Fill in Your Erc Broker Market Analysis Form

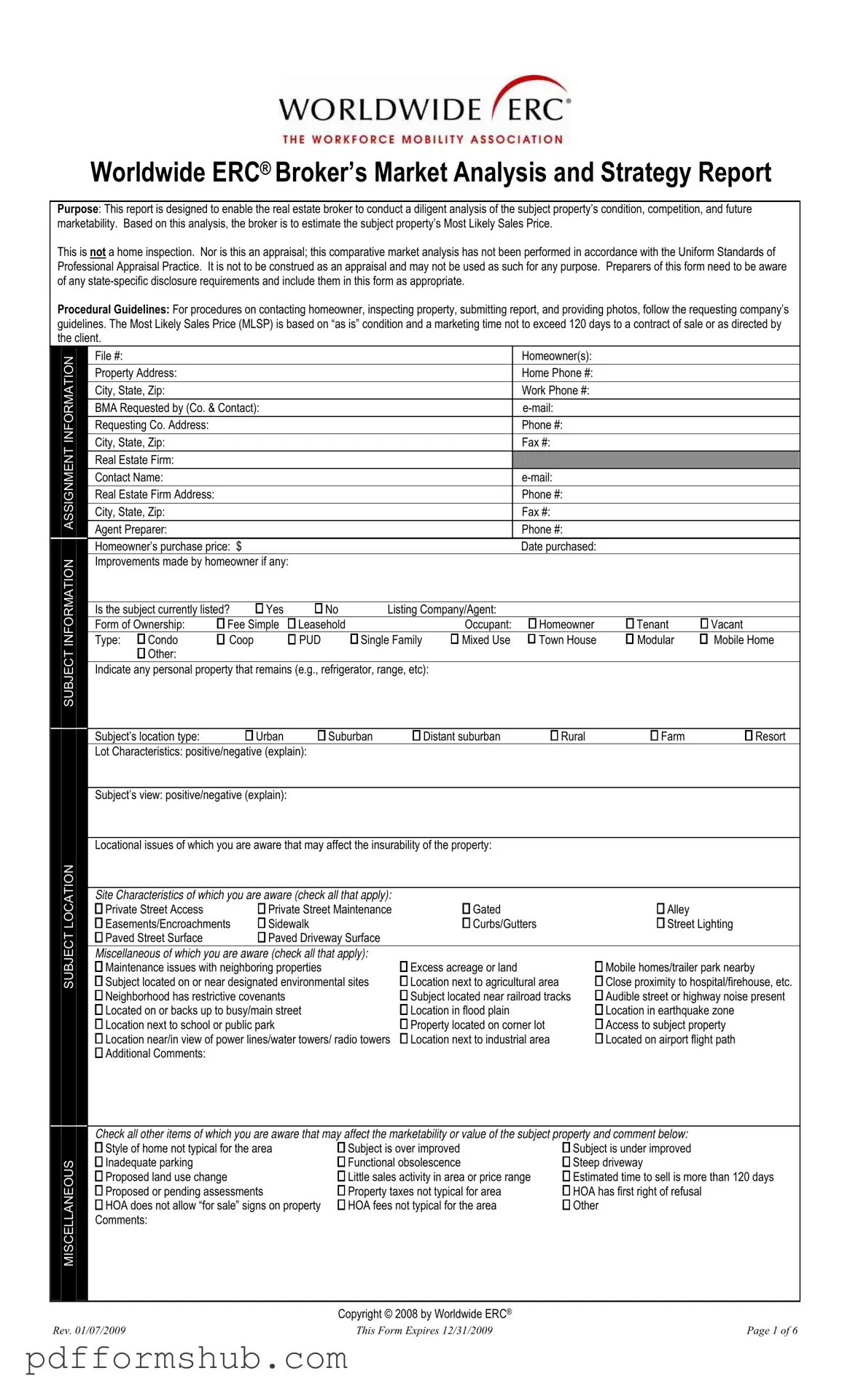

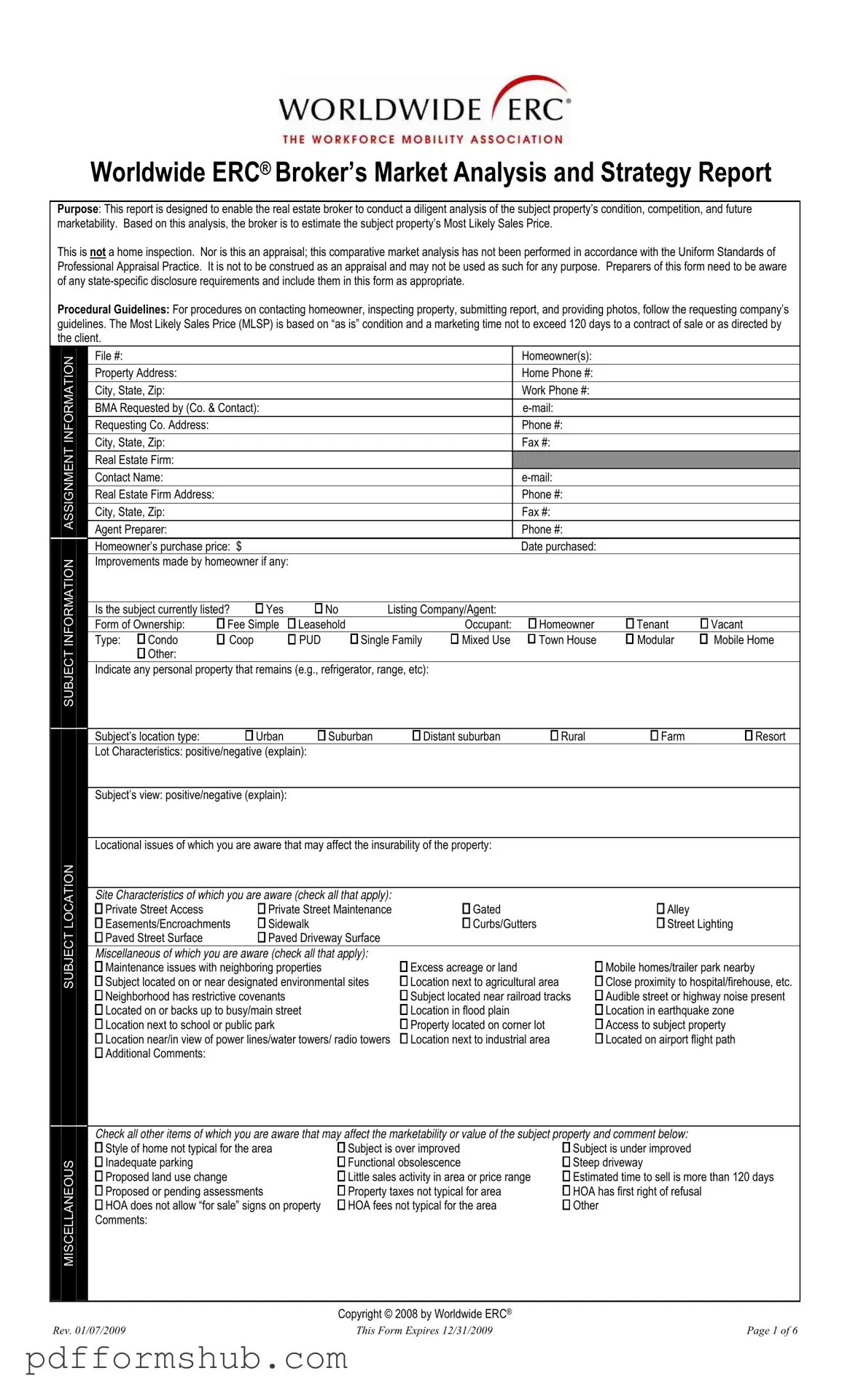

The Worldwide ERC® Broker’s Market Analysis and Strategy Report is a vital tool for real estate brokers. It assists in evaluating a property's condition, competition, and future marketability to estimate its Most Likely Sales Price. This report is not an appraisal or home inspection, and brokers should ensure compliance with state-specific disclosure requirements.

To get started, please fill out the form by clicking the button below.

Customize Form

Fill in Your Erc Broker Market Analysis Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Erc Broker Market Analysis online without printing hassles.