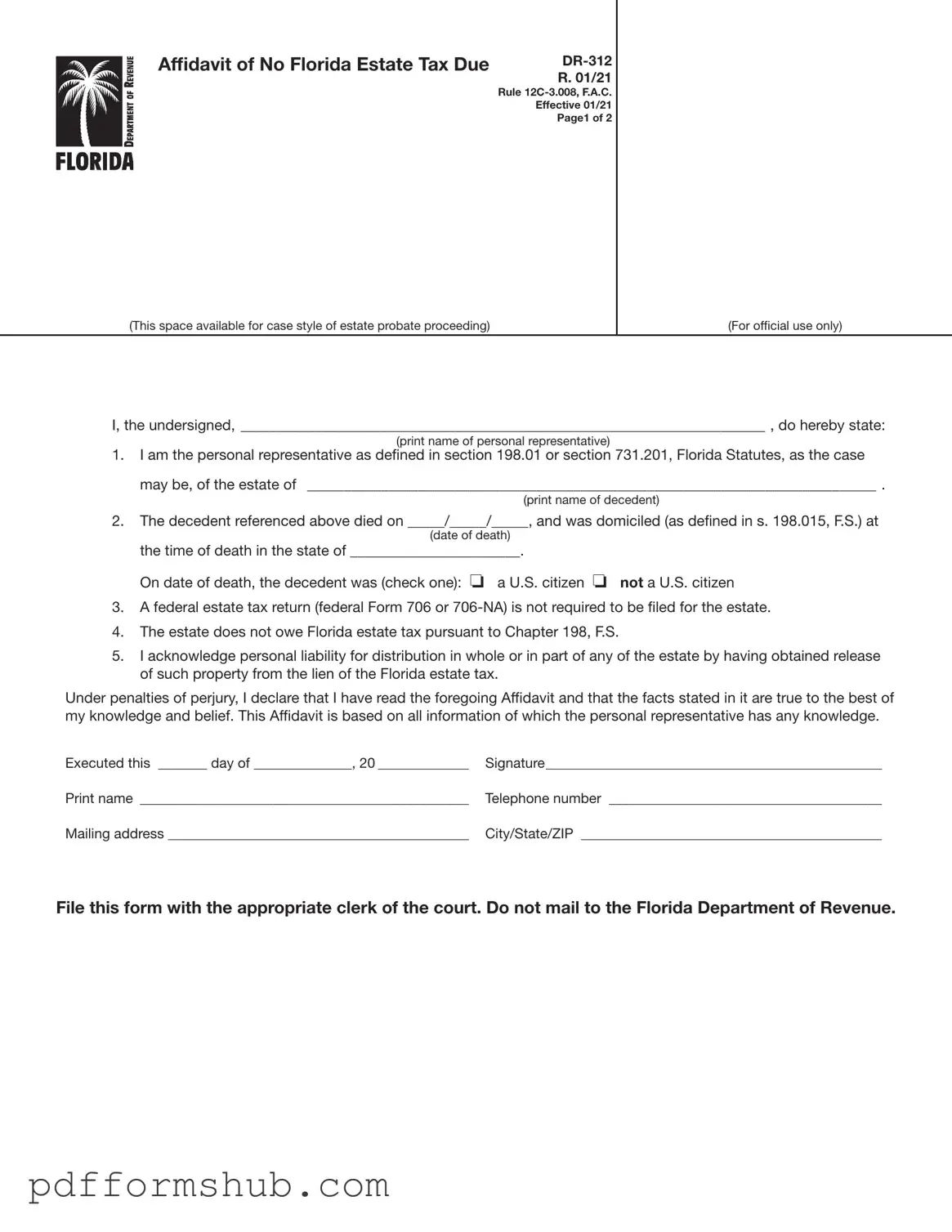

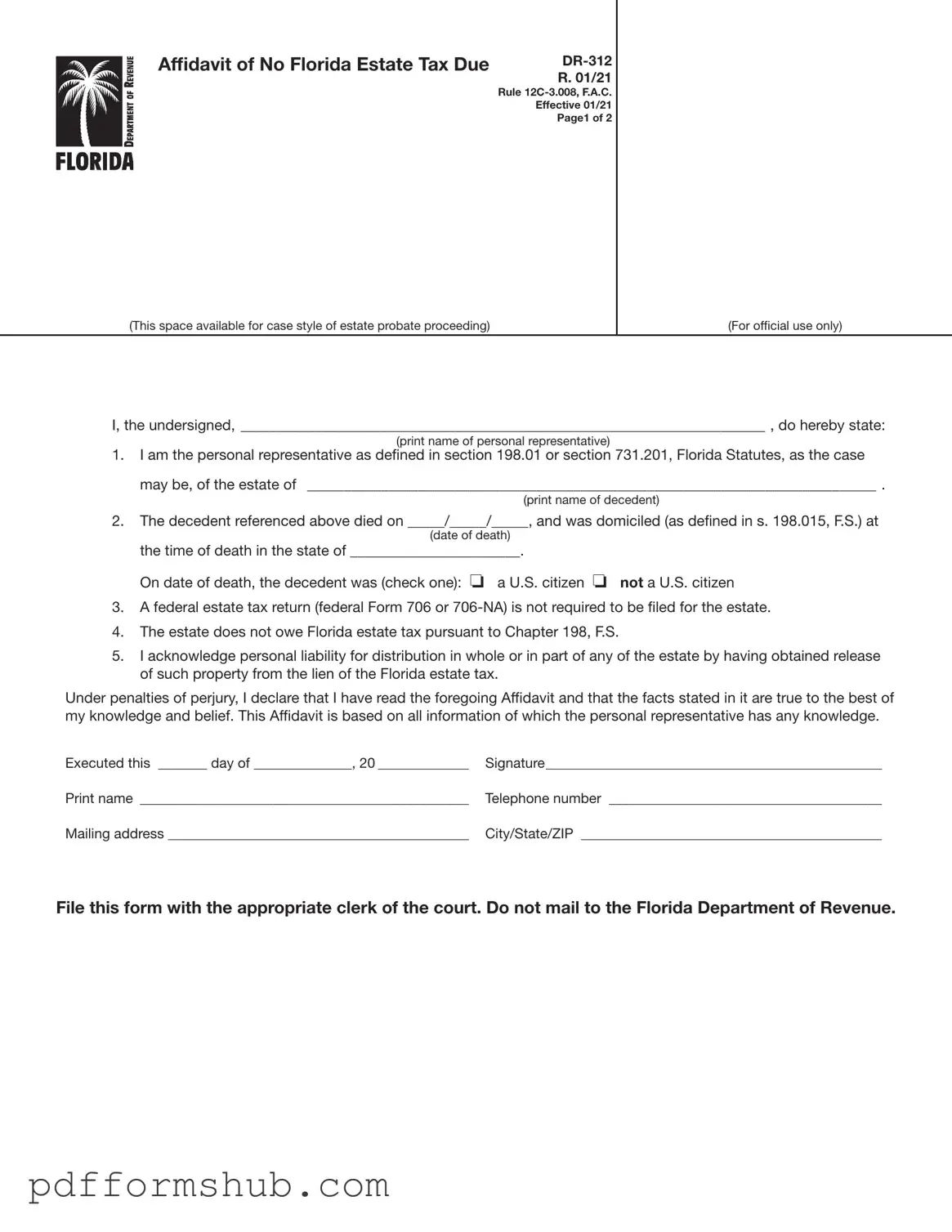

Fill in Your Fl Dr 312 Form

The Fl Dr 312 form, officially known as the Affidavit of No Florida Estate Tax Due, is a crucial document for personal representatives of estates that do not owe Florida estate tax. This form serves as a declaration that a federal estate tax return is not required and confirms the estate's non-liability for Florida estate tax. To ensure compliance and proper filing, please fill out the form by clicking the button below.

Customize Form

Fill in Your Fl Dr 312 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Fl Dr 312 online without printing hassles.